Bitcoin News Today: Bitcoin's $10T Path: DeFi Turns Digital Gold into Financial Weapon

- Cardano founder Charles Hoskinson predicts Bitcoin could hit $10T market cap in 5 years via DeFi-driven financial utility. - Achieving this would require $500,000/coin price with 20M BTC supply, surpassing gold and major corporations' valuations. - U.S. GENIUS Act establishes stablecoin regulations while banks fear deposit outflows from crypto competition. - Institutional adoption (e.g., U.S. government's 212k BTC) and DeFi innovations in yield generation support Bitcoin's financial integration.

Charles Hoskinson, founder of Cardano (ADA), has made bold predictions about Bitcoin’s future, forecasting that the cryptocurrency could reach a market capitalization of $10 trillion within the next five years. Speaking in a recent interview, Hoskinson emphasized that Bitcoin DeFi will be the primary catalyst for this exponential growth, as it introduces financial utility and yield generation to the traditionally static Bitcoin asset [1]. The Cardano founder highlighted that Bitcoin’s limited downside and comparable upside to other tokens make it an increasingly attractive investment, particularly once it can be integrated into structured financial products and retirement accounts [2].

Hoskinson’s timeline for Bitcoin aligns with broader industry expectations but offers a more aggressive projection. Currently valued at around $112,672, Bitcoin would need to reach a price of approximately $500,000 per coin to achieve a $10 trillion market cap, assuming a circulating supply of 20 million BTC [2]. This would represent a 342.8% increase from its current valuation. The prediction places Bitcoin as the second-largest asset class globally, trailing only gold [1]. Such a valuation would also surpass the market capitalizations of major corporations like Amazon , Google, and Microsoft , reshaping the landscape of global finance.

A key driver for this growth, according to Hoskinson, is the development of decentralized finance (DeFi) products tied to Bitcoin. While Bitcoin lacks native smart contract functionality, projects like Cardano are working to bridge this gap by enabling Bitcoin holders to generate yields on their assets [1]. This innovation could pave the way for Bitcoin to be treated as a conventional financial instrument, allowing it to be included in investment portfolios such as IRAs and 401(k)s [1]. The founder also noted the growing adoption of Bitcoin by institutional investors and sovereign wealth funds, citing the U.S. government’s 212,000 Bitcoin holdings as a significant development in the broader trend of digital asset adoption [2].

In addition to Bitcoin’s potential for institutional inclusion, the regulatory environment is beginning to shift in a way that could facilitate widespread adoption. The U.S. government’s recent passage of the GENIUS Act has established a clear legal framework for payment stablecoins, mandating one-to-one reserve backing and imposing transparency requirements [3]. While the legislation primarily targets stablecoins, its implications for broader crypto regulation are significant. By defining clear boundaries and responsibilities, the law has helped reduce regulatory uncertainty and signaled the U.S. government’s intent to maintain leadership in the global digital asset space [3].

The evolving regulatory landscape has also sparked debate between traditional banking institutions and the digital asset sector. Major U.S. banks have raised concerns that stablecoin innovations could divert trillions in deposits from traditional financial systems, potentially affecting lending capacity and increasing borrowing costs [4]. These fears are not unfounded, as the U.S. Treasury estimated that under certain conditions, deposit outflows could reach $6.6 trillion. In response, crypto industry groups have defended the innovation as a tool for expanding financial choice and fostering competition, arguing that restrictions on yield-based incentives would unfairly advantage traditional banks [4].

Hoskinson’s vision for Bitcoin’s future, then, is not just speculative but increasingly plausible within the context of technological and regulatory developments. With DeFi innovation expanding, institutional adoption on the rise, and regulatory clarity emerging, the conditions are aligning for Bitcoin to achieve a valuation that could redefine its role in the global financial system. As structured financial products and investment tools evolve, the potential for Bitcoin to become a staple in retirement accounts and institutional portfolios grows, reinforcing the argument that its journey toward a $10 trillion market cap is not merely an optimistic forecast, but a feasible outcome within the next several years [1].

Source:

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Who controls XRP in 2026? Top 10 addresses control 18.56% of circulating supply

Steak ‘n Shake Increases Bitcoin Exposure Following Eight Months of Crypto Payments

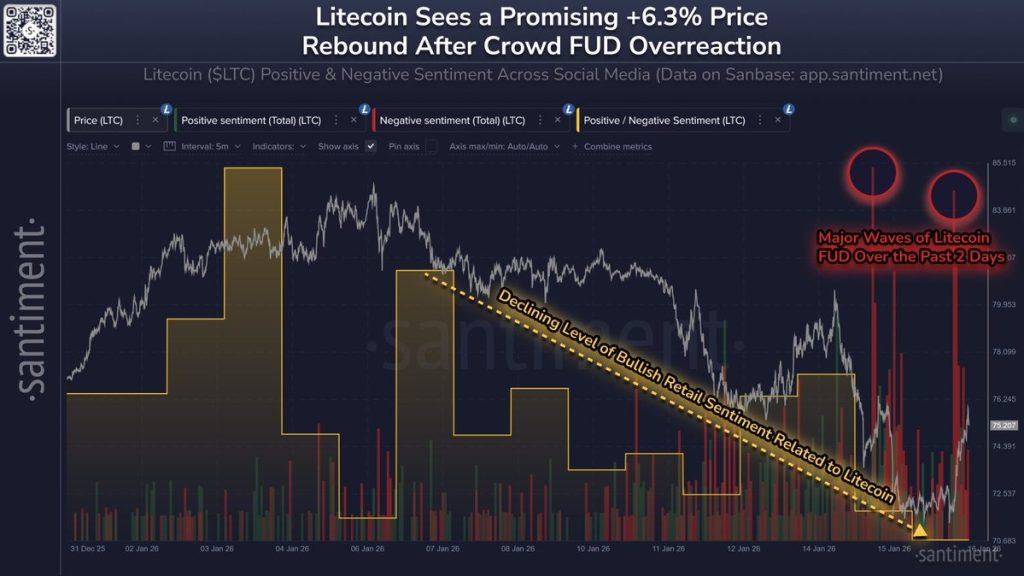

Are Traders Leaving Litecoin (LTC)? What It Means for This OG Crypto

Solana (SOL) Price Eyes $150 as Active Addresses Rebound and ETF Volumes Hit $6B