Can BRC2.0 Recapture the Former Glory of Bitcoin Inscriptions?

The BRC2.0 led by Domo has launched. Can native Bitcoin assets become popular again?

BRC2.0 Led by Domo Goes Live: Can Native Bitcoin Assets Become Popular Again?

Written by: Nicky, Foresight News

On September 2, 2025, at Bitcoin block height 912,690, BRC20 underwent a significant upgrade known as BRC2.0. This upgrade was jointly promoted by the Ordinals development team Best in Slot and the anonymous BRC20 creator Domo. The core change was the introduction of the Ethereum Virtual Machine (EVM), enabling BRC20 to execute Turing-complete smart contracts.

Since the launch of the Ordinals protocol in early 2023, the Bitcoin ecosystem has experienced a wave of innovation. Through this protocol, users can inscribe information on the smallest unit of bitcoin, the "satoshi," thereby issuing NFTs or fungible tokens. This mechanism gave rise to the BRC20 token standard, allowing the Bitcoin network to support a wider variety of asset issuance and trading activities.

BRC20 was originally a standard for issuing fungible tokens on the Bitcoin chain based on the Ordinals protocol. This upgrade, by integrating the EVM, has significantly expanded its functionality. Best in Slot CEO Eril Binari Ezerel stated that Bitcoin meta-protocols like BRC20 originally ran on indexers with functionality similar to "simple calculators," but by embedding the EVM, the indexer has become Turing-complete, thus supporting more complex logic and contract execution.

After the upgrade, developers can now build DeFi protocols, NFT marketplaces, lending systems, and synthetic assets directly on the Bitcoin network. This integration maintains compatibility with Ethereum tools while providing the security guarantees of the Bitcoin network.

In a statement, Domo pointed out that the goal of this upgrade is to combine the security and decentralization of the Bitcoin network with the mature smart contract ecosystem of the EVM, providing users with a composable, programmable, and Bitcoin-secured on-chain experience.

The BRC2.0 upgrade has introduced a clear technical distinction: Runes are non-programmable and likely will never be programmable, limiting them to meme coin use cases, whereas BRC2.0 unlocks DeFi-level applications. This functional difference gives BRC2.0 a unique position in the Bitcoin ecosystem, providing a technical foundation for more diverse application scenarios.

Technical Challenges

Although the BRC2.0 upgrade brings significant functional improvements, it also faces some technical challenges and limitations. The upgrade achieves programmability through an off-chain processing solution, integrating the EVM executor with the BRC20 indexer, with final state updates completed by the BRC20 indexer on the Bitcoin chain. Some consider this design to be less decentralized and to carry a risk of single points of failure.

Transactions on BRC2.0 are still subject to the underlying limitations of Bitcoin. Market buy and sell orders require multiple signatures and block confirmations, and transaction speed is still limited by the 10-minute block time. Due to Bitcoin's 10-minute block interval, standard AMM designs are vulnerable to MEV attacks and may result in failed transactions, as well as wasted BTC as miner fees.

Currently, projects such as CatSwap plan to launch mainnet AMM products in the coming weeks, but the initial phase should be regarded as experimental. More advanced "sequencer-based AMM" solutions are also under development and are expected to go live within 1 to 3 months, aiming for higher transaction speeds and mitigation of MEV risks.

Specific Applications of BRC2.0

After the launch of BRC2.0, Best in Slot introduced BiS DEX v1, claiming it to be the first decentralized exchange serving BRC2.0. Despite some server overloads and minor bugs, the platform processed over $200,000 in trading volume within 24 hours, with no user fund losses.

Currently, BiS DEX supports market buy and limit sell orders, but there are still some usage restrictions, such as having to wait for one block confirmation to list or delist tokens, resulting in higher time and cost. The team stated that they will launch instant order functionality in the next 4 to 8 weeks to improve trading speed and reduce fees. In addition, non-custodial quoting and more order types (such as limit buy, market sell, and stop-loss orders) will also be introduced later.

In terms of ecosystem applications, in addition to BiS DEX, several other projects are actively building:

- UniSat now supports BRC2.0 token deployment, offering 6-character token names, self-issuance options, 0–18 decimal settings, and has optimized the cost and efficiency of inscription services.

- CatSwap is mentioned as an upcoming AMM protocol, expected to become a liquidity provision facility in the BRC2.0 ecosystem.

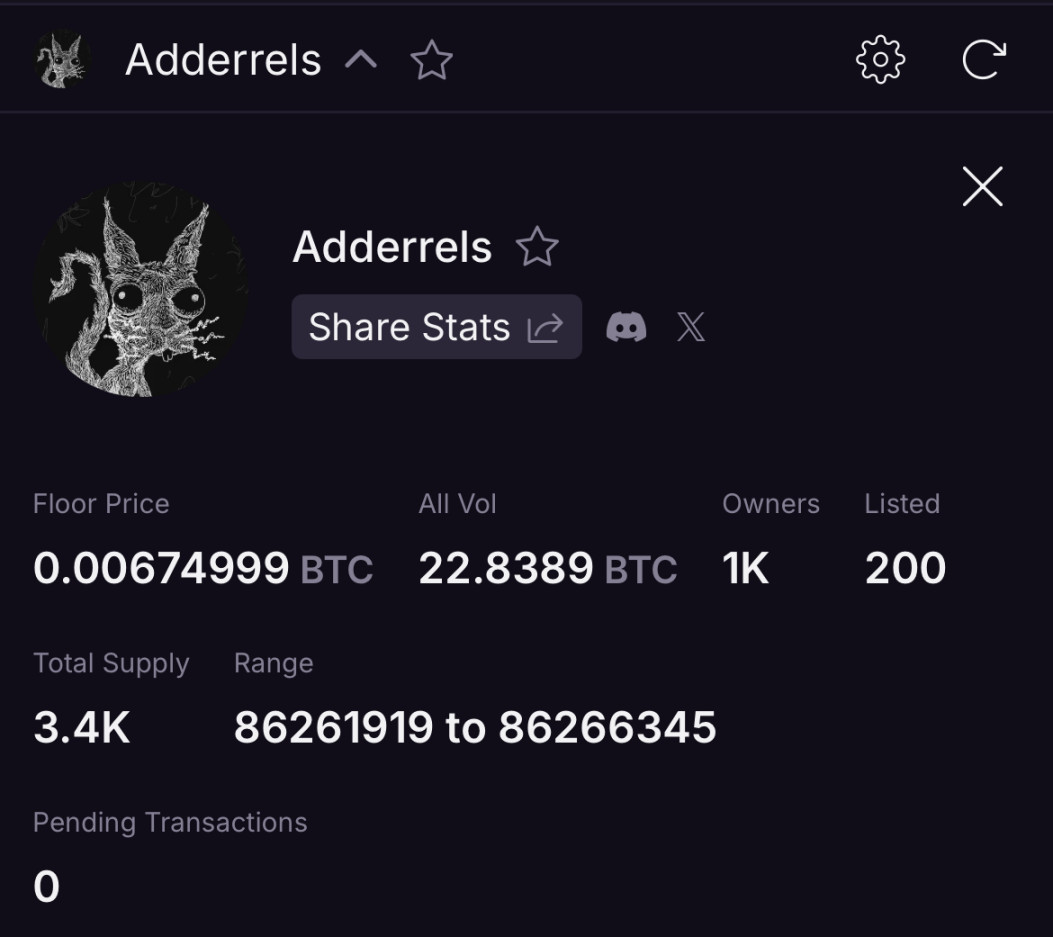

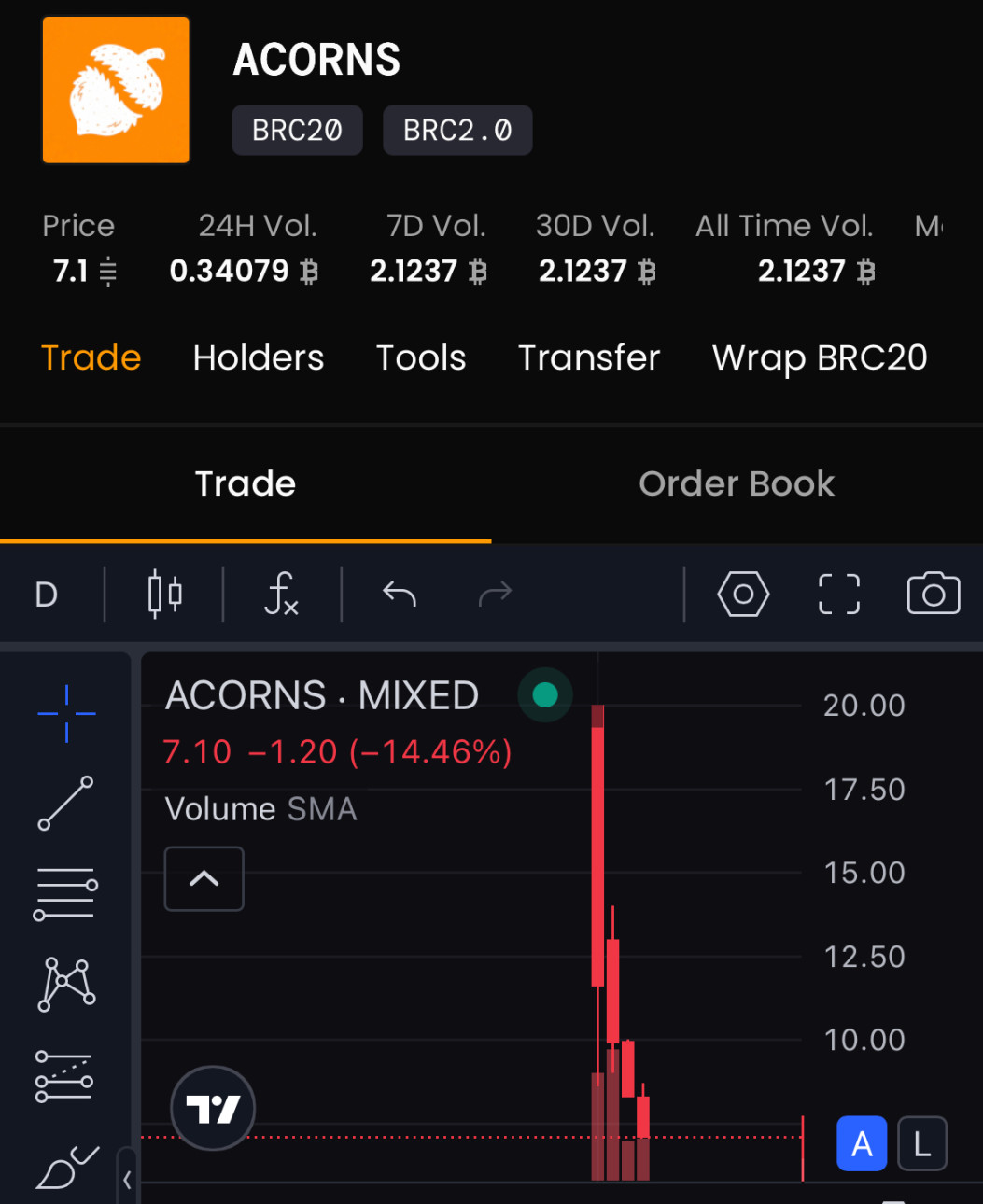

- The Adderrels project participates in ecosystem development by issuing NFTs and the ACORNS token, with part of the tokens to be used for providing liquidity to CatSwap. Currently, its NFT floor price is temporarily reported at 0.00675BTC (about $776). Notably, ACORNS, which is currently the top-traded token in the BiS DEX BRC2.0 section, has been falling for four consecutive days since its launch.

On the other hand, wrapped BTC and stablecoins are seen as important infrastructure for the development of the BRC2.0 ecosystem. Wrapped BTC is a key component. Without it, AMMs can only support token-to-token pools and not token-to-BTC pools. The team is in communication with several providers, including Lombard LBTC, Citrea cBTC, and SUBFROST frBTC, and expects that usable wrapped BTC solutions will emerge within 1 to 2 months.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Citibank and SWIFT complete pilot program for fiat-to-crypto PvP settlement.

Pantera Partner: In the Era of Privacy Revival, These Technologies Are Changing the Game

A new reality is taking shape: privacy protection is the key to driving blockchain toward mainstream adoption, and the demand for privacy is accelerating at cultural, institutional, and technological levels.

Exclusive Interview with Bitget CMO Ignacio: Good Code Eliminates Friction, Good Branding Eliminates Doubt

A software engineer's brand philosophy.