Solana News Today: Solana's Alpenglow Vote Could Redefine Blockchain Speed Standards

- Solana's Alpenglow upgrade (SIMD-0326) aims to reduce block finality to 150ms via Votor, replacing TowerBFT/PoH consensus mechanisms. - The proposal introduces Rotor for optimized block propagation and allows 20% adversarial validator tolerance, enhancing security and scalability. - With 9.7% validator approval and rising institutional interest, the upgrade could position Solana as a leader in high-performance blockchain infrastructure. - Market anticipation drove SOL to $208.24, while $820M+ in corporat

Solana is preparing for a significant shift in its network capabilities through the Alpenglow upgrade (SIMD-0326), a consensus enhancement proposal set to redefine the platform’s speed and scalability. The proposal, which entered the community voting phase from epoch 840 to 842, aims to reduce block finality time to approximately 150 milliseconds, a transformation that would place Solana among the fastest finality blockchains in existence [1]. The upgrade replaces Solana’s existing TowerBFT and Proof-of-History (PoH) consensus mechanisms with a new architecture centered on Votor, an off-chain voting system that streamlines consensus and reduces network load [2].

The proposed changes are expected to significantly enhance the network’s transaction finality and resilience. Under Alpenglow, the system can tolerate up to 20% of adversarial and unresponsive validators without slowing progress, offering an unprecedented level of security and efficiency. This resilience is a marked improvement over the current system and could position Solana as a leader in institutional-grade blockchain performance [2]. The upgrade also introduces Rotor, a streamlined block propagation system that replaces the multi-layered Turbine approach, further optimizing network operations [1].

Validator participation in the voting process is a key determinant of the proposal's success. As of the latest data, 9.8% of the validator community had cast their votes, with 9.7% of those signaling approval. The proposal requires a two-thirds majority of Yes and No votes to pass, and abstentions contribute to the quorum but not the supermajority threshold. The current pace of voting indicates growing interest and support for the upgrade, though final outcomes remain uncertain [2]. Early voting patterns suggest strong alignment with the proposed changes, indicating a potential consensus within the Solana community [2].

From a financial perspective, the anticipation surrounding Alpenglow has already influenced the market. Solana’s native token (SOL) surged to $208.24, marking a 7.68% gain in a single day. Analysts attribute this rally to a combination of technical momentum, structural demand, and the potential approval of a spot ETF by the U.S. SEC. Institutional interest in Solana is also growing, with firms like Chorus One launching institutional-grade validators in partnership with Delphi Digital, reinforcing the network’s infrastructure and scalability [3]. The rise in corporate treasury holdings—exceeding $820 million in SOL—further signals growing institutional confidence in the platform [3].

The broader implications of Alpenglow extend beyond speed and performance. By reducing transaction finality and increasing scalability, Solana could attract more decentralized applications (dApps), high-frequency trading systems, and enterprise-grade use cases. The upgrade aligns with Solana’s strategic vision of becoming a high-performance blockchain capable of competing with Ethereum’s Layer-2 solutions. With transaction costs at less than $0.0003 per transaction—compared to Ethereum’s average of $4.02—Solana’s cost efficiency offers a compelling advantage for developers and users seeking fast, affordable, and scalable blockchain solutions [6].

As the voting period concludes, the outcome will determine Solana’s future trajectory in the blockchain space. If approved, Alpenglow could serve as a transformative milestone, reinforcing Solana’s position as a leader in high-performance blockchain infrastructure and setting a new standard for consensus innovation.

Source:

[6] Validators to Decide Solana's Next Big Leap in Speed and ... (https://www.bitget.site/news/detail/12560604935246)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Unmissable: Quack AI’s Builder Night Seoul Summit Unites AI and Web3 Leaders on Dec 22

SIA: From a super AI trading platform to a functional on-chain AI ecosystem

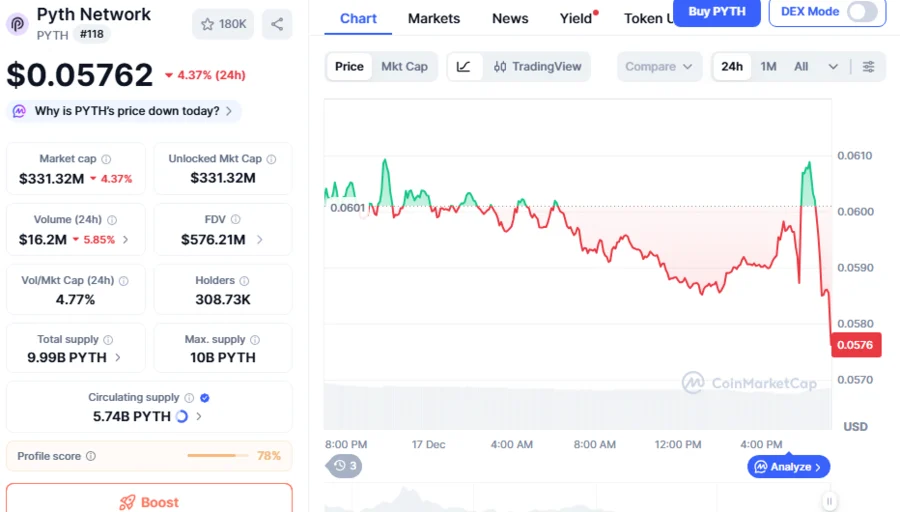

PYTH Drops 76% As Crypto Weakness Persists, Can New PYTH Network Reserve Trigger Market Rally?

Stunning Success: Sport.Fun’s FUN Token Sale Smashes 100% Target in One Day