Morgan Stanley: Fortinet (FTNT.US) firewall update performance disappointing, rating and target price downgraded

According to Jinse Finance APP, JPMorgan has downgraded Fortinet (FTNT.US) from "Hold" to "Underweight," and also lowered its target price from $78 to $67, partly due to disappointing firewall upgrade performance.

The team led by JPMorgan analyst Meta Marshall stated in a report to investors on Tuesday: "We believe Fortinet's strategy of attaching more products to its installed customer base will still succeed, but since the scale of firewall upgrades is smaller than expected, we think performance forecasts for fiscal year 2026/2027 may need to be revised downward, which will negatively impact its stock price."

Marshall added: "However, given that the free cash flow multiple is still in the low to mid-20s, and we believe that after product upgrades, its growth rate is expected to reach high single digits, we tend to think that the risk-reward ratio is not optimistic in the short term."

Marshall stated: "Investors believe the new management has the ability to reaccelerate revenue growth, but this expectation has not yet been reflected in estimates, despite ongoing short-term uncertainties. Since the new CEO only took office at the end of last year, investors may still give some leeway in the short term."

Despite downgrading Fortinet, JPMorgan still maintains a "Hold" rating on its competitor Check Point Software Technologies (CHKP.US).

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stellar (XLM) Price Prediction: Can Bulls Push Toward $0.30 in December?

21Shares XRP ETF Set to Launch on 1 December as ETF Demand Surges

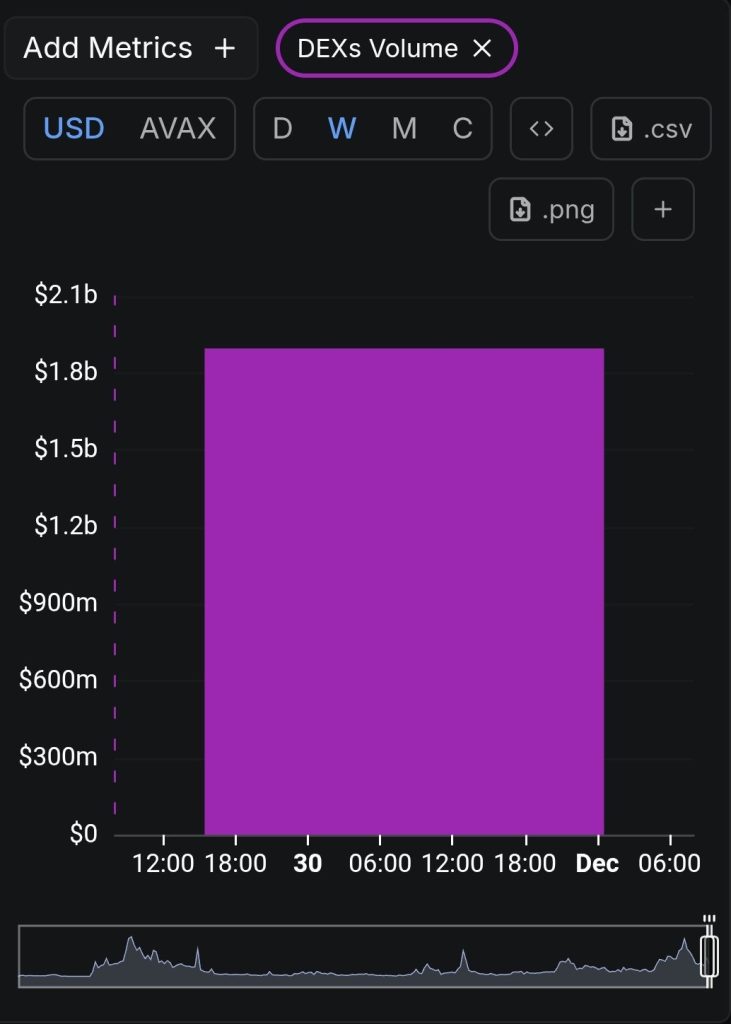

Avalanche (AVAX) Sees DEX Volume Surge as Price Rebounds From Key Support—Is a Major Breakout Near?

CZ Issues Market Warning as Crypto Exits Longest ‘Extreme Fear’ Streak