Nonfarm Payrolls Preview: Three Scenarios for Bitcoin's Price Movement Tonight

The US non-farm payroll report will have a significant impact on the bitcoin market. The market expects that weak data may accelerate a Fed rate cut, while strong data could trigger a pullback. Bitcoin is at the top area of the halving cycle, with a double-top pattern in the technical analysis and a key support level at $112,000. Summary generated by Mars AI. The accuracy and completeness of the content generated by the Mars AI model are still in an iterative update stage.

Tonight, the eyes of the global financial markets will be fixed on an economic data release that could determine their fate for the coming months—the US Non-Farm Payrolls (NFP) report. At a delicate moment when the price of bitcoin is teetering at key technical levels and the grand historical cycle indicator has quietly pointed to the "top region," this report hangs over the market like the sword of Damocles. The quality of its data could become the last straw that breaks the camel's back, or the spark that ignites a new round of upward momentum.

The market is filled with a complex, even somewhat twisted, sense of anticipation. In normal economic logic, strong employment data means economic prosperity. However, in the current context dominated by central bank liquidity, the logic has reversed: a weak report, suggesting recession risks, will instead be interpreted by the market as a clear signal that the Federal Reserve will have to accelerate rate cuts. "Bad news is good news"—this investment adage has become the common prayer of risk asset investors.

For bitcoin, this macro drama set to unfold at 20:30 (UTC+8) is of obvious importance. It not only concerns short-term capital flows but could also serve as a touchstone for a series of bearish theories. As veteran trader and Spectra Markets president Brent Donnelly has warned, the market may be sliding into a longer-term correction. He has even preemptively placed buy orders at the distant levels of $94,000 and $82,000 to prepare for a possible "panic sell-off."

The Cycle Clock: History's Hand Points to the Danger Zone

To understand the caution of market veterans like Donnelly, we must temporarily shift our focus away from tonight's short-term fluctuations and elevate it to a panoramic view of bitcoin's macro cycle. One repeatedly validated rule in the crypto world is the "halving cycle." Bitcoin undergoes a "halving" of its production roughly every four years, and this deflationary supply event has historically always triggered a magnificent bull market.

However, every feast must come to an end. Historical data shows that the time span from halving to the absolute peak of the bull market seems to be lengthening. An in-depth analysis report from Bitcoinsuisse reveals this trend:

- After the 2012 halving: The bull market peak appeared about 12 months later.

- After the 2016 halving: This process extended to about 17.5 months.

- After the 2020 halving: The market took about 18.2 months to reach the top.

The most recent halving occurred in April 2024. By this calculation, we are now in the 17th month. This means that by any historical cycle measure, bitcoin has already entered the traditionally defined "top region." This is not mysticism, but a sober observation based on historical patterns. Donnelly's core logic—"the craze for digital assets as corporate treasury assets is waning," combined with "the seasonal factors of the bitcoin halving cycle turning bearish"—is based on a deep insight into this macro clock. Cyclical patterns remind us that when everyone is immersed in euphoria, risks are quietly accumulating.

The Voice of the Chart: An Ominous 'Double Top' Picture

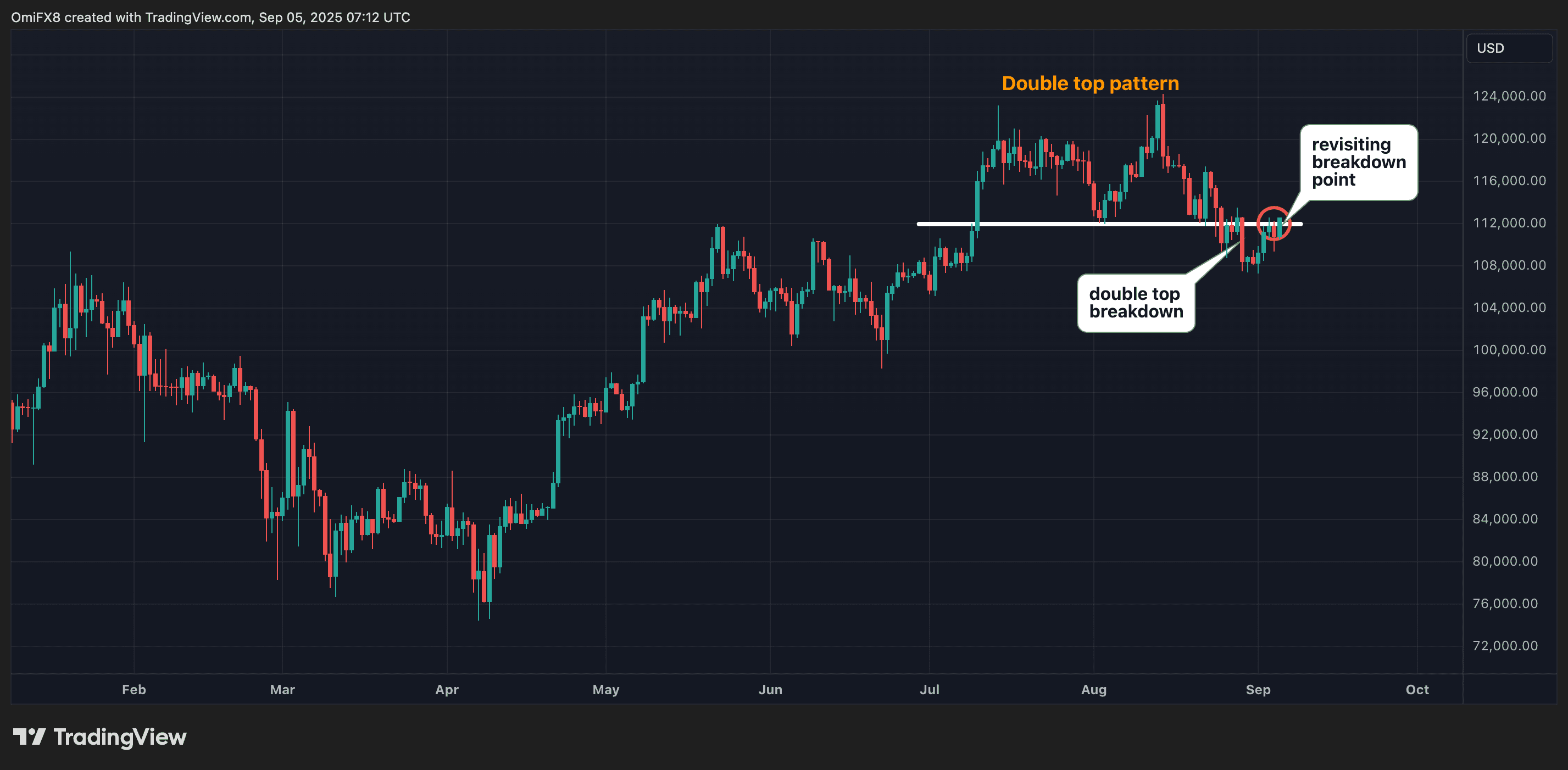

If the macro cycle is the thunder in the distance, then the technical chart is the dark cloud overhead. The current price action of bitcoin is painting a picture that makes many technical analysts uneasy—a textbook "double top" pattern.

This can be simply understood as a "failed attempt to break the top." After the first rally and pullback, the bulls regrouped and tried to break the previous high, but ultimately failed, forming a second peak at a similar height. This is usually seen as a signal of waning upward momentum and a shift in market sentiment from bullish to bearish.

The key to this pattern lies in its "neckline" support level. Currently, the market generally recognizes the neckline at around $112,000. This price level is like a dam—once it is effectively breached, it could trigger a chain reaction of stop-loss orders, thereby technically confirming the reversal pattern and opening the door to a deeper decline. This perfectly matches the observation mentioned in the material about "breaking the key support level of $111,982." Once lost, this level will turn from former support into strong future resistance.

Charts do not lie; they faithfully record the results of the tug-of-war between bulls and bears. At present, the price is hovering just above this life-and-death line, and tonight's NFP data is likely to be the final external force that determines whether the dam holds or collapses.

Three Scenarios: How NFP Data Will Decide Bitcoin's Fate

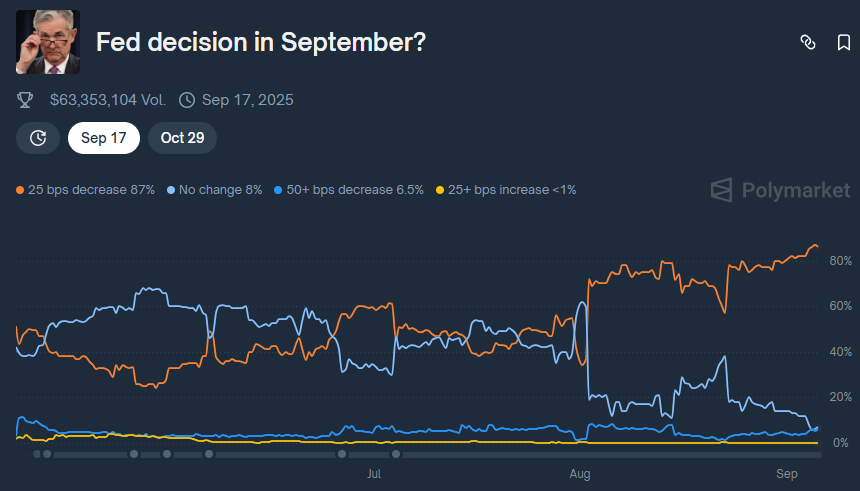

Before assessing the potential impact of different data outcomes, we must first understand the market's current "bottom card"—expectations that the Federal Reserve will soon begin a rate-cutting cycle have reached an unprecedented level of certainty. On the eve of the data release, CME's "FedWatch" tool showed that traders believe there is a 99.3% probability of a 25-basis-point rate cut in September—almost a foregone conclusion. Although the probability is slightly more conservative on the prediction market Polymarket, at 87%, the overall market direction is undoubtedly dovish.

More far-reaching is that derivatives contracts used to bet on Fed policy have already mapped out a clear long-term roadmap: the market expects that by the end of next year, the Fed will have cut rates a total of five times (each by 25 basis points), guiding the federal funds rate from the current 4.25%-4.5% range all the way down to around 3%. This means that tonight's NFP data is not only a test for the September meeting, but also the first key validation of this grand easing expectation.

It is precisely in this context of extreme certainty that any deviation from the script will be magnified by the market.

The Ultimate Variable: When Economic Data Meets Political Game

However, it would be too simplistic to think that the market will operate like a precision machine, following the above script step by step. This year, an unprecedented variable has been thrown into this complex game—open political pressure.

Recently, the incident of US President Trump attempting to remove Federal Reserve Governor Lisa Cook has evolved into a fierce conflict over central bank independence. This has made Fed Chair Powell's position exceptionally delicate. Felipe Villarroe, partner at TwentyFour Asset Management, pointed out sharply that this data "not only affects the short-term interest rate trajectory but will also shape the market's perception of whether Fed officials' decisions are politically biased."

This poses a dilemma for Powell and his colleagues: if tonight's data is truly poor (for example, scenario three), should the Fed decisively release strong dovish signals to fulfill its duty of stabilizing the economy, or should it hold back to avoid giving the impression of "succumbing to White House pressure"? Conversely, if the data is strong, will they candidly acknowledge economic resilience, or will they use the opportunity to emphasize potential risks, reserving room for future rate cuts in a more "politically correct" way?

This game around central bank independence casts a thick fog over pure economic data analysis. It means that the market's ultimate reaction may no longer be linear, and investors' confidence will be tested by both data and politics.

Summary

Tonight, bitcoin stands at a historic crossroads. The macro cycle clock is ticking, technical chart alarms are looming, and an employment report released far away in Washington is about to become the catalyst for it all.

Market participants, whether institutional traders like Brent Donnelly who are on high alert, or countless retail investors, are holding their breath. Will tonight's data become the needle that bursts the bubble, validating the prophecy of a cycle top and sending bitcoin down to those deeper correction targets? Or will it unexpectedly inject a shot of adrenaline, playing the final brilliant movement for this feast that has lasted 17 months?

The answer will be revealed in a few hours. But regardless of the outcome, tonight is destined to be a page recorded in the annals of the crypto market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Gain Insight into Cryptocurrency’s Promising Future for 2026

In Brief The next major crypto bull cycle will start in early 2026. Institutional investors and regulation drive long-term market confidence. Short-term shifts show investors favoring stablecoins amid volatility.

Stunning $204 Million USDT Transfer Ignites Market Speculation