Date: Mon, Sept 01, 2025 | 11:40 AM GMT

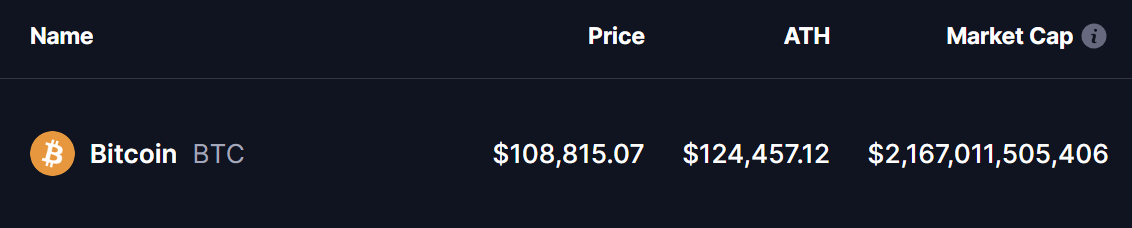

The cryptocurrency market is undergoing choppy waters after a strong rally that began in Q2, during which Bitcoin (BTC) surged to a new all-time high of $124K in Q3’s mid-August. Since then, BTC has cooled down to around $108K, reflecting a 12% pullback.

However, beyond the short-term decline, a key cycle pattern on the chart is signaling a potential bounce back — one that could set the stage for BTC to push toward new record highs.

Source: Coinmarketcap

Source: Coinmarketcap

Key Cycle Pattern Signaling Potential Next Move

According to the latest analysis shared by prominent crypto analyst Osemka , the next BTC move-up could happen as early as mid-Sep.

He’s comparing solar and lunar eclipses to big turning points (major pivot points) on trading charts. In other words, just like eclipses mark special cosmic events, certain points on charts (tops or bottoms) also act as “rare but powerful” markers in the market.

Bitcoin (BTC) Chart/Credits: @Osemka8 (X)

Bitcoin (BTC) Chart/Credits: @Osemka8 (X)

The cycle chart highlights a repeating ~25-week rhythm in BTC’s price action, where major bottoms tend to align with cyclical inflection points. Each past occurrence has been followed by significant rallies, and the current setup is echoing those historical moves.

What’s Next for BTC?

If this 25-week cycle continues to play out, Bitcoin must find its bottom by mid-September. Should that scenario materialize, a successful bounce could propel BTC toward a new all-time high by March 2026, aligning with the projected cycle extension.

While short-term volatility remains a factor, the chart structure suggests that Bitcoin’s long-term trend is still intact, with cyclical timing pointing toward another leg higher.