Crypto ETPs outflows totaled $1.43 billion last week, the largest weekly exit since March 2025, as investor sentiment polarized over U.S. monetary policy. Bitcoin drove the bulk of losses while spot Ether ETFs recorded nearly $430 million withdrawn in a single day, per CoinShares and market-flow data.

-

$1.43B outflows last week — largest since March 2025

-

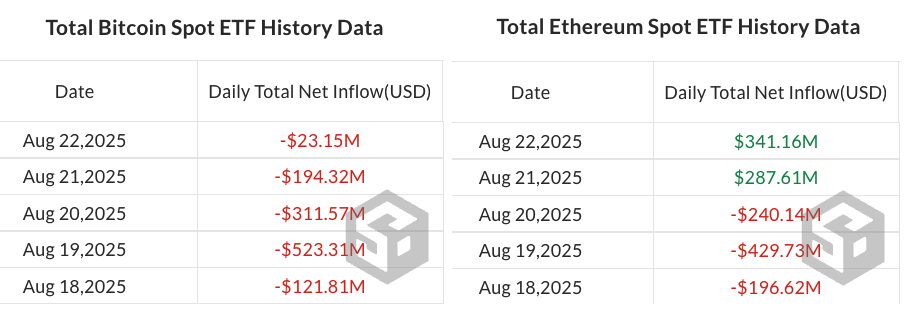

Spot Ether ETFs posted nearly $430M of withdrawals on one day; Bitcoin ETPs accounted for the majority of the net outflows.

-

Investor sentiment shifted after Jerome Powell’s Jackson Hole remarks, sparking a mid-week recovery and partial inflows.

Crypto ETPs outflows hit $1.43B last week; expert analysis on Bitcoin, Ether flows and investor sentiment. Read key takeaways and next steps.

What caused the $1.43 billion in crypto ETPs outflows?

Crypto ETPs outflows were driven primarily by polarized investor sentiment around U.S. monetary policy, with early-week pessimism producing heavy sell orders and a mid-week tone shift after Jerome Powell’s Jackson Hole address producing partial inflows. Market-flow providers and CoinShares reported $1.43 billion of net redemptions last week.

How did Bitcoin and Ether contribute to the outflows?

Bitcoin ETPs accounted for more than $1 billion of the outflows, reflecting stronger downside pressure on BTC relative to Ether. Spot Ether ETFs experienced their second-largest single-day outflows on record—about $430 million withdrawn on Tuesday—before a mid-week recovery reduced net losses.

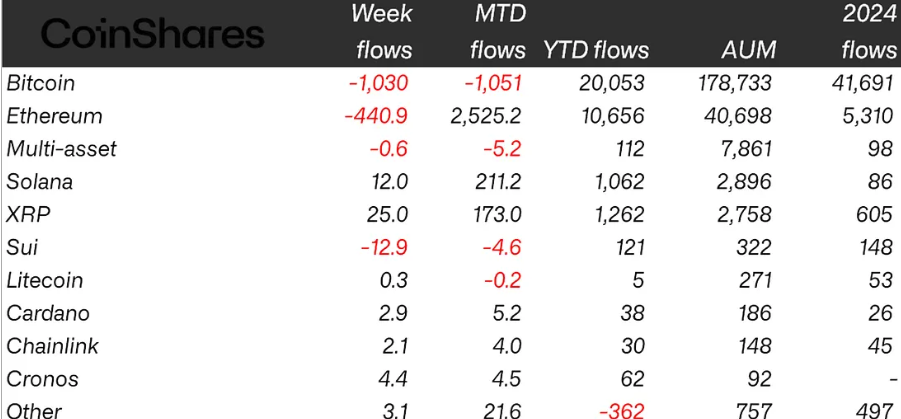

Crypto ETPs saw their biggest losses since March as outflows totaled $1.43 billion amid investor sentiment becoming “polarized,” CoinShares’ James Butterfill reported.

Cryptocurrency investment products reversed an emerging inflow trend, with significant outflows last week as Bitcoin and Ether prices declined.

Global crypto exchange-traded products (ETPs) saw $1.43 billion of outflows last week, ending a two-week inflow run that brought in $4.3 billion, CoinShares reported on Monday.

The outflows came amid Bitcoin (BTC) dipping from above $116,000 on Aug. 18 to $112,000 by the end of the trading week, while Ether (ETH) tumbled below $4,100 on Tuesday after starting the week at around $4,250, according to CoinGecko market data.

Last week’s losses marked the second-biggest outflows on record for spot Ether exchange-traded funds (ETFs), with almost $430 million withdrawn on Tuesday alone, according to SoSoValue data aggregators.

Why were flows so polarized during the week?

James Butterfill, CoinShares’ head of research, said investor sentiment grew “increasingly polarized” as markets digested U.S. monetary policy signals. Early-week pessimism prompted roughly $2 billion of outflows, while Powell’s Jackson Hole remarks were widely interpreted as more dovish, triggering $594 million of inflows later in the week.

Daily flows in spot Bitcoin ETFs versus spot Ether ETFs. Source: SoSoValue

How did the mid-week tone shift affect Ether specifically?

The mid-week tone shift was reflected more strongly in Ether, which staged a sharper recovery after the dovish interpretation of Jackson Hole remarks. Despite the single-day large outflow, Ether saw a mid-week rebound that reduced net weekly outflows and contributed to a rotation in investor allocations.

Butterfill highlighted that year-to-date inflows favored Ethereum, which represents 26% of total assets under management for inflows this year, versus 11% for Bitcoin, indicating structural demand differences between the two asset classes.

Crypto ETP flows by asset as of Friday (in millions of US dollars). Source: CoinShares

When did altcoins see meaningful flows?

Altcoin ETP flows were mixed: XRP received about $25 million in inflows, Solana posted roughly $12 million in gains, while Sui and Toncoin experienced outflows of about $13 million and $1.5 million, respectively. These movements reflect targeted reallocations rather than broad-based risk-on flows.

Frequently Asked Questions

How big were the daily Ether ETF outflows?

Spot Ether ETFs recorded nearly $430 million withdrawn on the heaviest single day of outflows, marking the second-largest single-day withdrawal on record for those products.

Did Jerome Powell’s remarks stop the outflows?

Powell’s Jackson Hole remarks were seen as more dovish than expected, sparking mid-week inflows of about $594 million and partially reversing early-week redemptions driven by policy uncertainty.

Key Takeaways

- Largest weekly outflow: $1.43 billion withdrawn from crypto ETPs, the biggest weekly loss since March 2025.

- Asset split: Bitcoin led outflows (> $1B) while Ether had large single-day withdrawals but a stronger mid-week recovery.

- Sentiment driver: U.S. monetary policy signals and Jerome Powell’s Jackson Hole remarks materially influenced flows.

Conclusion

Crypto ETPs outflows of $1.43 billion underscore how macro policy signals can swiftly shift investor allocations between Bitcoin, Ether and altcoins. Market participants should monitor daily ETP flow releases from CoinShares and market data providers for real-time sentiment indicators. COINOTAG will continue tracking fund flows and policy events for updated coverage.