A Historic First: Trump Dismisses Federal Reserve Board Member, Directly Challenging Central Bank Independence

If Cook resigns, it would potentially allow Trump to gain four seats, giving him a majority on the seven-member board.

Original Title: "Historic First! Trump 'Fires' Sitting Fed Governor, Advances 'Take Control of the Fed' Plan Once Again"

Original Author: Zhu Xueying, Wall Street Observer

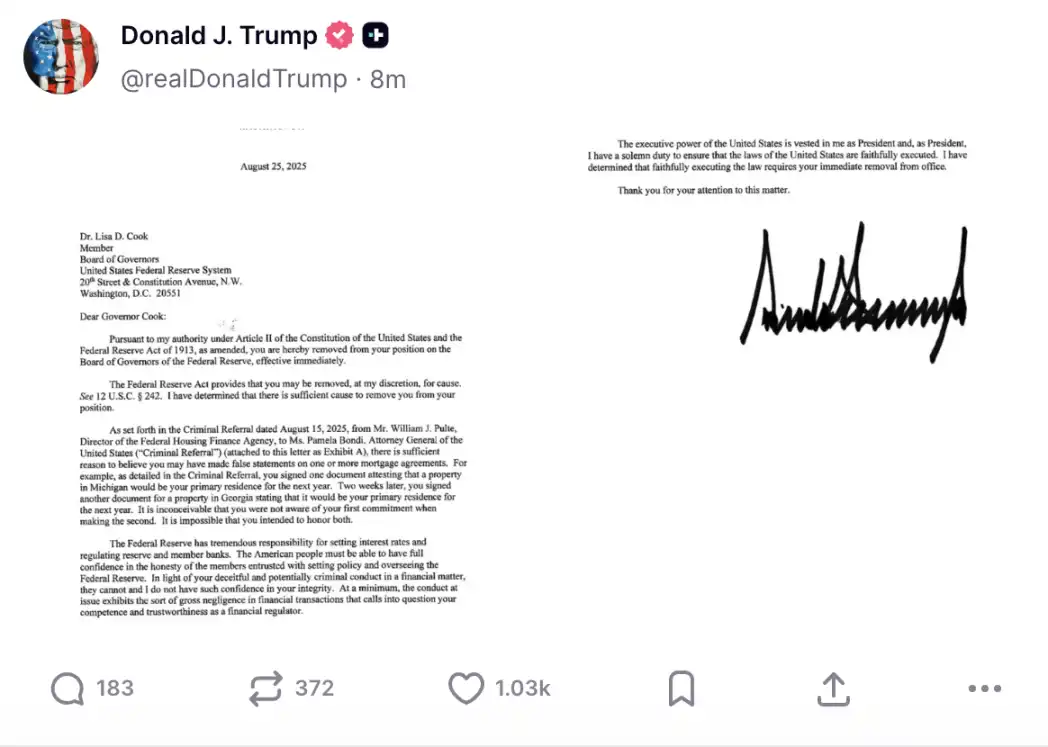

Just now, Trump made a significant move! He high-profiledly announced on social media that he is removing Fed Governor Lisa Cook from office, effective immediately.

This unprecedented move has shaken the financial markets, leading to widespread questioning. U.S. stock index futures fell in response, with the Nasdaq 100 Index contract down 0.2%. Safe-haven sentiment drove the yen higher against the dollar, and gold recovered from earlier losses.

If successful, Trump's actions will bring him one step closer to "taking control of the Fed." If Cook resigns, it will potentially allow Trump to fill four seats, giving him a majority on the seven-member board. Trump has already appointed two current board members in his first term and recently nominated his economic advisory committee chairman, Stephen Miran, to fill the third seat vacated earlier by Biden-appointed Adriana Kugler.

In analysis provided by Nick Timiraos, a Wall Street Journal reporter known as the "New Fed Communications Agency," Timiraos points out that Trump has appointed two members to the Fed's seven-member board. If he secures two more nominations, he will have a majority, potentially reshaping the entire Fed system.

Furthermore, according to Timiraos, if Trump secures a majority on the Fed board by March next year, they may refuse to reappoint regional Fed chairs, thus gaining control over FOMC meetings.

Unprecedented Dismissal Rocks Wall Street

In his letter, Trump accused Cook of "fraudulent and potentially criminal behavior" in financial affairs, stating that such actions have undermined her credibility as a regulator.

Citing the Second Amendment of the U.S. Constitution and relevant provisions of the 1913 Federal Reserve Act, Trump claimed to have identified sufficient grounds to remove Cook from office. The letter referenced a criminal referral submitted by the Federal Housing Finance Agency on August 15, alleging that Cook made false statements in mortgage loan documents. For example, she first claimed on a document in Michigan that the property was her primary residence, then made the same claim on a document in Georgia. Trump called this action "unimaginable," questioning her integrity and competence as a financial regulator.

Trump's dismissal threat against Cook marks a significant escalation of White House pressure on the Fed. If Trump successfully removes Cook, it would set a new precedent in American history—never before has a sitting Fed governor been removed by a president, and the market's concerns may trigger a constitutional crisis and exacerbate market turmoil.

In previous political conflicts, even in the intense confrontation between President Johnson and Fed Chairman William McChesney Martin, or President Nixon's pressure on Burns (Arthur Burns), no actual dismissal action has been taken.

Sam (Claudia Sahm), Chief Economist at New Century Advisors and former Fed economist, has stated in the past that,

“This is a new tactic of this administration to try to control the Fed, and they are using all means at their disposal to achieve this control.”

Does the President have the power to remove Fed governors? Yes, but with conditions

Legal experts emphasize that the Federal Reserve Act clearly states that governors “may be removed by the President for cause,” but this requires concrete evidence of misconduct, malfeasance, or the inability to perform duties, rather than political motivations.

While former Federal Housing Finance Agency (FHFA) director Bill Pulte previously accused Cook of lying on loan applications to obtain more favorable terms, alleging mortgage fraud. However, the current allegations against Cook have not been confirmed in court, and the Department of Justice has only stated that it will investigate the related accusations.

Previously, Trump posted a photo of Cook on his Truth Social platform with a red cross, calling her a “fraudster.” Cook is the first Black female member of the Fed Board of Governors, joining the Fed in 2022. Massachusetts Senator Elizabeth Warren condemned Trump's actions on social media as “illegal and politically motivated.”

Trump's “Three-Step Plan” to Control the Fed, Being Implemented Step by Step

Some analysts believe that if Cook resigns, Trump will have the opportunity to appoint a fourth Fed governor, gaining a majority in the seven-member Board of Governors. Trump has already appointed two of the current governors during his first term and recently nominated his Economic Advisory Board Chairman, Stephen Miran, to fill the third seat vacated by Biden's appointee Adriana Kugler.

On August 24, in an analysis by Nick Timiraos, a Wall Street Journal reporter known as the "new Fed wire service," it was stated that President Trump has currently appointed two members to the Federal Reserve's seven-person Board of Governors. If he receives two more nominations, he will have a majority, potentially reshaping the entire Fed system.

Furthermore, Timiraos' analysis suggests that if Trump secures a majority on the Fed's Board of Governors by March of next year, they may refuse to reappoint regional Fed presidents. Dismissing these dutiful chairs would break decades-long precedents and breach a crucial firewall established since the Fed's inception in 1913 to protect its independence.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.