Story (IP) Price Heats Up, But On-Chain Signals Hint at Weakness Behind the Rally

Story (IP) is on fire with a sharp rally, but on-chain data suggests the momentum may lack strong support. A pullback looms unless demand strengthens.

Story (IP) is among the standout performers in today’s market, with its price soaring nearly 10% in the past 24 hours.

Despite the price rally, on-chain indicators suggest caution, as sustained buying pressure may not fully support the surge.

Bearish Divergence Hits IP Despite Price Surge

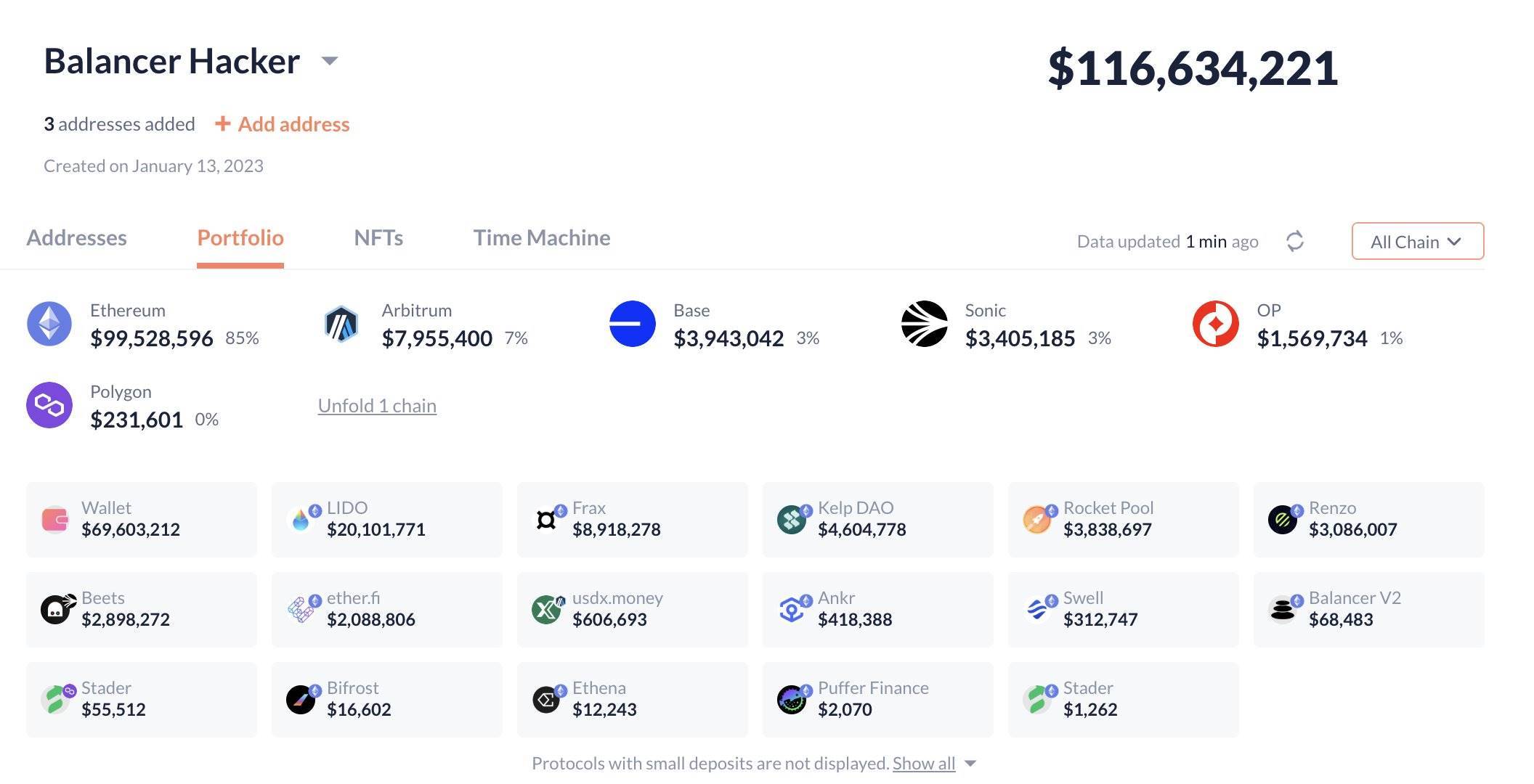

IP’s Chaikin Money Flow (CMF), which tracks the volume-weighted inflow and outflow of capital into an asset, has steadily declined even as IP’s price continues to climb. It sits below the zero line at -0.04 at press time, forming a bearish divergence.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

IP CMF. Source:

TradingView

IP CMF. Source:

TradingView

Typically, the CMF tracks the flow of capital into an asset, so when it declines while prices rise, it suggests that the rally lacks solid support from sustained demand.

When the CMF falls while prices climb, it suggests that buying is driven more by short-term hype than by sustained investor conviction. If this continues, IP’s recent gains could be at risk.

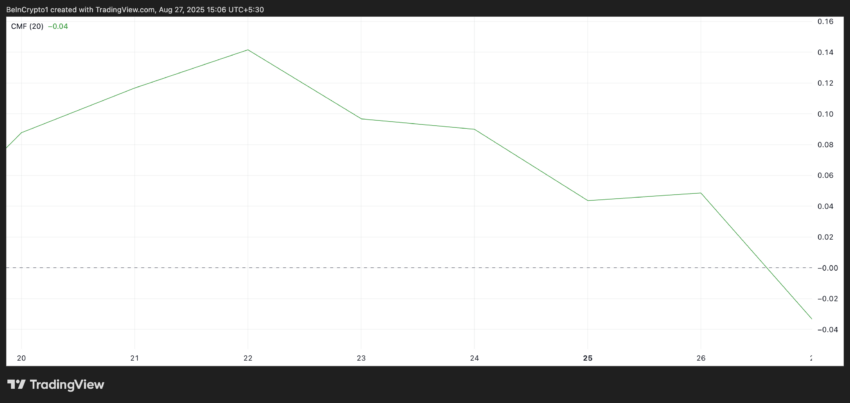

Further, the coin’s negative funding rate lends credence to this bearish outlook. According to Coinglass data, IP’s funding rate sits below one at -0.116% as of this writing.

IP Funding Rate. Source:

Coinglass

IP Funding Rate. Source:

Coinglass

The funding rate is used in perpetual futures contracts to keep the contract price aligned with the spot price. When the rate turns negative, short traders (those betting on price declines) dominate and are paid by long traders to maintain their positions.

IP’s low funding rate highlights strong bearish sentiment in the derivatives market. Despite its rally over the past day, futures traders are positioned for a decline. This shows a lack of confidence in its mid-to-long-term prospects.

Weak Demand Threatens Near-Term Dip

With no demand backing IP’s rally, it is at risk of a significant pullback once the general market’s momentum weakens. In this scenario, the coin’s price could plunge to $5.43.

IP Price Analysis. Source:

TradingView

IP Price Analysis. Source:

TradingView

On the other hand, if buy-side pressure surges, IP could rally to $6.54.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

South Korea’s Bitplanet Expands Bitcoin Treasury to 151.67 BTC

Bitcoin Flashes First “Red October” Since 2018

UFC Star Khabib Nurmagomedov’s MultiBank Partnership Tokenizes His Global Gym Brand on Mavryk

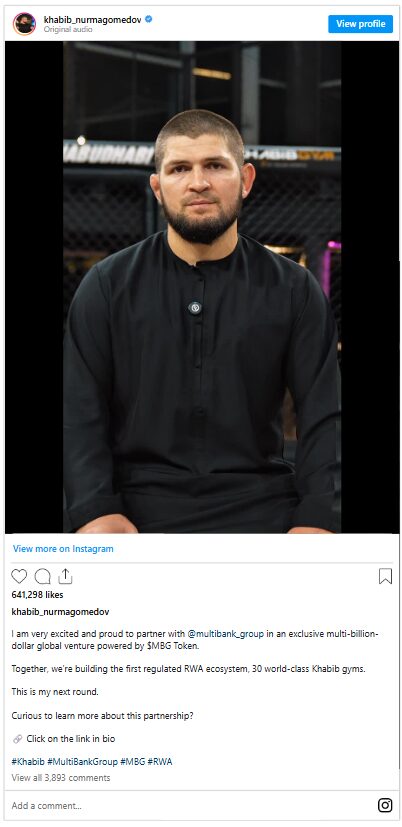

Six incidents in five years with losses exceeding 100 millions: A history of hacker attacks on the veteran DeFi protocol Balancer

For bystanders, DeFi is a novel social experiment; for participants, a DeFi hack is an expensive lesson.