Bitcoin News Today: Leverage Unwinds as Bitcoin Bounces, Liquidations Signal Fragile Recovery

- Bitcoin rebounds from $110K as traders anticipate Nvidia’s earnings, signaling potential short-term recovery. - Over 3,639 traders liquidated $29.79M in 24 hours, highlighting fragile leveraged positions in Bitcoin futures. - CRO and JTO outperform as investors diversify into altcoins amid market uncertainty. - High liquidation volumes exacerbate volatility but act as contrarian indicators for price reversals. - Nvidia’s earnings to influence risk-on sentiment, potentially boosting crypto flows amid macr

Bitcoin price rebounds from $110K ahead of Nvidia earnings, CRO, JTO lead altcoins

Bitcoin experienced a notable rebound from the $110,000 level in recent trading sessions, signaling a shift in market sentiment as traders brace for Nvidia's upcoming earnings report. The move came amid a broader wave of liquidation events in the crypto markets, which have served as a barometer for investor positioning and risk appetite. The recent volatility has led to a surge in forced liquidations, with Bitcoin derivatives markets witnessing a significant number of traders being wiped out in the wake of sharp price swings.

According to real-time data, over 3,639 traders globally were liquidated within a 24-hour window, with total liquidation value reaching approximately $29.79 million. The largest single liquidation event occurred in the OX-BTC pair, amounting to $1.1088 million in losses. These figures underscore the growing fragility in leveraged positions, particularly in Bitcoin futures, where aggressive long and short positions can lead to cascading liquidations during periods of heightened volatility.

Market observers interpret such liquidation patterns as a reflection of extreme sentiment, which can either precede or accompany price reversals. When traders collectively pile into one-sided bets—often driven by speculative fervor—sudden corrections can trigger a wave of forced exits. In the case of Bitcoin, the liquidation data suggests a potential short-term bounce, especially as the market witnesses a higher frequency of short-side liquidations. This dynamic could support a near-term recovery as leveraged short positions are unwound and buyers step in to cover these positions.

Beyond Bitcoin, the altcoin market has also seen activity. Coins like CRO and JTO have emerged as relative outperformers, gaining traction among investors looking to diversify their exposure beyond the leading cryptocurrency. These altcoins have benefited from renewed interest in speculative assets amid broader market uncertainty, though their price movements remain highly susceptible to macroeconomic cues and sector-specific developments.

The broader implications of these liquidation events extend beyond short-term price action. They highlight the increasing role of derivatives markets in shaping cryptocurrency valuations. As leverage continues to be a double-edged sword, the interplay between retail and institutional traders remains a key determinant of market stability. High liquidation volumes can exacerbate price swings, while also serving as a contrarian indicator when interpreted correctly.

As the market approaches Nvidia’s earnings report, the crypto sector remains closely watchful for signs of cross-market influence. Earnings performance in the tech and AI sectors has historically impacted risk-on sentiment, which in turn could influence capital flows into high-beta assets like Bitcoin and certain altcoins. The coming days will be critical in determining whether the recent rebound is part of a sustainable recovery or a temporary respite in a broader bearish trend.

Source:

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ripple (XRP) Is Running Trials With NASDAQ

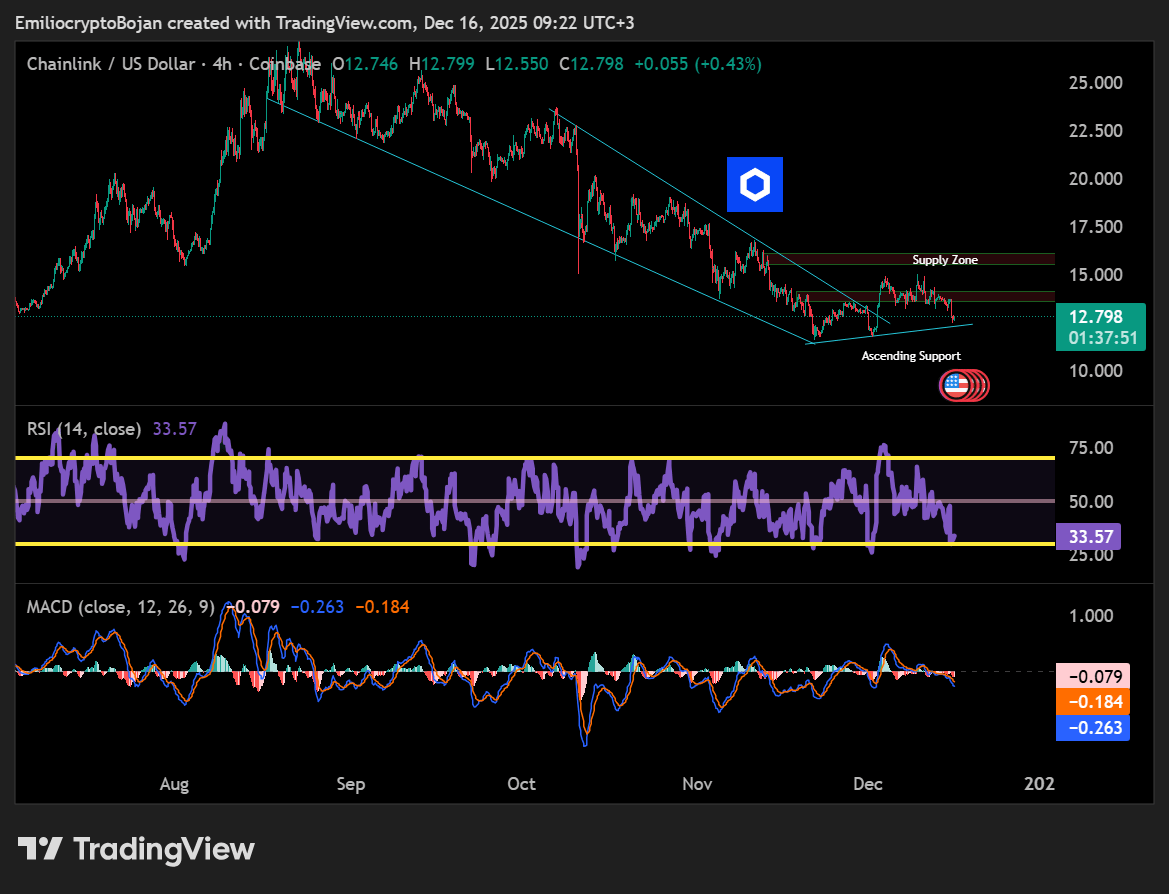

Chainlink’s price stalls – But here’s why smart money keeps moving in