$110,800 Is Bitcoin’s New Key Defense Line: Glassnode

Bitcoin faces a potential correction. It must quickly reclaim $110,800. Failure to do so could trigger a further downturn. Glassnode identified a key metric. $110,800 is the average cost for new investors, based on May through July buyers. During this period, Bitcoin hit new all-time highs. Bitcoin Should Defend $110,800 Glassnode explains that the average … <a href="https://beincrypto.com/110800-bitcoins-new-key-defense-line-glassnode/">Continued</a>

Bitcoin faces a potential correction. It must quickly reclaim $110,800. Failure to do so could trigger a further downturn.

Glassnode identified a key metric. $110,800 is the average cost for new investors, based on May through July buyers. During this period, Bitcoin hit new all-time highs.

Bitcoin Should Defend $110,800

Glassnode explains that the average cost of newer investors, who have been in the market for one to three months, reveals their short-term behavior and shows the nature of new money. Based on Glassnode’s data, this price stands at $110,800 now.

Historically, this price level is significant, below which it often signals a bear market, leading to a substantial price correction.

BTC: Realized Price by Age. Source: Glassnode

BTC: Realized Price by Age. Source: Glassnode

The Glassnode chart reveals this trend. The orange line shows the cost for new investors, and the black line shows Bitcoin’s price. When the black line crosses below the orange, prices tend to fall.

On Monday, Bitcoin saw its largest long liquidation event since December 2024. On Tuesday, Bitcoin’s price briefly fell, hitting a low of $108,600. It has since slightly rebounded. A sharp price drop triggered the sell-off, liquidating over $150 million in long positions. This is why a swift recovery above $110,800 is crucial.

Ethereum Shows Signs of Overheating

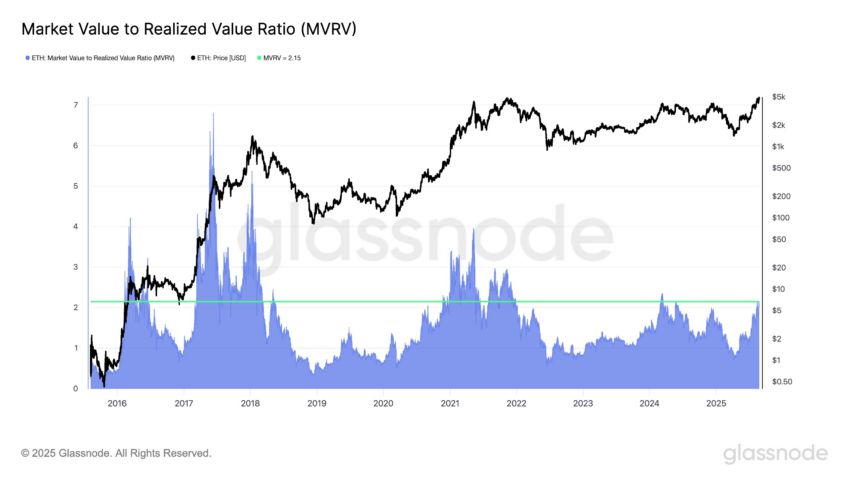

Ethereum’s price has reached a high level. Glassnode noted its significant valuation. “With Ethereum hitting a new ATH, the MVRV ratio has climbed to 2.15,” they stated.

The MVRV ratio is a key on-chain indicator. It compares market value to realized value, helping to gauge whether the market is overvalued.

[Market Value to Realized Value Ratio(MVRV). Source: Glassnode]

[Market Value to Realized Value Ratio(MVRV). Source: Glassnode]

2.15 MVRV ratio is noteworthy, meaning that investors hold unrealized profits, i.e., their average gains are over 2.15 times their cost.

Regarding the unprecedented number, Glassnode explained, “This level mirrors prior market structures.” It matches March 2024 and December 2020, leading to high volatility and profit-taking.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Starknet Price Prediction 2025: Can STRK Turn Its Rebound Into a Full Recovery?

XRP News: SEC’s Peirce Says She Never Backed Ripple Lawsuit

Zcash Price Prediction 2025: Can Rising Network Strength Push ZEC Toward a New Cycle?

XRP Price Prediction For November 22