[Bitpush Weekly Web3 News Highlights] Sources: Nasdaq is tightening scrutiny of "crypto custody" companies; Ethereum Foundation will sell 10,000 ETH to support R&D and other operations; Spot gold rises to $3,600, hitting a new all-time high; Strategy not included in the S&P 500 Index

Bitpush Weekly Web3 News Highlights:

[Insider: Nasdaq Tightens Scrutiny on "Crypto Treasury" Companies]

Bitpush news, according to The Information citing insiders, Nasdaq is strengthening its oversight of listed companies purchasing cryptocurrencies through fundraising, requiring companies to obtain shareholder approval and to disclose in detail the purpose of the purchase, associated risks, and the impact on their core business. Otherwise, they may face suspension or even delisting. Nasdaq is the exchange for the vast majority of cryptocurrency stock trading and currently requires some companies to obtain shareholder approval before issuing new shares to purchase stocks.

[Ethereum Foundation to Sell 10,000 ETH to Support R&D and Other Work]

Bitpush news, the Ethereum Foundation announced that over the next few weeks, it will convert 10,000 ETH through centralized exchanges to continuously support research and development, grants, and donations.

These conversions will be carried out in multiple small orders rather than a single large transaction.

[Spot Gold Rises to $3,600, Setting a New All-Time High]

Bitpush news, spot gold rose 1.5%, reaching a high of $3,600.15 per ounce, setting a new all-time high. So far this year, spot gold has risen by $976, an increase of 37%.

[Strategy Not Included in S&P 500 Index]

Bitpush news, the Strategy company founded by Michael Saylor failed to be included in the S&P 500 index.

[Trump Media Completes Acquisition of 684 Million CRO Tokens Worth About $178 Million]

Bitpush news, Trump Media & Technology Group (Trump Media, ticker DJT) announced the completion of a transaction with Crypto.com, acquiring 684.4 million Cronos (CRO) tokens at approximately $0.15 per token. The transaction was settled 50% in cash and 50% in stock exchange, valued at about $178 million, accounting for about 2% of CRO's circulating supply. This collaboration will promote the integration of CRO into the rewards system of the Truth Social and Truth+ platforms, with institutional-grade custody provided by Crypto.com. Previously, Trump Media also established the Trump Media Group CRO Strategy, planning to create a digital asset treasury company centered on CRO through a merger with Yorkville Acquisition Corp.

[Justin Sun Responds to WLFI Blacklist Incident: Only Conducted Small Recharge Tests, No Market Impact]

Bitpush news, in response to World Liberty Financial (WLFI) blacklisting its related addresses, Justin Sun stated that his address only conducted a small amount of exchange recharge testing, with a very low amount, and subsequently performed address dispersion operations. No buying or selling behavior was involved, so it could not possibly impact the market.

[Stripe and Paradigm-Incubated Payment Public Chain Tempo Launches Private Testnet]

Bitpush news, according to official sources, the payment public chain Tempo, incubated by Stripe and Paradigm, has launched its private testnet. Tempo is designed specifically for stablecoins and real-world payments, aiming to provide low fees, support for transferring and paying gas fees with any stablecoin, optional privacy, and over 100,000 TPS.

The first batch of partners includes Anthropic, Coupang, Deutsche Bank, DoorDash, Lead Bank, Mercury, Nubank, OpenAI, Revolut, Shopify, Standard Chartered, Visa, and others.

Tempo's application scenarios cover global payments and collections, payroll, embedded financial accounts, fast and low-cost cross-border remittances, 24/7 settlement of tokenized deposits, micropayments, agent payments, and more. Tempo is built on Reth and is EVM-compatible.

[Federal Reserve to Hold Payments Innovation Conference Next Month to Discuss Stablecoins, AI, and Tokenization]

Bitpush news, the Federal Reserve will hold a payments innovation conference on October 21. Topics will include stablecoins, artificial intelligence, and tokenization.

[Bank of America Predicts Serious Internal Disagreement at Federal Reserve September Meeting]

Bitpush news, according to Golden Ten Data, Bank of America expects serious internal disagreement at the Federal Reserve's September interest rate decision. Dovish members Waller, Bowman, Daly, and Milan (who is expected to be confirmed as a board nominee) may push for further rate cuts, while hawkish members such as Harker, Bostic, Musalem, and Schmid emphasize inflation risks. Even if there is a 25 basis point rate cut at the September meeting, there may still be dissenting votes in both directions within the committee.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

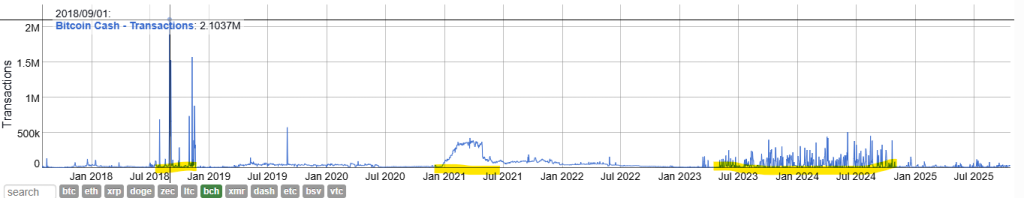

Bitcoin Cash Price Prediction 2025, 2026 – 2030: Will BCH Hit $1000?

̦Phantom Wallet CEO Says No IPO or Blockchain Launch Ahead, Doubles Down on Solana

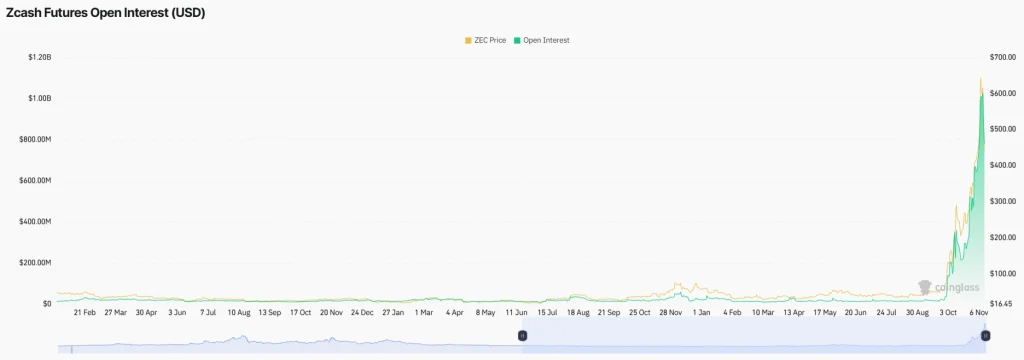

ZCash Price Eyes $537 Breakout While Bears Guard $433 Support: What’s Next?

ASTER Heats Up as PEPE Whale Joins Massive Buyback Momentum