Hyperliquid Emerges as Crypto “Killer App” With Explosive Growth

Hyperliquid is redefining perp DEX trading with soaring revenue and trillions in volume. But as growth accelerates, questions about risks, competition, and sustainability remain.

Hyperliquid (HYPE) is taking the market by storm as its monthly revenue surpasses $110 million, with perpetual trading volume hitting $2.5 trillion.

Dubbed crypto’s new “killer app,” the platform opens up explosive growth opportunities while raising questions about risks and sustainability.

Hyperliquid Surges

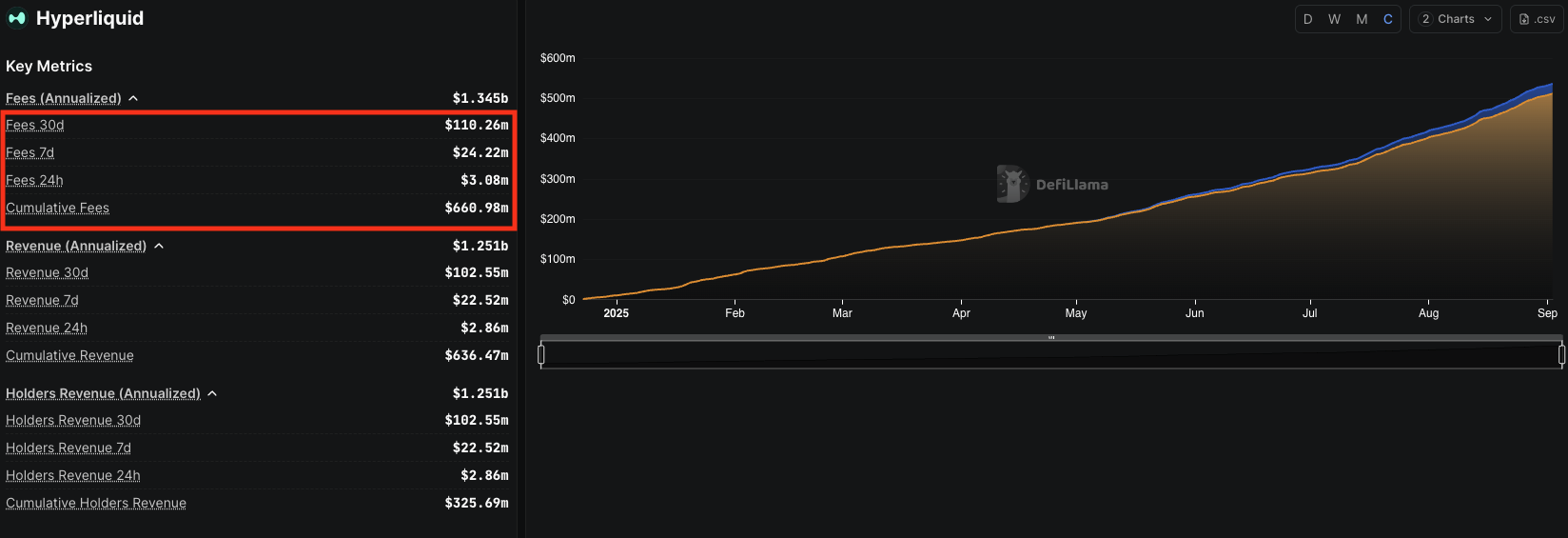

In the past 30 days, Hyperliquid’s revenue exceeded $110 million, bringing its cumulative revenue to nearly $661 million. This is a rare growth trajectory for a non-custodial perp DEX. Data from DefiLlama shows that the protocol’s fee generation continues to rise steadily despite the market’s “slow summer.”

Revenue from Hyperliquid. Source:

DefiLlama

Revenue from Hyperliquid. Source:

DefiLlama

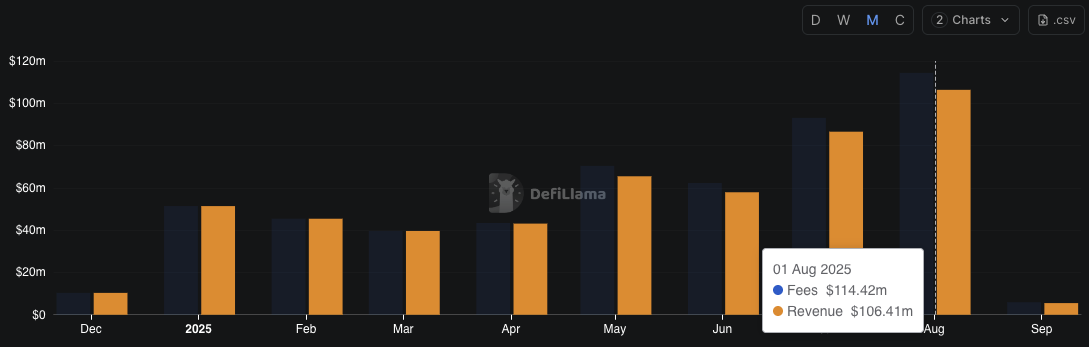

According to DefiLlama, in August alone, Hyperliquid’s revenue and fees reached $106 million and $114 million, respectively. These numbers were higher than July’s $86 million and $93 million. In July, Hyperliquid accounted for as much as 35% of the total revenue across the blockchain sector.

Revenue and fees from Hyperliquid in August. Source:

DefiLlama

Revenue and fees from Hyperliquid in August. Source:

DefiLlama

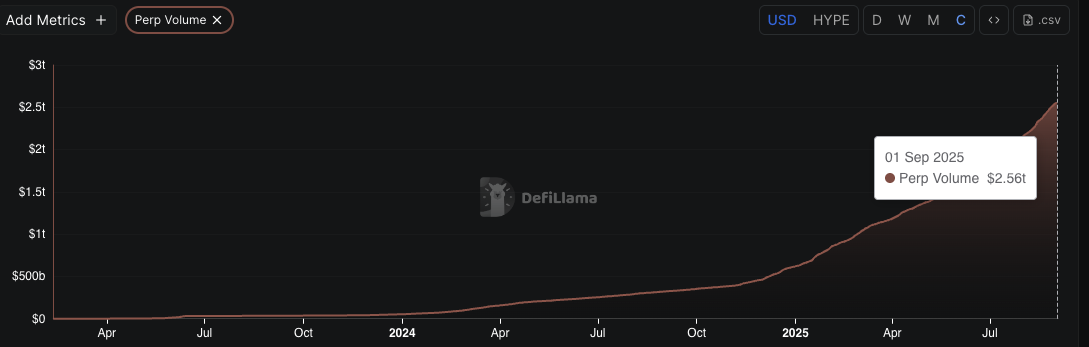

Beyond revenue and fees, Hyperliquid’s perpetual volume has surpassed $2.5 trillion. In fact, according to a user on X, even during the so-called “slow summer,” the platform still recorded more than $1 trillion in trading activity.

Perpetual volume on Hyperliquid. Source:

DefiLlama

Perpetual volume on Hyperliquid. Source:

DefiLlama

This growth highlights a stark contrast to DEX activity on Solana. According to Will Clemente, while Solana-based DEXs have declined in activity since the memecoin frenzy earlier this year, Hyperliquid’s users and volumes have been “trending up and to the right all year pretty much.”

The Next Potential App?

Hyperliquid’s recent surge has also sparked mixed reactions. With its simple product, CEX-like experience, and ability to expand its ecosystem quickly, Hyperliquid has the potential to become crypto’s new “killer app.”

However, from another perspective, some users argue that Hyperliquid still faces structural risks such as admin control and potential downtime. In fact, Hyperliquid faced a brief frontend outage that prevented users from placing, closing, or withdrawing orders, although backend operations continued unaffected.

“If Hyperliquid goes down can users withdraw funds? (e.g., submit proofs). If Hyperliquid turned evil, can they steal user funds?” X user Ryan questioned.

Meanwhile, competition in the perp DEX race is heating up with new entrants like Lighter. With features such as order match/liquidation verification and unified yield–margining, Lighter is considered a “formidable competitor.”

Hyperliquid’s scale advantage and current user base remain dominant, especially as revenue and trading volumes maintain momentum. If the execution milestones in its roadmap are carried out, Hyperliquid has the foundation to continue shaping crypto’s next major momentum shift.

Despite this, HYPE is showing signs of retracement, currently trading at $44.63 USD. Technicals showed $50–$51 as key resistance turned support, with targets at $55, $58, and $73 if bullish momentum sustains.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.