Matrixdock’s tokenized dold XAUm launches on Sui

Matrixdock has launched its flagship gold-backed token, XAUm, on the Sui blockchain, marking the first issuance of XAUm on a non-EVM chain.

- XAUm is backed 1:1 by LBMA-accredited gold of 99.99% purity and audited by Bureau Veritas.

- The Sui blockchain was chosen for its parallel execution, sub-second finality, and horizontally scalable infrastructure.

Matrixdock, Asia’s leading RWA tokenization platform under Matrixport Group, has officially launched its flagship tokenized gold product XAUm, on the Sui ( SUI ) blockchain — marking the first time XAUm will be issued on a non-EVM chain.

“By bringing gold onchain, XAUm transforms a traditionally static asset into one with expanded digital utility,” said Eva Meng, Head of Matrixdock. “We’re excited to expand XAUm to Sui, a blockchain purpose-built for scalability .”

“Tokenized assets are rewiring global finance, and XAUm on Sui is a powerful example of Sui being at the forefront of this wave of innovation,” commented Christian Thompson, Managing Director of the Sui Foundation.

Matrixdock selected the Sui blockchain for the XAUm launch because of its advanced technical architecture and growing user base. The blockchain’s parallel execution, sub-second finality, and horizontally scalable infrastructure make it ideal for fast, cost-efficient, and high-throughput tokenized asset transactions.

About XAUm

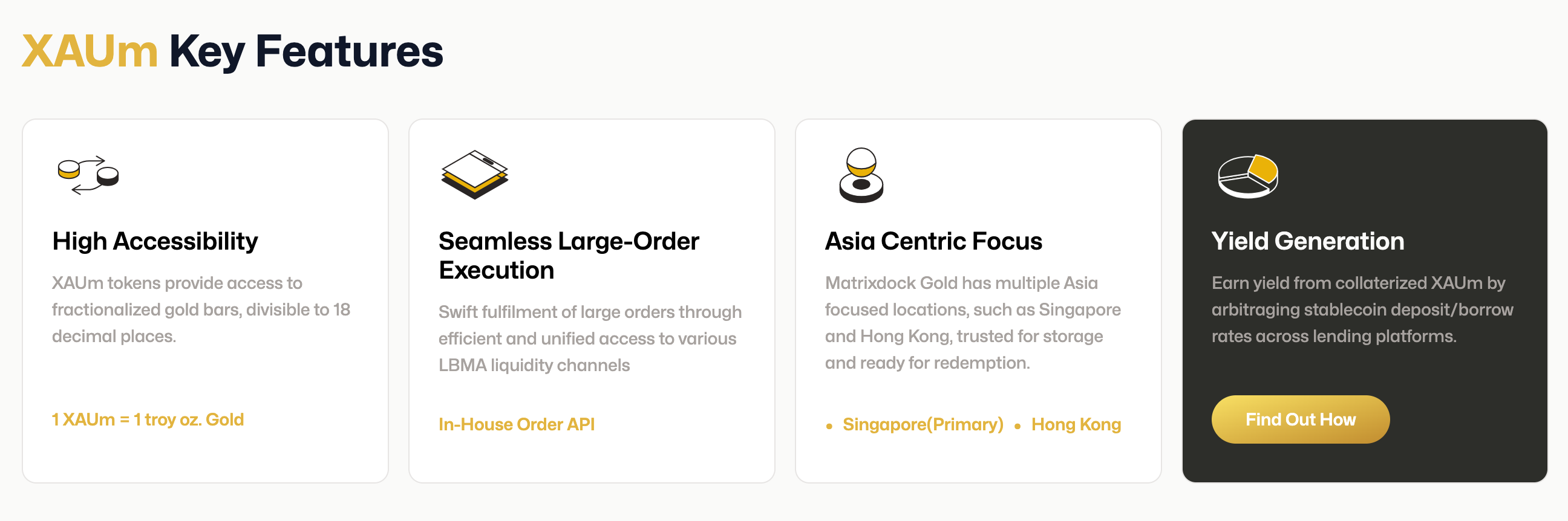

XAUm enables users to hold, trade, lend, and redeem institutional-grade physical gold, combining the stability of tangible gold with the speed and transparency of blockchain technology.

The token is fully backed 1:1 by London Bullion Market Association (LBMA)-accredited gold of 99.99% purity and undergoes rigorous audits by Bureau Veritas. Its H1 2025 physical gold reserve audit report is publicly available .

Source: matrixdock.com

Source: matrixdock.com

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.