Institutional investors reach $33.6B in Bitcoin ETF holdings during Q2

Investment advisors drove institutional Bitcoin (BTC) exposure via exchange-traded funds (ETFs) to $33.6 billion during the second quarter of 2025.

Data shared by Bloomberg ETF analyst James Seyffart on Aug. 25 revealed that institutions added 57,375 BTC across all tracked categories.

Bloomberg Intelligence data shows advisors now hold $17.4 billion in Bitcoin ETF positions, nearly doubling hedge fund managers’ $9 billion exposure.

Brevan Howard Capital Management emerged as the largest institutional Bitcoin ETF shareholder among the new investors. The fund manager increased its BlackRock iShares Bitcoin Trust (IBIT) holdings by 71% to 37.5 million shares worth $2.3 billion as of June 30.

Harvard Management Company entered the Bitcoin ETF space with a $117 million position in IBIT. Harvard’s Bitcoin allocation ranks alongside its largest US-listed holdings, including Microsoft at $310 million and Amazon near $235 million, representing approximately 8% of its reported portfolio.

The university endowment now holds more Bitcoin than gold in dollars, with its SPDR Gold Trust position valued at roughly $102 million at quarter-end.

Increases in every category

Seyffart also highlighted that advisors have become “by far the biggest holders” of spot Bitcoin ETFs. They added 37,156 BTC during the second quarter and reached 161,909 BTC.

He said that “pretty much every category” out of the 15 listed had increasing exposure during the second quarter, except pension funds, which maintained $10.7 million positions.

Brokerage firms’ allocation via Bitcoin ETFs reached $4.3 billion, after the second-largest addition among institutions of 13,911 BTC. Banks registered the third-largest allocation of 2,476 BTC, and now have roughly $655 million in Bitcoin through ETF shares.

Investment advisors’ $17.4 billion allocation exceeds the combined holdings of hedge funds, brokerages, and holding companies, signaling a shift toward professional wealth management integration.

Seyffart noted that the $33.6 billion allocated by institutional investors relates to 13F form filings, representing only 25% of the total Bitcoin ETF shares.

He added:

“The other 75% are owned by non-filers which is largely going to be retail.”

Despite the increasing institutional appetite, retail appears to drive most of the Bitcoin ETF still flows.

The post Institutional investors reach $33.6B in Bitcoin ETF holdings during Q2 appeared first on CryptoSlate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stellar (XLM) Price Prediction: Can Bulls Push Toward $0.30 in December?

21Shares XRP ETF Set to Launch on 1 December as ETF Demand Surges

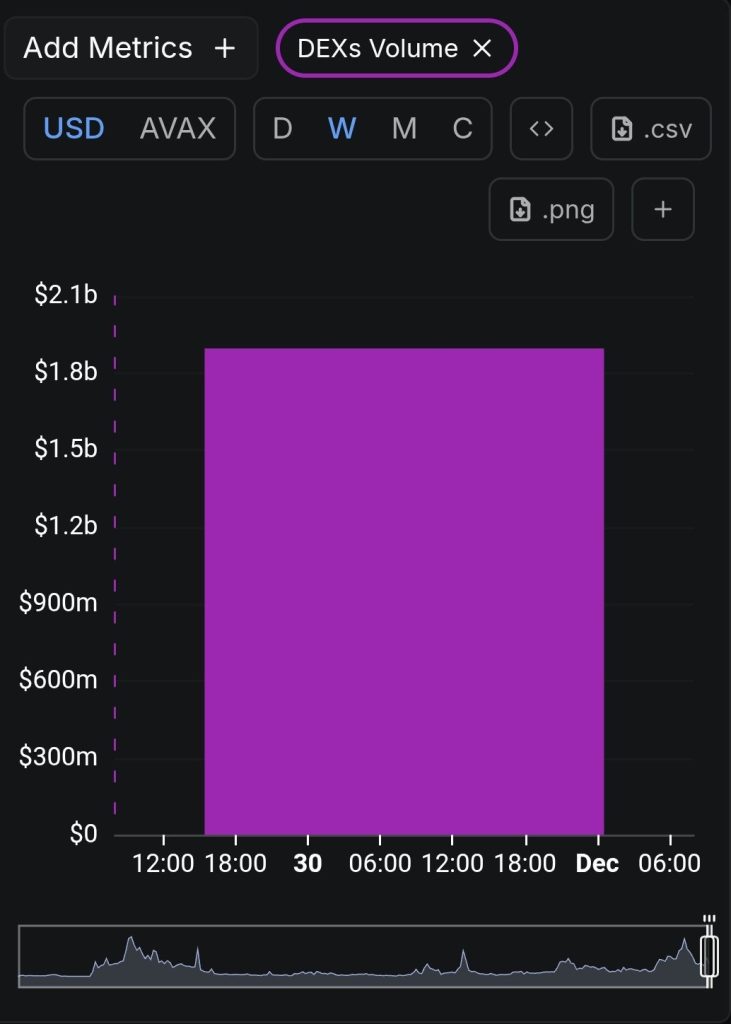

Avalanche (AVAX) Sees DEX Volume Surge as Price Rebounds From Key Support—Is a Major Breakout Near?

CZ Issues Market Warning as Crypto Exits Longest ‘Extreme Fear’ Streak