Bitcoin News Today: CoinShares Turns Loss into Gain with Smarter Treasury Moves

- CoinShares reported a $32.4M net profit in Q2 2025, down 5.3% QoQ but up 1.9% YoY, driven by $30M in asset management fees and $7.8M treasury gains. - Bitcoin and Ethereum price surges drove a 26% QoQ AUM increase to $3.5B, supported by $170M net inflows into spot crypto ETPs and Valkyrie ETF brand unification. - Diversified capital markets income included $4.3M from ETH staking and $2.2M-$2.6M from trading/lending, while treasury strategy reversed Q1 losses with $7.8M unrealized gains. - The firm plans

CoinShares International Limited reported a net profit of $32.4 million for the second quarter of 2025, reflecting a slight decline from the previous quarter but an increase year-over-year. The European asset manager, which specializes in digital assets, attributed the profit to robust asset management fees and a rebound in its treasury strategy. The company’s financial results include $30.0 million in asset management fees, a $11.3 million capital markets gain, and $7.8 million in treasury gains, contributing to an adjusted EBITDA of $26.3 million and a basic earnings per share of $0.49. This marks a 5.3% decrease from the previous quarter but a 1.9% increase from the same period in 2024 [1].

The firm’s strong performance was supported by a significant recovery in digital asset prices during the quarter. Bitcoin and Ethereum prices surged by 29% and 37%, respectively, contributing to a 26% quarter-over-quarter increase in assets under management (AUM), which reached $3.5 billion. This growth was primarily driven by rising crypto prices and record inflows into the firm’s physically backed exchange-traded products (ETPs). Despite outflows from its legacy derivatives-based ETPs, the firm’s spot crypto ETPs saw $170 million in net inflows, marking the second-highest on record. The inflows were further supported by the transition of Valkyrie ETFs to the unified CoinShares brand following its acquisition [3].

CoinShares’ Capital Markets unit also demonstrated resilience and diversity in its income-generating activities. ETH staking was the top contributor, generating $4.3 million in the quarter. Delta-neutral trading strategies and lending contributed $2.2 million and $2.6 million, respectively. The firm’s liquidity provisioning income dipped slightly to $1.5 million, reflecting reduced gross flows on the XBT Provider platform. The diversified approach to capital markets activities ensured a stable income stream, even during periods of market volatility [1].

The firm’s treasury strategy rebounded strongly, with $7.8 million in unrealized gains, reversing the $3.0 million loss recorded in the first quarter. This turnaround was attributed to improved market conditions and tactical adjustments to its holdings. The firm’s ability to adapt its treasury strategy to market dynamics was a key factor in its overall financial performance [4].

Looking ahead, CoinShares is preparing for a potential U.S. listing to capitalize on the country’s more favorable regulatory environment and deeper capital markets. The firm’s leadership expressed confidence in the move, citing recent successful listings by companies like Circle and Bullish as positive precedents. CEO Jean-Marie Mognetti emphasized that the U.S. market offers substantial growth opportunities and higher valuations for digital asset companies. While the timing of the listing remains uncertain, the firm anticipates further clarity in the third quarter [1].

The firm’s strategic expansion into the U.S. market is part of its broader vision to reinforce its leadership in Europe while leveraging new opportunities in North America. The regulatory environment in the U.S. has been increasingly supportive of crypto innovation, with landmark legislation and a presidential administration that appears to champion the sector. CoinShares aims to capitalize on these favorable conditions to unlock additional value for its shareholders. As the firm continues to navigate the evolving digital asset landscape, its focus on expanding its product offerings and enhancing operational efficiency positions it well for sustained growth in the second half of 2025 [3].

Source:

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Germany Pushes MiCAR as Banks Open Regulated Crypto Access

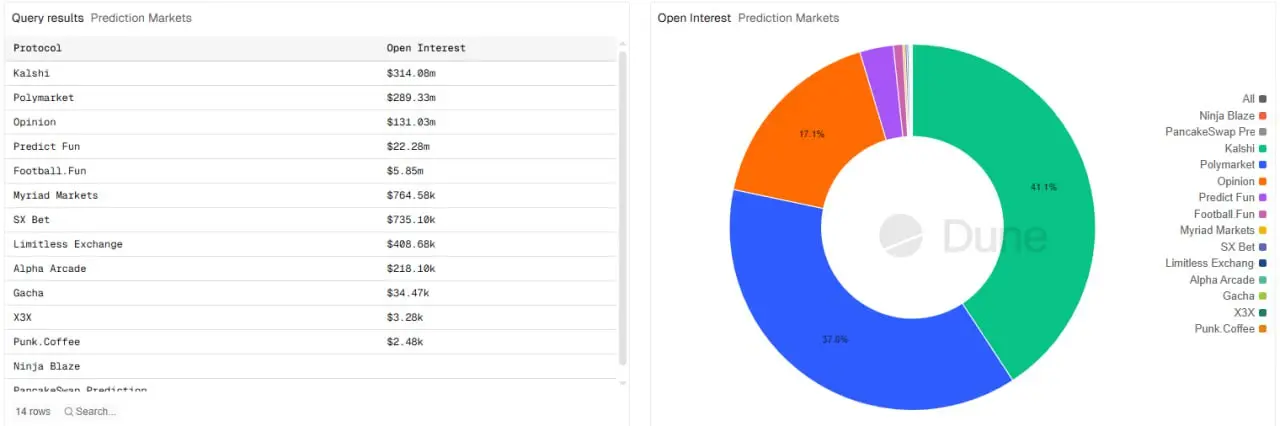

Prediction markets smash daily records as Kalshi claims 66.4% share of $700M volume

Saks Global seeks bankruptcy protection as challenges hit the luxury sector

Vitalik Buterin Amplifies Web3 Vision with New Insights