Global markets stumble at the start of September as the sell-off of long-term government bonds in developed countries accelerates

The international financial market ushered in a gloomy start to September. As the US market resumed trading after a long weekend, the prevailing bearish sentiment intensified the wave of sell-offs in long-term bonds across developed countries. The yield on the US 30-year Treasury bond approached the psychological threshold of 5%, the yield on Japan's 30-year government bond hit a multi-decade high, the yield on the UK's 30-year gilt climbed to its highest level since 1998, and the yield on France's 30-year government bond surpassed 4.5% for the first time since 2009.

Ipek Ozkardeskaya, Senior Analyst at Swissquote Bank, pointed out that the driving factors behind this wave of long-term bond sell-offs include market concerns over the ballooning scale of sovereign debt and the political obstacles faced by countries in implementing fiscal tightening policies. The continued rise in long-term bond yields in developed countries reflects deep-seated doubts in the market regarding debt sustainability and the effectiveness of policy measures.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

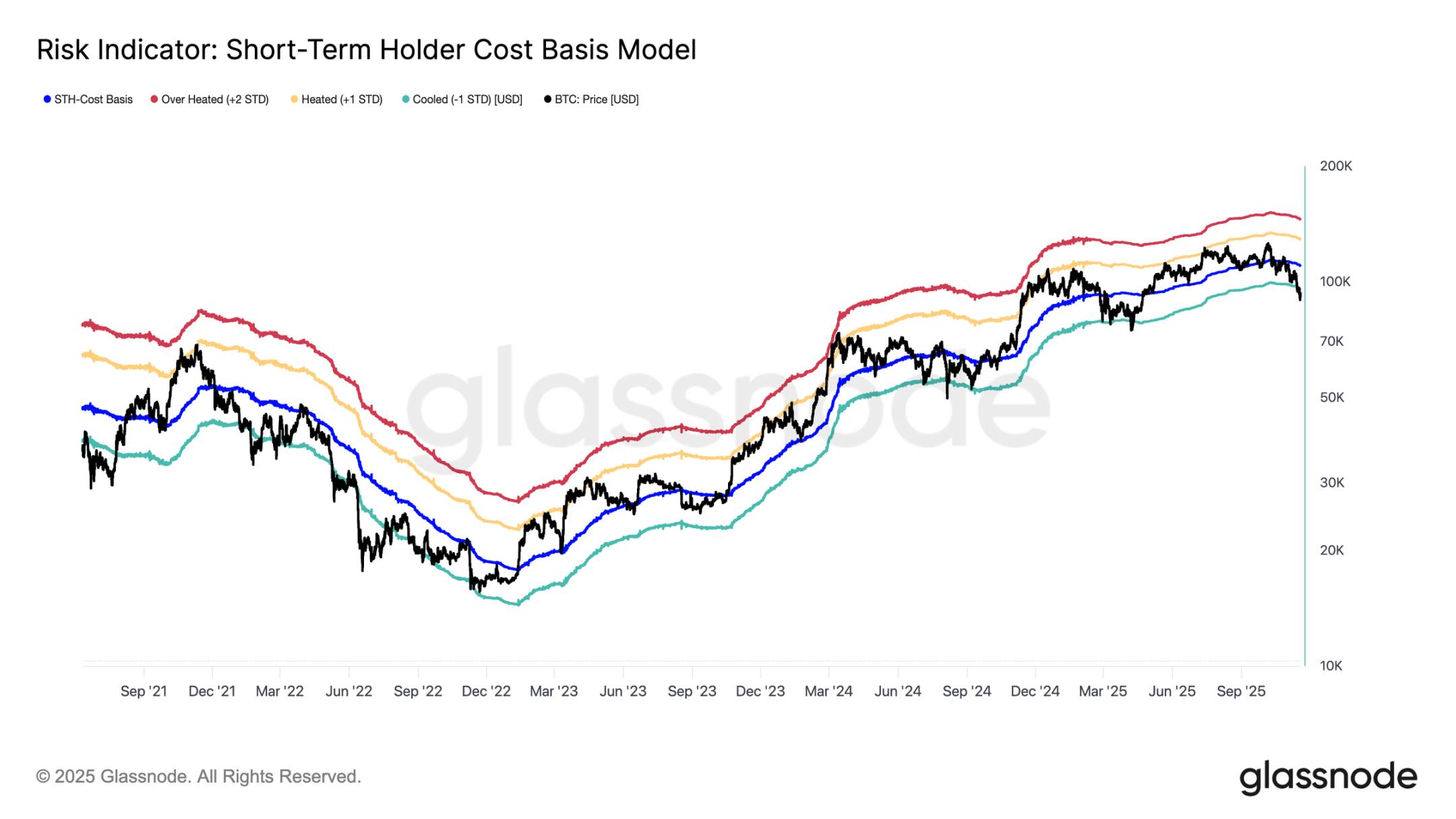

Bitcoin plunges 30%. Has it really entered a bear market? A comprehensive assessment using 5 analytical frameworks

Further correction, with a dip to 70,000, has a probability of 15%; continued consolidation with fluctuations, using time to replace space, has a probability of 50%.

Data Insight: Bitcoin's Year-to-Date Gains Turn Negative, Is a Full Bear Market Really Here?

Spot demand remains weak, outflows from US spot ETFs are intensifying, and there has been no new buying from traditional financial allocators.

Why can Bitcoin support a trillion-dollar market cap?

The only way to access the services provided by bitcoin is to purchase the asset itself.

Crypto Has Until 2028 to Avoid a Quantum Collapse, Warns Vitalik Buterin