Gold Surpasses $3,500, Ushering in a New Era! Rate Cut Expectations and Political Risks Drive Dual Momentum

On September 2, gold prices broke through $3,500, reaching a historic high. The prospect of a Federal Reserve rate cut and growing concerns about its future have injected new momentum into the precious metal’s multi-year rally.

During early Asian trading on Tuesday, spot gold prices rose as much as 0.9%, hitting a record high of $3,508.73 per ounce and surpassing the previous peak set in April. So far this year, the precious metal has risen more than 30%, making it one of the best-performing commodities.

Gold is the preferred safe-haven asset during times of political and economic turmoil and typically benefits from a low interest rate environment. This year, gold has also been supported as investors sought safety from market volatility triggered by the global trade war initiated by US President Trump. The President’s escalating attacks on the Federal Reserve have become the latest source of investor concern, as worries about central bank independence could erode confidence in the United States.

The latest rally has been supported by market expectations that the Federal Reserve will cut rates this month, after Fed Chair Powell cautiously opened the door to rate cuts. A key US employment report to be released this Friday may further confirm the weakening labor market—providing justification for a rate cut. This has enhanced the appeal of precious metals, which do not pay interest to holders.

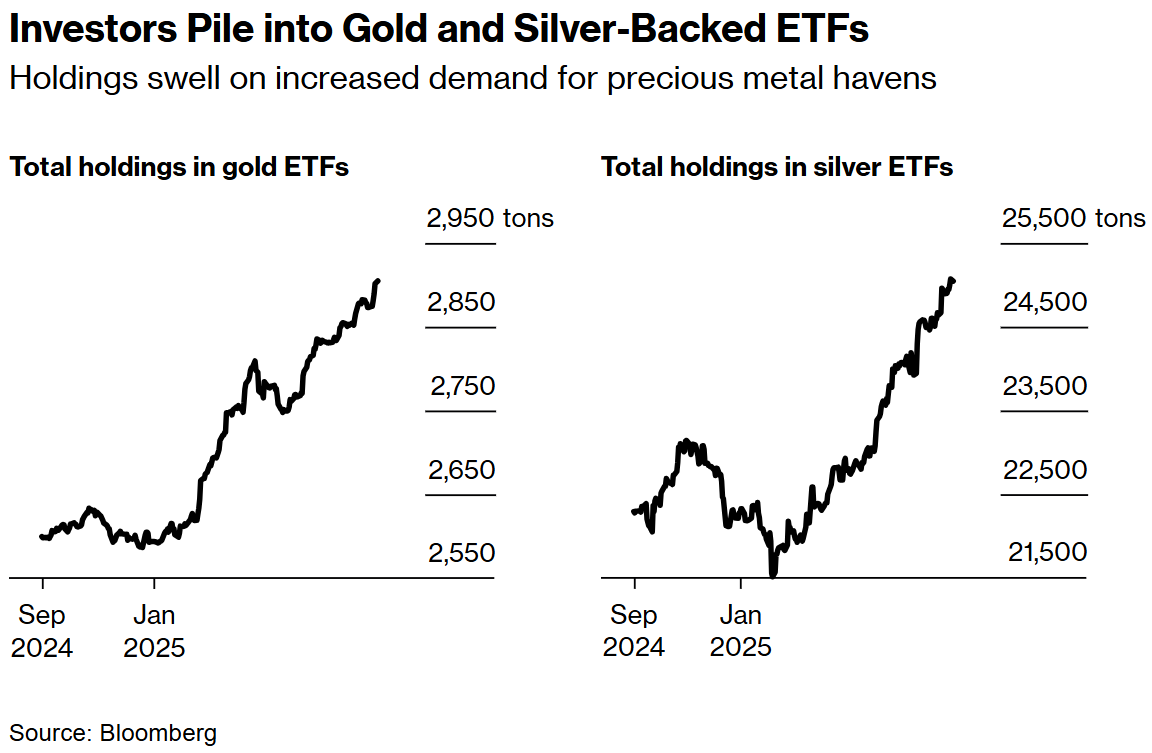

UBS strategist Joni Teves said: “Investors increasing their gold holdings, especially as a Fed rate cut looms, is driving gold prices higher. Our base case is that gold prices will continue to hit new highs in the coming quarters. The low interest rate environment, weak economic data, and persistently rising macro uncertainty and geopolitical risks have strengthened gold’s role as a portfolio diversification tool.”

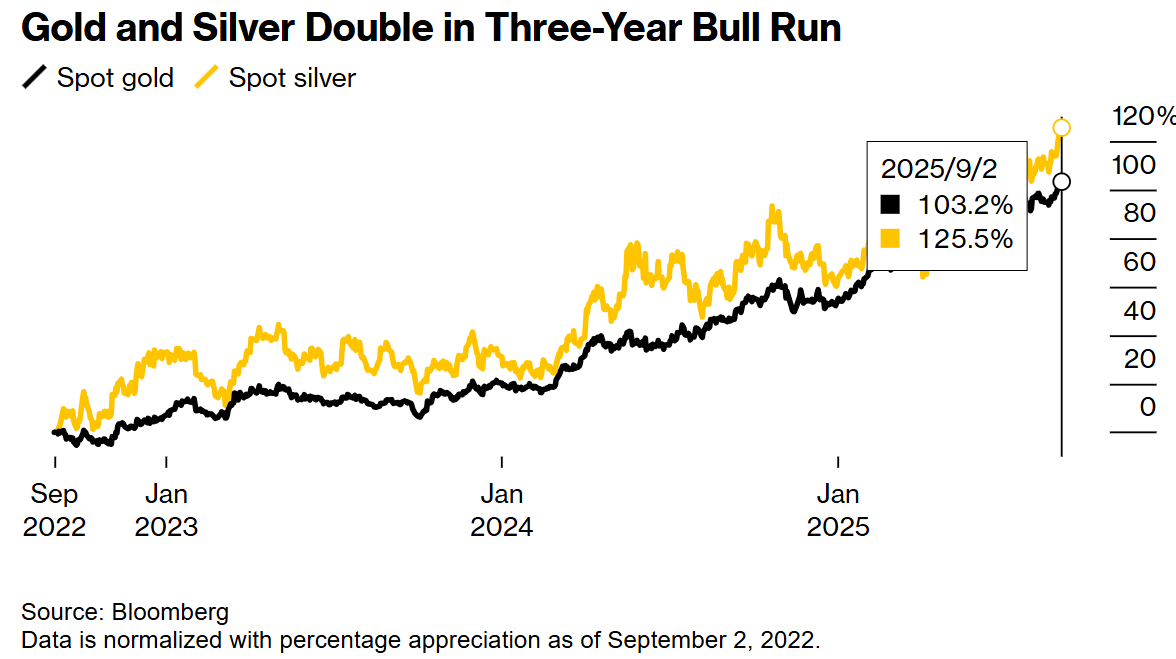

Gold and Silver Double in Three-Year Bull Market

Over the past three years, both gold and its lower-priced “cousin” silver have more than doubled, as rising risks in the geopolitical, economic, and global trade arenas have driven increased demand for these time-honored safe-haven assets. This year, Trump’s escalating attacks on the Federal Reserve have become the latest source of investor concern, as worries about the Fed’s independence could weaken confidence in the United States.

The market is awaiting a court ruling to determine whether Trump had legitimate grounds to remove Fed Governor Cook from the central bank. In addition, a federal appeals court has stated that the President illegally imposed global tariffs under the emergency powers act, adding uncertainty for US importers and delaying the government’s promised economic dividends.

The last time gold surged to a record high was in April, when Trump announced a preliminary plan to impose comprehensive tariffs on most US trading partners. As the President withdrew some of the most aggressive trade proposals, safe-haven demand cooled, and gold prices quickly retreated, remaining range-bound for several months.

“The space above $3,500 is yet to be determined, so the market will closely watch price action. The last time gold broke through $3,500 was during intraday trading, so we are keenly watching whether gold can close above this level intraday, as this could bring some upward momentum,” said OCBC forex strategist Christopher Wong. “The risk of new geopolitical tensions and policy uncertainty resurfacing remains, which will be bullish for gold prices.”

Meanwhile, silver’s rally has continued to outpace gold. So far this year, silver prices have risen more than 40%, and on Monday, prices broke through $40 per ounce for the first time since 2011. Silver is also valued for its industrial uses in clean energy technologies such as solar panels.

According to the Silver Institute, an industry organization, the market is set to experience a fifth consecutive year of supply shortages. A weaker US dollar has also boosted the purchasing power of major consumer countries such as China and India.

Investors have flocked to silver ETFs, with holdings rising for the seventh consecutive month in August. This has led to a reduction in silver inventories in London and ongoing market tightness. Lease rates (reflecting the cost of borrowing silver, usually short-term) remain elevated at around 2%, far above the normal near-zero level.

Concerns over potential US tariffs have also supported precious metal prices. Last week, silver was added to Washington’s list of critical minerals, which already includes palladium.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Interop Roadmap: How to Unlock the “Last Mile” for Mass Adoption

From cross-chain to "interoperability," many of Ethereum's fundamental infrastructures are accelerating towards system integration for large-scale adoption.

A $170 million buyback and AI features still fail to hide the decline; Pump.fun is trapped in the Meme cycle

Facing a complex market environment and internal challenges, can this Meme flagship really make a comeback?

Saylor Dismisses Sell-Off Rumors as Strategy Increases Bitcoin Holdings Amid Market Drop