BlockDAG’s Pre-Launch Ecosystem and ROI Potential: A New Paradigm in Crypto Fundraising

- BlockDAG, a hybrid DAG-PoW blockchain, raised $386M in presales through 29 batches, outperforming peers like Avalanche with whale participation and 2,900% early investor returns. - Its 70% community token allocation (28B for miners, 5.25B for community) and EVM-compatible architecture enabling 10 TPS aim to address blockchain scalability while securing 4,500+ developers and 300+ dApps. - Strategic partnerships with Inter Milan and Seattle Seawolves, plus third-party audits by Halborn/CertiK, bolster inst

The cryptocurrency landscape in 2025 is witnessing a seismic shift in how Layer 1 (L1) projects validate their value propositions. BlockDAG, a hybrid DAG-PoW blockchain, has emerged as a standout contender, leveraging a growth model that challenges traditional fundraising paradigms. By analyzing its performance, resource allocation, and adoption metrics, this article argues that BlockDAG’s approach to sustainability and scalability could redefine the L1 space.

Performance: A Benchmark for L1 Fundraising

The allocation of funds further reinforces sustainability. 20% of the token supply is reserved for initial distribution, while 70% is allocated to the community, including 28 billion BDAG for miners, 5.25 billion for community building, and 1.75 billion for liquidity pools. This structure ensures long-term network security and user incentives, critical for scaling adoption.

Adoption Metrics: Building a Decentralized Ecosystem

BlockDAG’s hybrid architecture—combining DAG-PoW with EVM compatibility—enables 10 blocks per second, addressing the blockchain trilemma. This technical foundation has attracted 4,500+ developers and spurred the creation of 300+ dApps. The X1 mobile miner app, with 3 million users, and the sale of 19,000 ASIC miners, highlight a robust mining ecosystem. Meanwhile, 200,000 token holders are already on-chain, signaling strong grassroots participation.

Third-party validation by Halborn and CertiK adds credibility, a prerequisite for institutional adoption. Strategic partnerships with entities like Inter Milan and Seattle Seawolves further amplify real-world utility. Analysts project a 36x ROI by 2025, driven by early-batch discounts, deflationary tokenomics (50 billion supply), and infrastructure-driven demand.

Sustainability vs. Meme-Driven Models

While projects like Pepe Dollar rely on meme-driven branding, BlockDAG prioritizes structured utility and ESG-aligned energy efficiency. Its mining accessibility and institutional-grade security position it as a traditional L1 contender. The deflationary model, combined with EVM interoperability, ensures cross-chain developer appeal.

Conclusion: A New Paradigm for L1 Fundraising

BlockDAG’s model demonstrates that sustainability and scalability are achievable through strategic resource allocation, technical innovation, and community-first design. By aligning incentives for miners, developers, and investors, it sets a precedent for future L1 projects. As the crypto market matures, projects that prioritize infrastructure over hype—like BlockDAG—will likely dominate.

Source:

[1] BlockDAG: The Pre-Launch Powerhouse Set to Disrupt Layer 1 Space

[2] BlockDAG | Best Crypto Layer 1 Crypto in 2025

[3] Hyperliquid (HYPE): S1 2025 Activity Report

[4] Top Layer 1 Crypto Projects in 2025

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

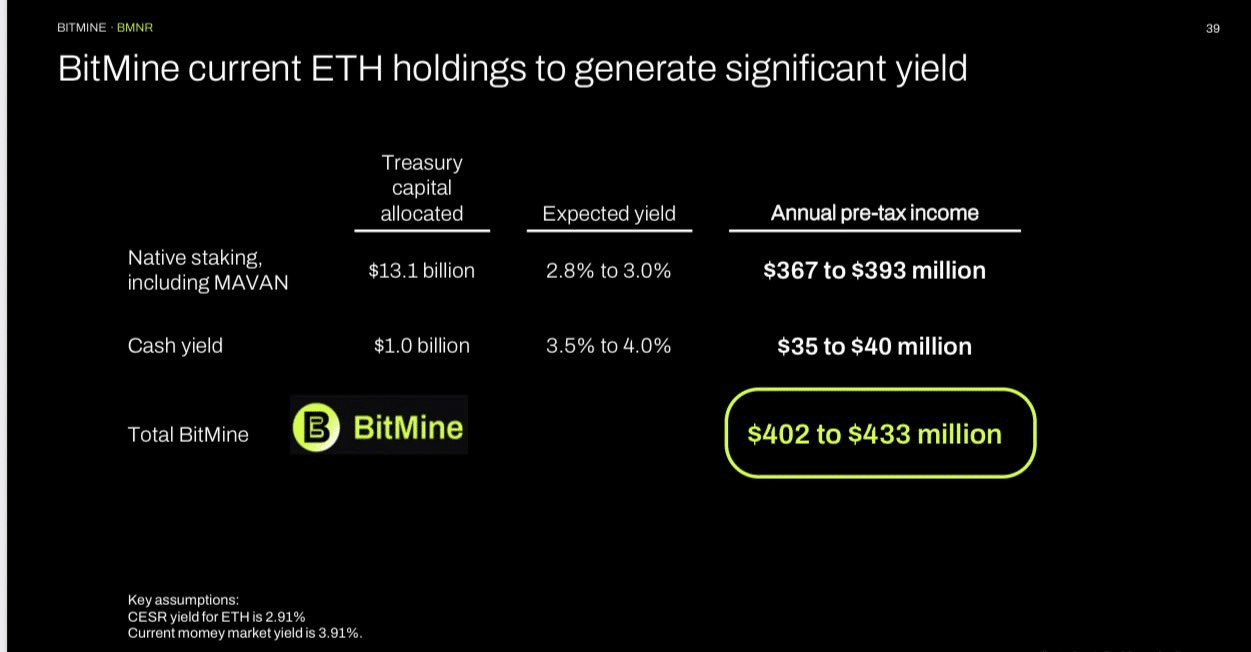

From $3.5K to $12K? Here’s why BMNR’s Ethereum forecast makes sense

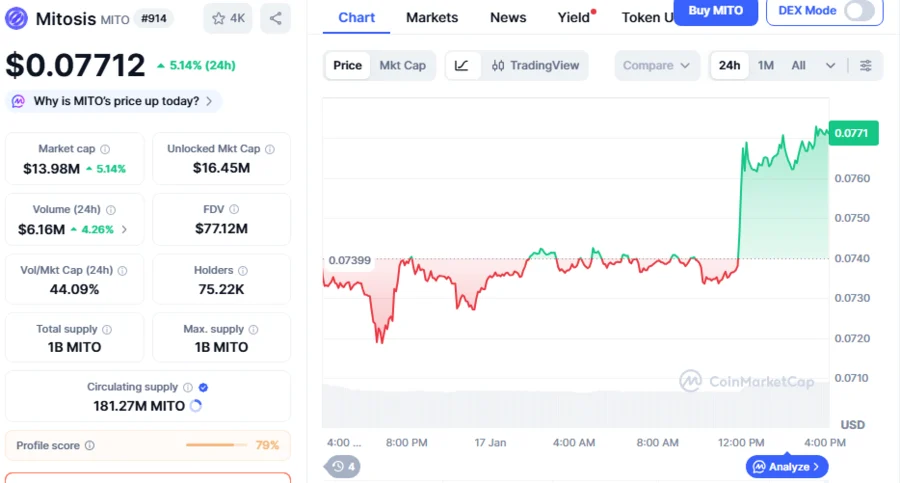

Mitosis Price Flashes a Massive Breakout Hope; Cup-And-Handle Pattern Signals MITO Targeting 50% Rally To $0.115305 Level

Recent financial moves by Trump spark renewed worries about possible conflicts of interest

Why Quant (QNT) Price Is Rising Today: Can It Hit $100 This Weekend?