Shiba Inu Crash Ahead? Why Tight Budgets Could Hit SHIB Hard?

Shiba Inu (SHIB) price has been struggling to hold momentum as global macroeconomic headwinds start to weigh on investor sentiment. Retail executives from Walmart, Target, and others are signaling that consumers remain cautious, pulling back from discretionary spending while prioritizing value. Inflation is still elevated, and looming tariffs could increase financial pressure. These same forces shaping household spending also spill into the crypto market, where risk appetite drives flows into assets like $SHIB. Let’s break down how consumer caution and tariff fears could affect SHIB price next move .

Shiba Inu Price Prediction: What Retailer Warnings Signal for Risk Assets Like SHIB?

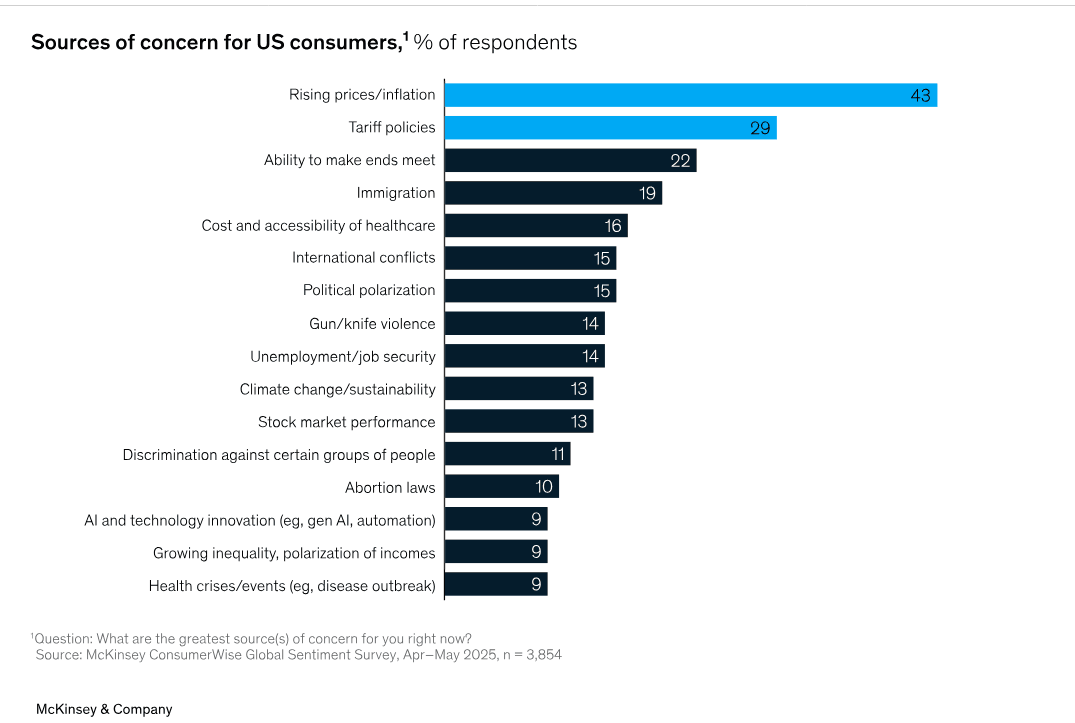

Image Source: McKinsey

Image Source: McKinsey

US consumer sentiment is showing clear signs of strain. With tariffs set to raise everyday costs, many households plan to cut back on non-essential purchases and redirect spending toward value-driven goods. This cautious mood could ripple into risk assets like SHIB, where retail participation is a key driver.

Executives across major retailers described a common theme: shoppers are still hunting for value and cutting back on non-essential purchases. In a climate where even cosmetics and big-ticket financed projects are softening, discretionary spending is getting squeezed. Crypto, especially meme tokens like SHIB, falls squarely in the discretionary bucket for retail investors. If households are saving more and avoiding financial risks, speculative inflows into SHIB may slow.

The tariff angle complicates things further. Companies admit costs are climbing, even if sticker prices haven’t fully passed them on yet. That means less disposable income left for crypto investing once tariffs work their way into consumer prices.

Shiba Inu Price Prediction: SHIB’s Struggle Around Key Support Levels

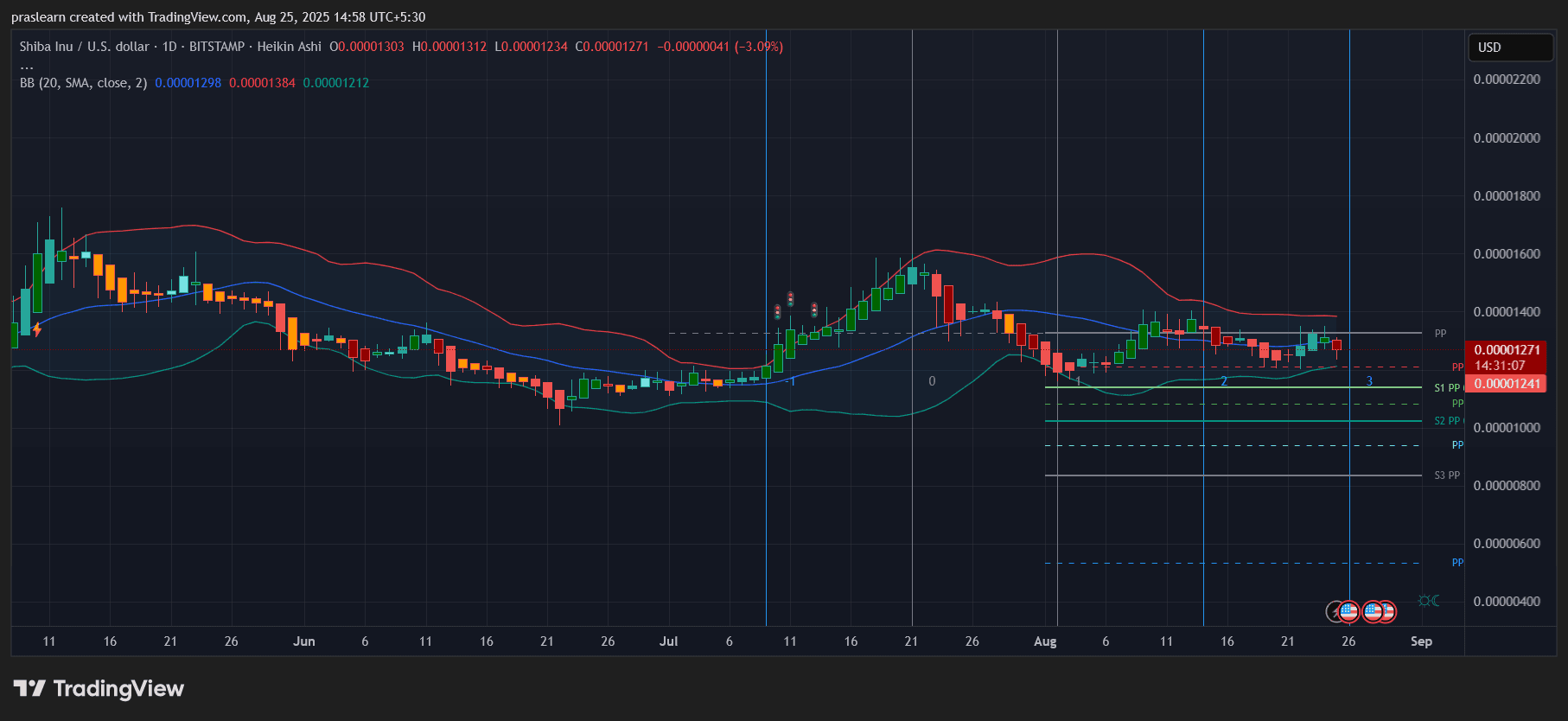

SHIB/USD Daily chart- TradingView

SHIB/USD Daily chart- TradingView

Looking at the daily chart, SHIB price is currently trading around 0.00001271 after losing 3% in the last session. The Bollinger Bands are tightening, showing volatility compression—a precursor to a sharp move. Price action has been capped below the mid-band (around 0.0000138), while the lower band near 0.0000120 is acting as interim support.

The pivot points reinforce this cautious setup. Immediate support lies at 0.00001241 (S1), and a break below this could send $SHIB to test deeper zones at 0.00001100 or even 0.00001000. On the upside, resistance at 0.00001380 must be cleared for bulls to regain control. Until then, SHIB remains range-bound with a bearish tilt.

Macro Pressure Meets Technical Fragility

Shiba Inu price is trading at a time when household budgets are stretched, and risk tolerance is fragile. The parallel between consumers skipping discretionary purchases and retail traders avoiding speculative crypto plays is direct. Just as shoppers choose alternatives over cosmetics or financed renovations, investors may rotate away from meme coins toward safer or utility-driven tokens.

If tariffs gradually raise living costs, the pool of speculative capital shrinks further. SHIB thrives on excess retail enthusiasm, and the consumer tone right now is defensive, not exuberant.

Short-Term Prediction: Volatility Ahead

Unless Shiba Inu Price breaks convincingly above 0.0000138, the bias remains bearish to neutral. A sustained close under 0.0000124 would confirm downside momentum, opening the door to 0.0000110. Conversely, if macro sentiment improves and risk-on appetite returns, bulls will need to push SHIB above 0.0000140 to set up a rally toward 0.0000160.

In the short term, expect choppy sideways action with risk skewed to the downside. Traders should watch consumer sentiment data and tariff policy updates as much as technical indicators—both are shaping whether SHIB can find the retail-driven momentum it relies on.

Conclusion

SHIB’s price outlook is tied not just to charts but to the broader consumer environment. As households cut back on discretionary spending, the appetite for speculative tokens like SHIB weakens. Technicals show a coin stuck in consolidation, with sellers holding the upper hand. Unless resistance levels are reclaimed and macro pressures ease, SHIB price faces the risk of further pullbacks.

$ShibaInu, $SHIB

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Digital dollar hoards gold, Tether's vault is astonishing!

The Crypto Bloodbath Stalls: Is a Bottom In?

Can the 40 billion bitcoin taken away by Qian Zhimin be returned to China?

Our core demand is very clear—to return the assets to their rightful owners, that is, to return them to the Chinese victims.