XRP in Trouble or Ready to Soar? September Could Decide

XRP price enters September at a crossroads, caught between macroeconomic headwinds and technical uncertainty. The Federal Reserve’s Beige Book highlights how tariffs are driving up costs, straining household budgets, and slowing hiring. These pressures increase the odds of a rate cut later this month, a move that could breathe new life into risk assets like cryptocurrencies. At the same time, inflation risks tied to tariffs complicate the picture, leaving investors to weigh whether XRP price is primed for a bullish breakout or vulnerable to another leg down.

XRP Price Prediction: What the Beige Book Reveals?

The Federal Reserve’s Beige Book just painted a worrying picture: tariffs are inflating costs, squeezing households, and forcing companies to freeze hiring. With consumer spending and employment—two key economic pillars—under pressure, the Fed is now under mounting pressure to cut interest rates in September. Futures markets already price a 96% chance of a rate cut.

For XRP price and the broader crypto market, this sets the stage for a potential shift. Rate cuts usually weaken the dollar and inject liquidity into risk assets. But tariffs complicate the picture, since they add inflationary pressure. This tug of war between inflation fears and recession risks could make September volatile.

XRP’s Technical Setup on the Daily Chart

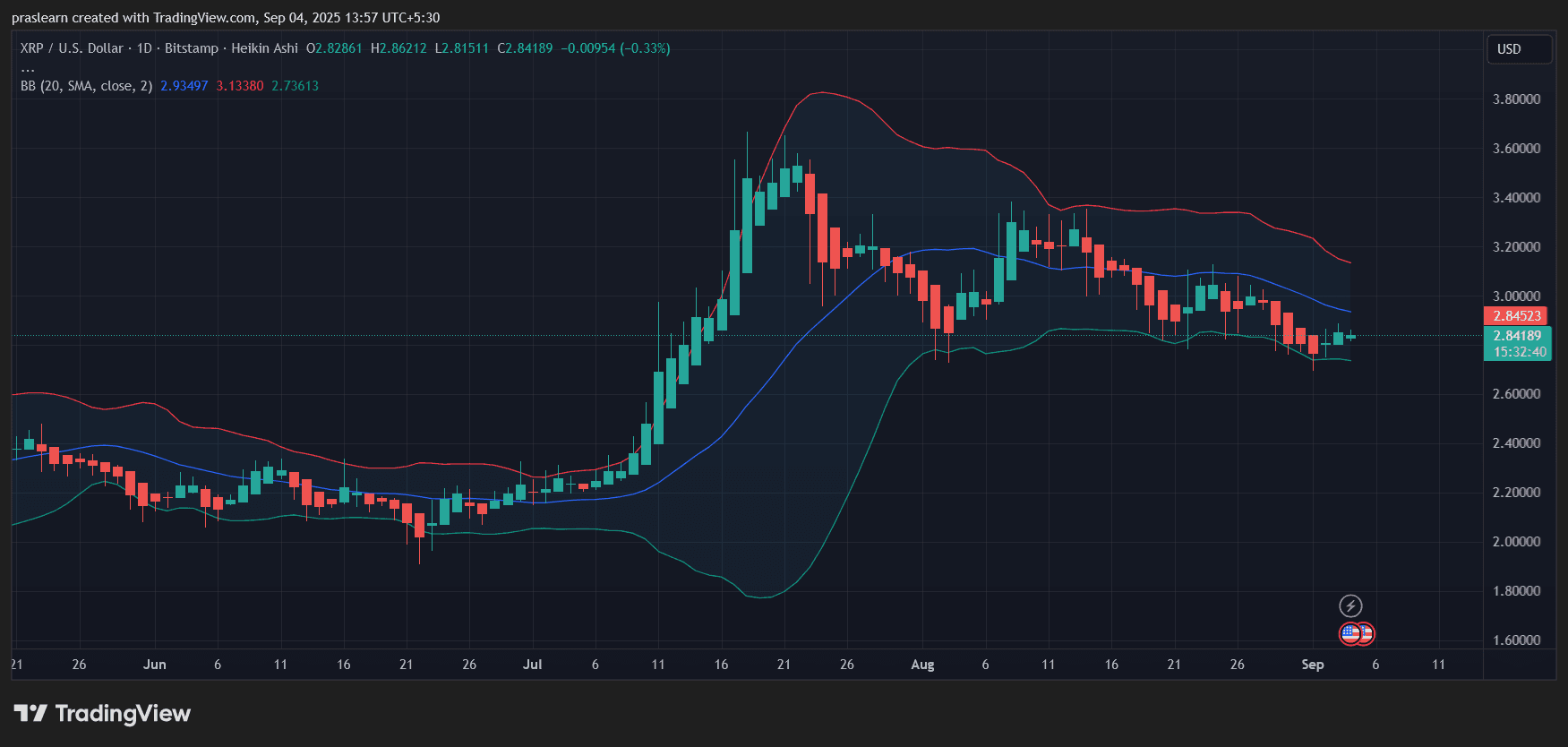

XRP/USD Daily Chart- TradingView

XRP/USD Daily Chart- TradingView

Looking at XRP’s daily chart, the token has been consolidating after its July breakout to above 3.6 USD. Since mid-August, XRP has been drifting lower, stabilizing around 2.8 USD. Key observations:

- Bollinger Bands are narrowing, hinting at an upcoming volatility surge.

- XRP is trading just below the mid-band (20-day SMA at ~2.93 USD), suggesting a neutral-to-bearish short-term tone.

- The lower Bollinger Band around 2.73 USD is providing support, while resistance sits near 3.13 USD.

This structure shows XRP is coiling for a move, with September’s macro triggers likely to decide the breakout direction.

How Fed Policy Could Impact XRP Price?

If the Fed cuts rates in September as markets expect, liquidity will return and risk assets could rally. For XRP price, a rate cut would lower dollar strength, potentially making crypto more attractive. That opens the door for XRP to retest the 3.1–3.2 USD resistance.

On the flip side, if inflation from tariffs forces the Fed to hold rates steady, markets could sour quickly. That scenario risks a breakdown below 2.7 USD, dragging XRP back toward the 2.5 USD zone.

Investor Sentiment and Macro Link

Crypto market has increasingly moved in tandem with global liquidity cycles. XRP price July rally coincided with growing bets on Fed easing. Now, with the Beige Book confirming economic stagnation, investors may lean back into digital assets as a hedge against both inflation and a weaker job market.

Still, the inflation angle tied to tariffs shouldn’t be dismissed. If consumer prices continue rising despite weak growth, the Fed may hesitate longer, creating uncertainty. That hesitation would cap XRP’s upside momentum.

XRP Price Prediction: September Outlook for XRP

The path for $XRP price in September hinges almost entirely on the Fed’s decision and the market’s interpretation of tariffs-driven inflation. Two scenarios stand out:

- Bullish case: A Fed rate cut triggers renewed liquidity, XRP climbs past 3.1 USD and could aim for 3.4 USD.

- Bearish case: Inflation concerns delay easing, XRP breaks below 2.7 USD and risks sliding toward 2.5 USD.

At the moment, the bias leans slightly bullish given the high probability of a September cut. But traders should brace for volatility—$XRP is sitting at a pressure point where macro news will dictate the next trend.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin (BTC/USD) Price Alert: Bitcoin Breaks Major Resistance - Next Stop $100,000?

Ethereum treasury demand collapses: Will it delay ETH’s recovery to $4K?

Can BNB price retake $1K in December?

Trending news

More[Bitpush Daily News Selection] Trump actively hints at Hassett as the next Federal Reserve Chairman; Bloomberg: Strategy may consider offering bitcoin lending services in the future; Strategy CEO: Strategy sets $1.4 billion reserve through stock sale to ease bitcoin selling pressure; Sony may launch a US dollar stablecoin for payments in gaming, anime, and other ecosystems

Bitcoin (BTC/USD) Price Alert: Bitcoin Breaks Major Resistance - Next Stop $100,000?

![[Bitpush Daily News Selection] Trump actively hints at Hassett as the next Federal Reserve Chairman; Bloomberg: Strategy may consider offering bitcoin lending services in the future; Strategy CEO: Strategy sets $1.4 billion reserve through stock sale to ease bitcoin selling pressure; Sony may launch a US dollar stablecoin for payments in gaming, anime, and other ecosystems](https://img.bgstatic.com/multiLang/image/social/44682a8c7537c9a9b467e17ed74a704d1764777241317.jpg)