Did "cutting" reach the Trump family? Justin Sun blacklisted by WLFI!

On-chain data shows that WLFI has officially blacklisted one of Justin Sun's wallet addresses, directly locking over $100 millions worth of unlocked WLFI tokens in that address, as well as billions of tokens that are still in a locked state.

On-chain data shows that WLFI has officially "blacklisted" one of Justin Sun's wallet addresses, directly locking more than $100 million worth of unlocked WLFI tokens in that address, as well as billions of tokens that are still locked.

Written by: Ye Zhen

Source: Wallstreetcn

Is a high-profile cryptocurrency experiment turning into a public internal conflict?

The crypto project World Liberty Financial (WLFI), endorsed by the Trump family, has, after a turbulent listing, blacklisted the wallet address of one of its biggest supporters—Tron founder Justin Sun. This move has dealt another blow to already fragile market confidence.

On Thursday, according to on-chain data, WLFI officially blacklisted one of Justin Sun's wallet addresses, directly locking more than $100 million worth of unlocked WLFI tokens in that address, as well as billions of tokens that are still locked.

The trigger for this dramatic event was a transfer made by Justin Sun. According to Arkham Intelligence data, before being blacklisted, the address transferred about $9 million worth of WLFI tokens. Justin Sun responded by saying that his address only conducted "a few very small general exchange deposit tests" and address diversification operations, with no buying or selling involved, and thus could not have affected the market.

Justin Sun Blacklisted After Transferring Tens of Millions of Dollars

The conflict between Justin Sun and the WLFI project became fully public on Thursday. Although World Liberty did not specify the exact reason for blacklisting his wallet, the timing was extremely sensitive. On-chain data shows that after Justin Sun's address transferred 50 million WLFI tokens 14 hours earlier, the project team quickly took action.

According to Arkham data, the frozen address still holds 545 million WLFI, worth about $102.3 million at current market prices, in addition to 2.4 billion locked tokens.

As an important early supporter of the project, Justin Sun was appointed as an advisor to World Liberty and purchased $75 million worth of WLFI tokens. He also promised to buy $100 million worth of Trump-related TRUMP Memecoin and was thus invited to attend a dinner hosted by President Trump.

Regarding this transfer, Justin Sun explained on social platform X that his actions would not have any impact on the market. However, the market was clearly not fully convinced.

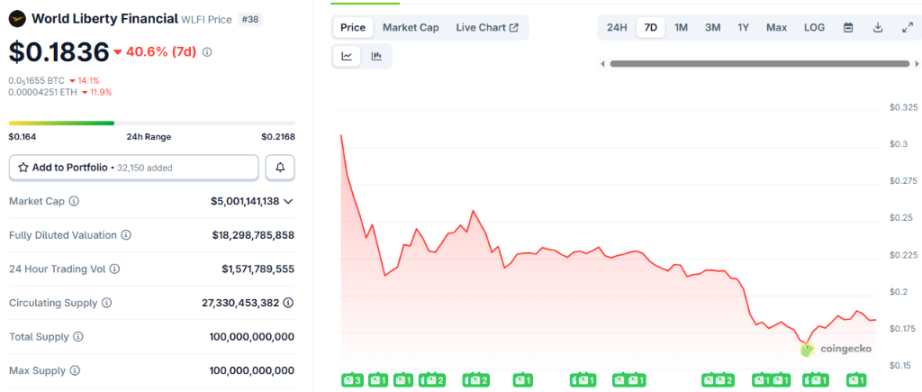

The price of WLFI tokens had already started to fall several hours before Justin Sun's transfer, plunging as much as 24% on Thursday.

Unverified User Speculation: A "Golden Cicada Shedding Its Shell"?

Amid market turmoil, an unverified user speculation has been circulating in the community, claiming that Justin Sun may have used complex operations to evade market monitoring. The comment alleges that Justin Sun first stated on social media that he would not sell to stabilize market sentiment, then launched a 20% annualized deposit campaign on his controlled exchange HTX to attract retail investors, subsequently transferred users' deposits through multiple addresses to Binance for selling, and finally used tokens from his own wallet to pay HTX users.

The analysis concludes that in this way, Justin Sun's wallet address did not appear to directly participate in dumping, but the funds may have already been "safely pocketed."

Price Drops After Listing, Circulating Supply Controversy Shakes Market Confidence

In fact, even before blacklisting Justin Sun, the WLFI project had already faced harsh criticism for its chaotic listing performance. The token was listed for trading this Monday with an opening price of $0.32, but quickly plummeted to a low of $0.21, and is now trading steadily around $0.18, a significant drop from the issue price.

The core of shaken market confidence stems from the circulating supply disclosed by the project at the last minute before issuance. According to media reports, World Liberty announced on September 3 that 25 billion tokens would enter circulation, a number five times higher than the 5 billion previously expected by investors.

This sparked strong dissatisfaction among investors, many of whom questioned the data transparency and the ambiguity of "early supporter" qualifications on its governance forum.

AirdropAlert.com founder Morten Christensen said, "Ideally, the first day's performance should have been very good. But unfortunately, the team's communication failure before issuance and the negative sentiment on X turned the first day red (meaning a drop)."

What made the market even more chaotic was that online traders noticed that within hours after the issuance, market estimates of the circulating supply ranged from 3% to 25%, further increasing selling pressure.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trump vs JPMorgan: The Ultimate Showdown Between Two Dollar Monetary Orders and the New Era of Bitcoin

ETH traders ramp up positioning, setting a price target at $3.4K

BTC price pauses at $92K: Can Bitcoin avoid another crash?

Crypto bull market signal: ERC-20 stablecoin supply preserves $185B record