Why do we need DeFi?

The architecture of DeFi unleashes new financial freedom, breaking down barriers of geography, identity, and institutions.

Original Title: A Bird's Eye View

Original Author: zacharyr0th, Aptos Labs

Translated by: Alex Liu, Foresight News

Practical Use Cases of DeFi

· The traditional banking system remains the foundation of finance, but it has long been plagued by systemic risks, regulatory failures, and conflicts of interest.

· Decentralized Finance (DeFi) offers permissionless access to financial tools—featuring censorship-resistant, borderless stablecoin usage, and transparent yield generation.

· The future financial landscape will arise from a pragmatic fusion between traditional institutions and decentralized infrastructure.

The global financial system is built on a vast network of intermediaries, processing trillions of dollars in transactions daily. While this architecture has historically supported global trade and capital flows, it has also introduced bottlenecks, inefficiencies, and systemic risks.

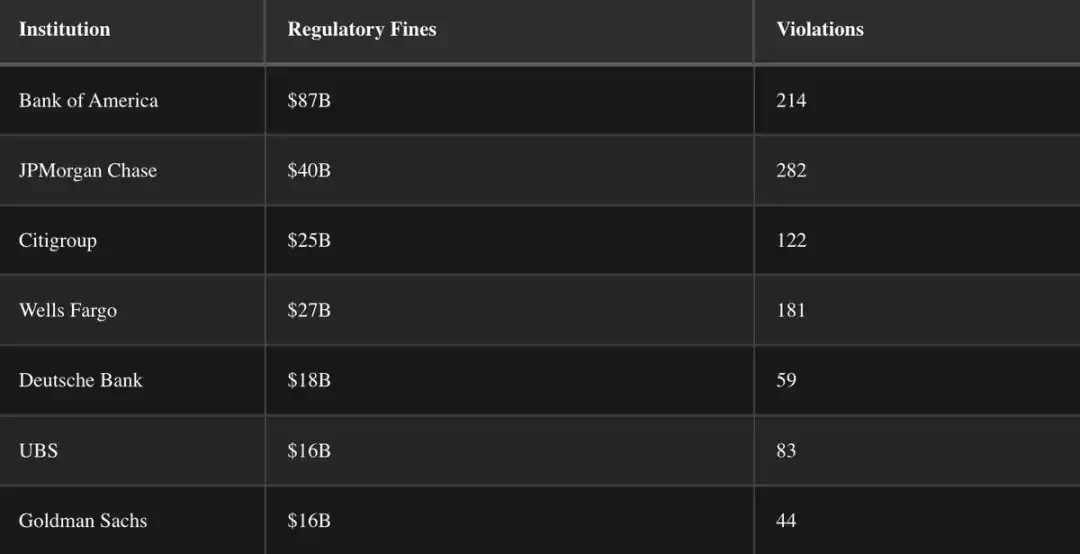

Technology continues to advance, yet traditional institutions remain deeply entrenched—not only operationally, but also politically and socially. Some institutions are considered "too big to fail," while others go bankrupt quietly. Despite the prestige of many institutions, their histories are still tainted by regulatory violations and unresolved conflicts of interest.

These phenomena reflect a deep-rooted systemic issue—not just a lack of regulation, but a design flaw.

Worse still, the boundaries between regulators and the regulated are often blurred. Former SEC Chairman Gary Gensler worked at Goldman Sachs for 18 years before overseeing Wall Street; Federal Reserve Chairman Jerome Powell amassed considerable investment banking wealth before setting monetary policy; former U.S. Treasury Secretary Janet Yellen received over $7 million in speaking fees from financial institutions she would later regulate.

Admittedly, professional expertise can be compatible between the public and private sectors, but this "revolving door" phenomenon is nothing new—it has almost become the norm.

The Mission and Mechanism of Central Banks

In 1913, following a series of bank runs, the Federal Reserve was established. Designed by financiers such as J.P. Morgan, the Fed is a quasi-governmental institution: theoretically accountable to Congress, but in practice operating independently.

In 1977, the Fed's dual mandate was officially established:

· Maximize employment

· Maintain price stability (currently interpreted as about 2% inflation)

Although monetary policy continues to evolve, its main tools remain the same: interest rate adjustments, balance sheet expansion, and open market operations.

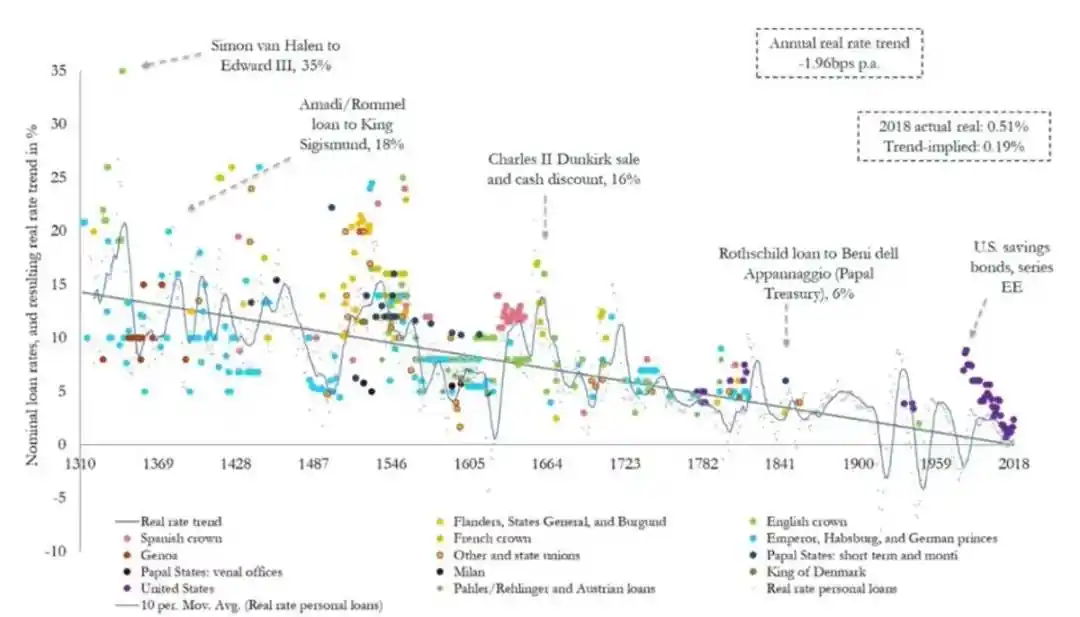

Since 2012, the Fed has explicitly set a 2% annual inflation target, which has had a broad impact on asset values and the purchasing power of the dollar. From a long-term historical perspective, interest rates have shown a steady decline.

As the financial system becomes more complex and interconnected, borrowing costs continue to fall.

Value and Perception

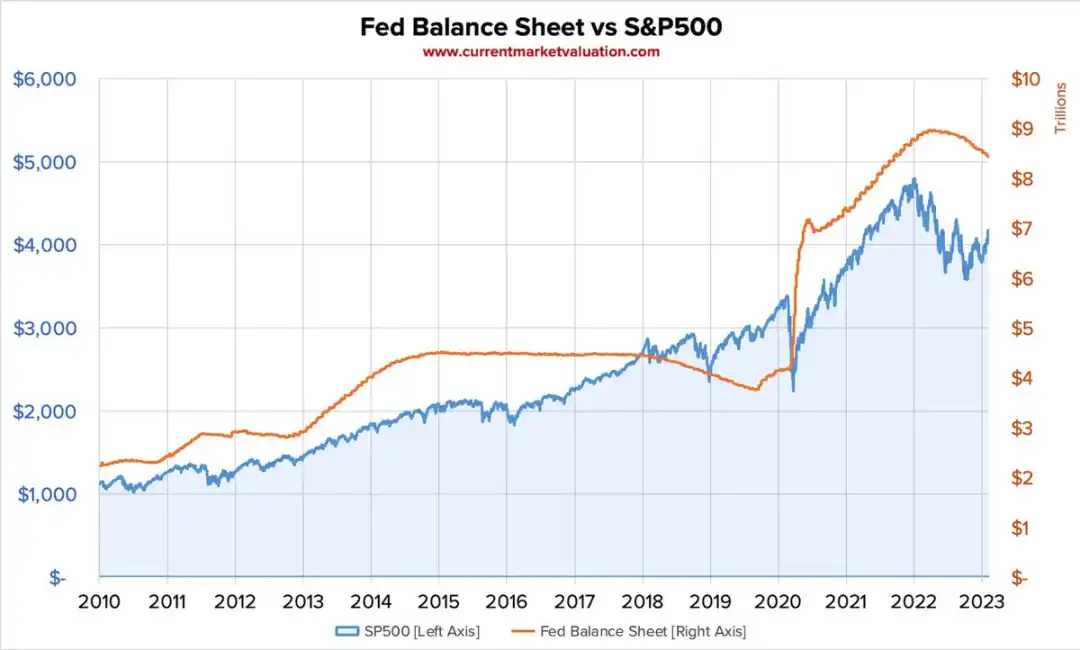

Since 2008, the correlation between the Fed's balance sheet and the S&P 500 index has grown stronger, raising questions about the long-term effects of monetary expansion.

Some argue that, due to its global dominance, the U.S. can "print money freely" with relatively minor consequences; the dollar's reserve currency status and global trust in U.S. institutions provide a buffer against inflation erosion. But not all countries enjoy this privilege. In many parts of the world—especially where goods and services are not priced in dollars or euros—DeFi is not an option, but a necessity.

In developed economies, people can debate the theoretical benefits of decentralization; but for billions in less developed regions, they face real problems that traditional banks cannot or will not solve: currency devaluation, capital controls, lack of banking infrastructure, political turmoil. These require solutions outside the traditional system.

Stablecoins and Inflation Resistance

Between 2021 and 2022, Turkey experienced severe economic turmoil, with inflation rates reaching 78.6% year-on-year.

For ordinary people, local banks could not provide effective solutions, but DeFi could. Through stablecoins and non-custodial wallets, people could avoid asset devaluation, conduct global transactions, and bypass unjust capital controls—all enabled by open-source tools accessible to anyone.

These wallets require no bank account, no cumbersome paperwork—just a private key or mnemonic phrase to access on-chain accounts.

Censorship Resistance

A large number of truck drivers protesting at the U.S.-Canada border had their bank accounts frozen by authorities, making them unable to repay loans or purchase necessities—even though they had not violated any specific laws.

In centralized systems, financial autonomy is not a given, whereas DeFi offers a different model: based on open infrastructure, governed by code rather than regional policies.

Yield and Innovation

DeFi protocols have redefined financial primitives: lending, trading, insurance, and more—but these innovations come with new risks.

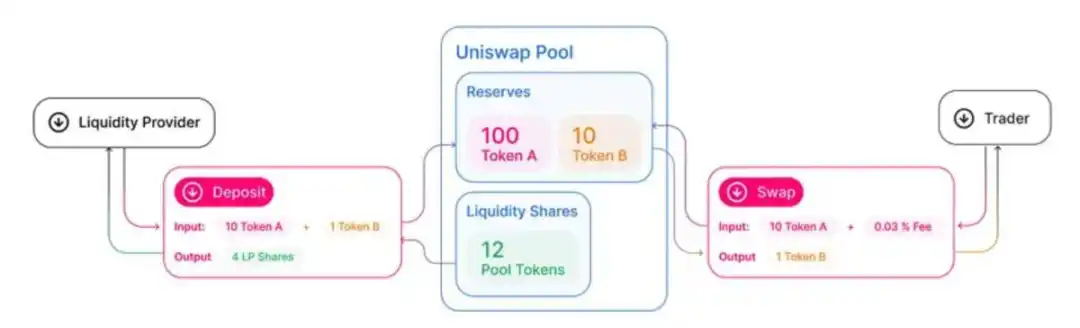

Some protocols have collapsed, malicious actors have been exposed, but the market naturally filters for sustainable innovation. Survivors—such as automated market makers (AMMs) and liquidity pools—represent DeFi best practices: building transparent, permissionless infrastructure that distributes trading fees to liquidity providers, rather than concentrating market-making profits in the hands of a few gatekeepers.

This is a fundamentally different model from traditional finance—where market access, especially for market-making, is highly restricted and lacks transparency.

A Balanced Future

At least in the short term, the future of finance will be neither fully decentralized nor fully centralized, but a hybrid. DeFi is not a complete replacement for traditional finance, but it does fill the gaps overlooked by traditional systems: accessibility, censorship resistance, transparency. In economies plagued by regional inflation or financial repression, DeFi is already solving everyday problems.

In countries like the U.S. where the banking system is safer, DeFi’s value proposition also holds, but more in theory. For most people in stable economies, traditional banks still offer convenience, consumer protection, and reliability that DeFi has yet to fully match. Once traditional financial infrastructure upgrades to a blockchain-based settlement layer, this theory will gradually become reality.

Until then, some will pursue financial sovereignty, some entrepreneurs will build on the frontier, and some smart capital will use DeFi primitives to seek higher risk-adjusted returns—of course, accompanied by a large number of meme coins and airdrop activities.

What Do Others Think?

"The goal of DeFi is not to fight traditional finance, but to build an open and accessible financial system to complement existing infrastructure." — Ethereum co-founder Vitalik Buterin

"DeFi protocols represent a paradigm shift in financial infrastructure, providing programmable and transparent alternatives to traditional financial services." — Dr. Fabian Schär, Professor of Distributed Ledger Technology at the University of Basel

"While DeFi platforms may offer promising technological innovations, they still need to operate within a framework that protects investors and maintains market integrity." — Former U.S. SEC Chairman Gary Gensler

Why DeFi Matters

In a world of economic volatility and eroding institutional trust, decentralized systems are gradually demonstrating their capabilities: leveraging new blockchain attributes to enhance traditional payments and financial operations.

DeFi’s architecture—permissionless, global, transparent—unleashes new financial freedoms, breaking down barriers of geography, identity, and institutions. Smart contracts automate complex processes, reduce costs, and eliminate friction—things traditional infrastructure cannot achieve.

Risks remain, but progress is happening.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Federal Reserve meeting minutes reveal sharp divisions: many believe a December rate cut is inappropriate, while some are concerned about disorderly declines in the stock market

All participants agreed that monetary policy is not fixed, but is influenced by the latest data, the evolving economic outlook, and the balance of risks.

Despite Losses, Strategy’s S&P 500 Entry In Sight