Nasdaq takes action! Strict regulation on "crypto speculation" listed companies

According to foreign media The Information reports, the Nasdaq exchange plans to strengthen its regulation of listed companies raising funds to purchase cryptocurrencies. It will require companies to obtain shareholder approval and to disclose in detail the purpose of the purchase, associated risks, and the impact on their core business. Otherwise, they may face suspension or even delisting.

This policy news quickly triggered a chain reaction, with the share prices of several crypto-related companies falling and the crypto market declining in the short term.

The Fundraising Frenzy Behind the Data: 154 Companies and $98 Billion in “Crypto Buying Impulse”

This move by Nasdaq is not without reason.

According to a research report released by the well-known investment bank Architect Partners in Q3 2025, since January 2025, more than 154 publicly listed companies in the United States have proposed or completed fundraising plans, explicitly stating “purchasing bitcoin or other cryptocurrencies” as the use of funds, with a total fundraising amount reaching $98 billion. This scale far exceeds the cumulative total of only 10 companies and $33.6 billion in similar fundraising in previous years.

Many companies, under the guise of “blockchain strategy deployment” or “diversified treasury allocation,” are actually attempting to ride the crypto market boom.

The most common practice among them is to try to become a “stock proxy” for a popular token—by purchasing large amounts of a certain cryptocurrency (such as BTC, ETH, or even meme coins) in the open market, making their own stock a tool for secondary market investors to indirectly bet on that token. Especially in a bull market environment, this strategy can easily push up stock prices, generate buzz, and even help major shareholders cash out at high prices.

This regulatory upgrade by Nasdaq is precisely aimed at curbing such financial behaviors that deviate from core business and are driven by short-term speculation.

Rapid Market Response: Who Is Falling? Who Is Misunderstood?

The market reaction was immediate.

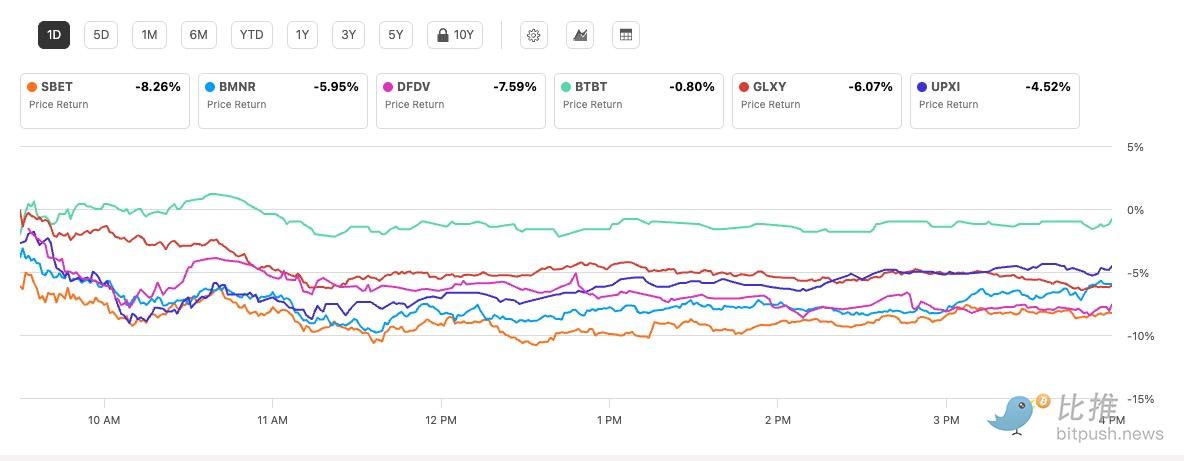

The share prices of several companies highly associated with crypto assets saw significant declines. As of this writing, MicroStrategy (MSTR) is down 2.7%, SharpLink Gaming (SBET) plunged 8.3%, Bitmine Immersion Technologies (BMNR) fell 6%, Metaplanet (MTPLF) dropped 6.7%, Mercury Fintech Holding (MFH) plunged 19%, and Kindly MD (NAKA) fell 5.2%.

Meanwhile, cryptocurrency prices also faced selling pressure: bitcoin fell 2.1% in the past 24 hours to around $109,300, and ethereum dropped 3.3% to $4,300.

Behind these fluctuations is not only the market’s natural reaction to short-term negative news, but also a sign that investors are beginning to reassess the true value and compliance costs of “crypto concept stocks.”

Behind these fluctuations is not only the market’s natural reaction to short-term negative news, but also a sign that investors are beginning to reassess the true value and compliance costs of “crypto concept stocks.”

Since the Trump administration, the United States has maintained a “welcoming” attitude toward crypto regulation, but federal agencies such as the SEC (Securities and Exchange Commission) and CFTC (Commodity Futures Trading Commission) have been relatively slow in enforcement and legislative progress. This relaxed environment has emboldened many companies to aggressively pursue crypto asset allocation plans, and even led to the emergence of companies whose core narrative is “holding coins.”

However, with repeated incidents of companies using the crypto concept to hype stock prices, followed by executives cashing out and stock price collapses, exchanges as frontline regulators have had to take the lead. This Nasdaq policy can be seen as a form of “supplementary regulation”—maintaining market order and investor protection through listing rules before federal legislation is fully established.

In fact, this is not the first time Nasdaq has shown a cautious attitude toward the crypto sector. From delaying the listing of several crypto mining companies to imposing stricter information disclosure requirements on companies with a high proportion of blockchain business, its policies have consistently favored “risk prevention over promoting innovation.”

The Two Sides of the Coin

Critics argue that while Nasdaq’s approach is reasonable, it carries the risk of “over-blocking.”

Some companies genuinely trying to integrate blockchain technology into their business fundamentals—for example, those advancing supply chain finance digitization or experimenting with tokenized asset issuance—may also be deterred by the increased compliance costs of the new regulations. Lengthy shareholder approval processes and complex information disclosure could cause companies to miss market opportunities.

In addition, strict controls may push innovative companies toward private markets, other international exchanges (such as those in Canada or Singapore), or even directly raise funds through DAOs or tokenized structures, thereby weakening Nasdaq’s own competitiveness and the innovative vitality of the US capital market.

For investors, Nasdaq’s strengthened regulation is a double-edged sword. On the positive side, stronger regulation can reduce market manipulation such as pump-and-dump schemes, curb pure concept speculation, help squeeze out bubbles, and protect small and medium investors from the harm of information asymmetry.

But on the other hand, in a bull market environment, the “fundraising—crypto purchase—stock price surge” mechanism has previously brought significant returns to some investors. With stricter regulation, such high-volatility, high-return opportunities may decrease. Investors may need to turn to other instruments (such as spot bitcoin ETFs, futures ETFs, trust products, etc.) to gain crypto asset exposure, or accept a more stable but less explosive market.

This Nasdaq decision is likely to become a bellwether for mainstream exchanges worldwide. Currently, the New York Stock Exchange (NYSE), Chicago Board Options Exchange (CBOE), and others have not yet introduced similarly stringent policies, but they are closely monitoring market and regulatory responses. It is possible that a set of “corporate crypto holding information disclosure standards” applicable to US and even global exchanges will be developed in the future.

Meanwhile, companies are also adjusting their strategies. Many have begun restructuring fundraising plans, repackaging “cryptocurrency investment” as “digital treasury management” or “blockchain technology development” projects to avoid direct scrutiny. Legal teams are busy interpreting the new rules, and shareholder communication costs have risen significantly.

Regardless of the outcome, Nasdaq seems to be striving to balance two roles: on one hand, as a financing platform for innovative companies, and on the other, as a guardian of market order.

Perhaps the true significance of this regulatory experiment lies in the fact that it is no longer about “whether to regulate,” but about “how to regulate in a way that is both fair and smart.” The integration of the crypto world and traditional finance is now irreversible, but the path to integration will inevitably be filled with similar clashes and compromises.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Consensus Layer Reconstruction Beam Chain: The Ultimate Path or a Technical Maze?

Is the 5-year implementation timeline for Beam Chain reasonable? What does the community think?

November 21 Key Market Information Gap, A Must-See! | Alpha Morning Report

1. Top News: Base Co-founder Jesse's jesse Token Released, Currently Valued at $14 Million 2. Token Unlock: $DMC, $ID

Bitcoin slump to $86K brings BTC closer to ‘max pain’ but great ‘discount’ zone

Trending news

MoreEthereum Consensus Layer Reconstruction Beam Chain: The Ultimate Path or a Technical Maze?

[Bitpush Daily News Highlights] Goldman Sachs: Stock sell-off expected to reach $40 billion next week; Jefferies report: Tether's gold reserves reach 116 tons, making it one of the world's largest non-sovereign gold holders; TechCrunch: Prediction market Kalshi raises $1 billion, valuation reaches $11 billion

![[Bitpush Daily News Highlights] Goldman Sachs: Stock sell-off expected to reach $40 billion next week; Jefferies report: Tether's gold reserves reach 116 tons, making it one of the world's largest non-sovereign gold holders; TechCrunch: Prediction market Kalshi raises $1 billion, valuation reaches $11 billion](https://img.bgstatic.com/multiLang/image/social/266a4eb2f52d42906f0b432a905d6ba81763665562274.png)