Earnings Preview | Can "Vietnam's Tesla" VinFast Turn Profitable in Q2?

Summary: "Vietnam's Tesla" VinFast Auto will release its Q2 2025 financial report before the market opens on September 4. The market is looking forward to seeing this Southeast Asian EV star improve its delivery capabilities, optimize its supply chain, and turn profitable.

Q1 Performance Review

In the first quarter, VinFast's revenue grew by about 150% to 656.5 million USD, exceeding analysts' expectations. However, this was still not enough to offset rising sales and operating costs, with the company posting a loss per share of 0.30 USD, slightly higher than analysts' forecast of 0.28 USD. Net loss for the first quarter reached 712.4 million USD, up 20% from the same period last year.

In the first quarter, VinFast delivered 36,330 vehicles globally, an increase of 296% year-on-year. During the same period, electric scooter deliveries reached 44,904 units, up 473% year-on-year.

Q2 Outlook

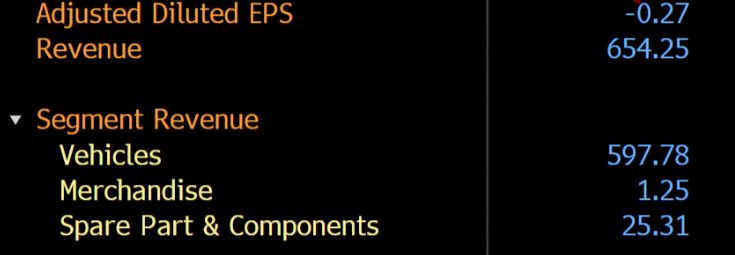

According to Bloomberg data, analysts expect VinFast's Q2 revenue to be 654 million USD, with adjusted diluted earnings per share at -0.27 USD.

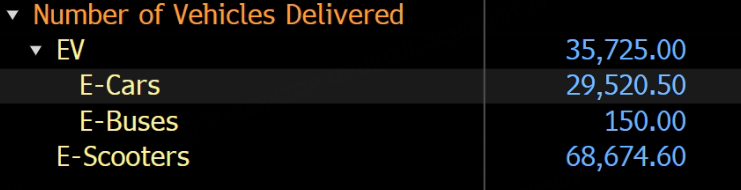

VinFast's Q2 electric vehicle deliveries are expected to reach 35,725 units.

Main Focus Points

Production Ramp-up and Delivery Pace

The delivery pace remains the core variable for revenue and gross margin. If the expansion of channels in the US and Southeast Asia proceeds as planned and the supply chain remains stable, quarterly deliveries are expected to continue rising. Increased deliveries can bring scale effects, dilute unit fixed costs, and, combined with marginal improvements in logistics and supply chain, theoretically help improve gross margins. Fulfilling deliveries will also support the stability of the pricing system and boost future sales confidence.

Cost Control and Gross Margin Improvement

Increasing localization rates and improving production line efficiency can reduce costs. The North Carolina plant is expected to start mass production in 2026, but the preliminary work of local procurement and supply chain integration has already provided bargaining support for the logistics and parts costs of imported vehicles. In the short term, Q2's marginal recovery mainly comes from optimizing the efficiency of the Vietnam production line and reducing material costs. By improving yield rates, reducing rework rates, and optimizing transportation and warehousing expenses, a continuous decrease in unit costs can be achieved. As supply chain stability improves, costs from emergency air freight and abnormal repairs will decrease, and gross margins are expected to improve marginally.

Simultaneous Development of North American and Southeast Asian Markets

The North American market remains the company's strategic focus, with the dealership model already in place. As channel coverage expands, potential orders are also increasing. However, delivery capabilities are still constrained by logistics and local certification processes. If Q2 can demonstrate more stable delivery volumes and after-sales satisfaction, repurchase and word-of-mouth effects will gradually emerge in subsequent quarters.

The completeness of dealers' after-sales infrastructure and local parts supply capabilities are important factors affecting user satisfaction, and the execution details in Q2 are worth paying attention to.

On the other hand, the Southeast Asian market has local advantages, with mature supply chains in Vietnam and surrounding regions, and cost and efficiency advantages in transportation radius and service networks. If regional expansion in Q2 goes smoothly, it can partially offset uncertainties in the North American market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

No wonder Buffett finally bet on Google

Google holds the entire chain in its own hands. It does not rely on Nvidia and possesses efficient, low-cost computational sovereignty.

HYPE Price Prediction December 2025: Can Hyperliquid Absorb Its Largest Supply Shock?

XRP Price Stuck Below Key Resistance, While Hidden Bullish Structure Hints at a Move To $3

Bitcoin Price Prediction: Recovery Targets $92K–$101K as Market Stabilizes