The Rise of ETH Treasuries: How Institutional Adoption is Reshaping Digital Asset Diversification

In the past two years, Ethereum has undergone a metamorphosis that has redefined its role in global finance. No longer a speculative asset or a technological experiment, it has emerged as a cornerstone of institutional treasury strategies, blending the attributes of a reserve asset with the programmability of a financial infrastructure. This transformation is not merely a function of price appreciation but a reflection of profound shifts in how institutions perceive risk, return, and diversification in an era of macroeconomic uncertainty.

The catalysts for this shift are manifold. Ethereum's 2024–2025 upgrades—Dencun, Pectra, and Fusaka—have addressed long-standing scalability and efficiency challenges. Transaction costs on Layer 2 networks have plummeted by 95%, enabling Ethereum to process over 100,000 transactions per second. This technical robustness, combined with the SEC's 2025 reclassification of Ethereum as a utility token, has unlocked a flood of institutional capital. The result? A $7.9 billion inflow into Ethereum-based ETFs in 2025 alone, outpacing even Bitcoin's ETF performance.

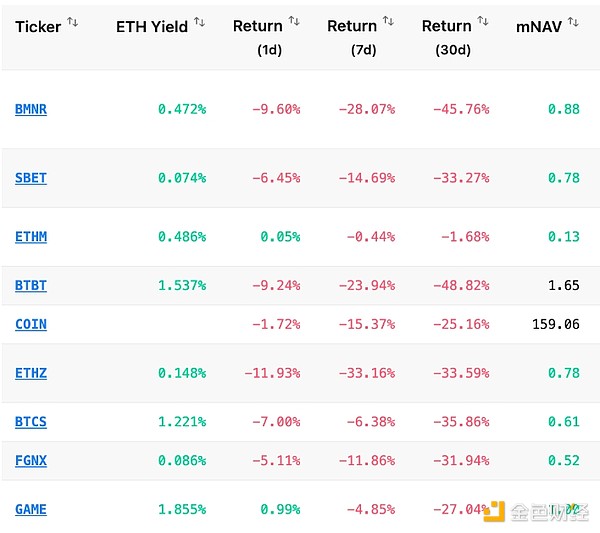

The strategic appeal of Ethereum lies in its dual identity. It is both a store of value and a yield-generating asset. Staking, now accounting for 26% of total supply, offers annualized returns of 4.5–5.2%, dwarfing the paltry yields of U.S. Treasuries. Firms like BitMine Immersion Technologies and SharpLink Gaming have mirrored MicroStrategy's Bitcoin playbook, allocating billions to ETH staking. BitMine's ambition to acquire 5% of circulating ETH underscores a broader trend: institutions are treating Ethereum not as a speculative bet but as a strategic reserve asset with compounding potential.

Yet the implications extend beyond yield. Ethereum's dominance in the stablecoin market—51% of the $138 billion sector—is a testament to its role in liquidity management. ERC-20 tokens underpin cross-border payments, DeFi protocols, and tokenized real-world assets (RWAs), creating a diversified ecosystem that mitigates the volatility of traditional portfolios. For instance, tokenized U.S. treasuries and real estate on Ethereum now offer institutional investors a blend of liquidity, transparency, and diversification.

The Federal Reserve's dovish policy has further accelerated this shift. With interest rates near historic lows and a high probability of cuts post-Jackson Hole, institutions are reallocating capital from low-yield bonds to Ethereum's yield-bearing infrastructure. This is not a flight from risk but a recalibration of risk-return profiles. Ethereum's deflationary supply model—burning 4.5 million ETH since 2021—adds a tailwind to long-term price appreciation, making it a compelling hedge against inflation and currency devaluation.

However, the road to $20,000 is not without potholes. Overleveraged positions in ETH, particularly in corporate and sovereign portfolios, pose systemic risks. A 30% price drop could trigger cascading liquidations, a scenario Ethereum co-founder Vitalik Buterin has warned against. Prudent investors must balance exposure with hedging mechanisms—options, futures, or diversified RWA allocations—to mitigate volatility.

For traditional investors, the lesson is clear: Ethereum is no longer a niche asset. It is a structural component of modern portfolios, offering a unique blend of yield, liquidity, and programmability. For crypto-native investors, the challenge lies in managing leverage and aligning strategies with macroeconomic cycles. The key is to treat Ethereum as a hybrid asset—part infrastructure, part reserve currency—while maintaining disciplined risk management.

In conclusion, Ethereum's institutional adoption marks a paradigm shift in asset allocation. It is not merely a competitor to gold or Bitcoin but a reimagining of what a reserve asset can be. As the U.S. Treasury, Ethereum Foundation, and major financial firms collectively hold millions of ETH, the future of finance is being rewritten on a blockchain. For investors, the imperative is to adapt—leveraging Ethereum's programmability while safeguarding against its volatility. The road ahead is uncertain, but one thing is clear: the age of ETH treasuries has arrived.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How does the leading player in perpetual DEX view the future trend of HYPE?

If you believe that the trading volume of perpetual DEXs will continue to grow, then HYPE is one of the purest and most leveraged ways to capitalize on this trend.

Privacy Meets Social Trust: How UXLINK and ZEC Are Building the Next Generation of Web3 Infrastructure

As ZEC advances compliant privacy and UXLINK builds real-world social infrastructure, the industry is moving towards a safer, more inclusive, and more scalable future.

Market Prediction and Emerging Parataxis: What is the current major challenge?

The prediction market project is experimenting with new primitives and mechanisms, including a prediction derivatives market, advanced automated market makers and liquidity mechanisms, interoperability primitives, and more.

With the market continuing to decline, how are the whales, DAT, and ETFs doing?