InDrive, recognized for its unique bidding system in ride-hailing throughout Asia and Latin America, is now introducing a “super-app” concept tailored to emerging markets—broadening its reach from transportation services to include daily necessities for customers.

Launching its grocery delivery service in Kazakhstan first, InDrive aims to branch into several new service areas within the next year across leading markets such as Brazil, Colombia, Egypt, Pakistan, Peru, and Mexico. This strategic shift follows over 360 million downloads and 6.5 billion global transactions, solidifying InDrive’s status as the world’s second most-downloaded ride-hailing app after Uber since 2022.

“When customers interact with your platform more frequently, their loyalty increases, their value in the ecosystem grows, and they tend to remain with you longer,” said Andries Smit, InDrive’s chief growth business officer, in an exclusive interview.

The decision to begin with grocery delivery was fueled by rapid expansion in InDrive’s delivery operations—surpassing 41 million global orders in 2024 and over 14 million in the second quarter of 2025, making it one of the company’s fastest-growing business lines.

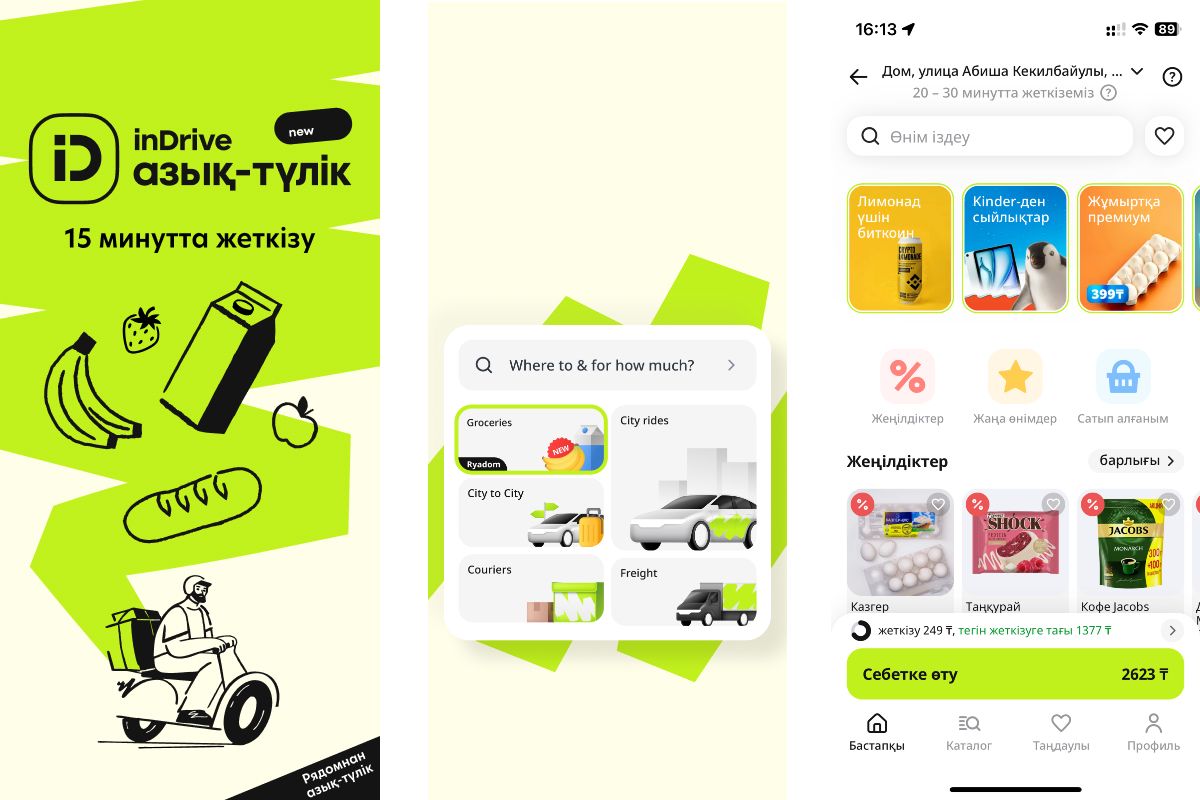

Headquartered in Mountain View, California, InDrive has introduced its grocery delivery in Kazakhstan, promising delivery within 15 minutes for more than 5,000 items. The initial trials in Kazakhstan produced a net promoter score of 83%, indicating strong customer approval, and customers placed an average of five grocery orders each month, according to the company.

Smit explained to TechCrunch that InDrive uses a dark store approach for its grocery deliveries in Kazakhstan, focusing largely on ready-to-eat foods, with about 10% of inventory being fresh produce—an approach intended to encourage customer loyalty. He noted that the business model will be customized for other regions, where partnering with local businesses, particularly small shops, is under consideration.

Though he did not reveal detailed numbers, Smit mentioned that the company has grown its network of dark stores in Kazakhstan by 30% since August.

Why is Kazakhstan the first market?

InDrive currently operates in 982 cities across 48 countries and holds a leadership position in eight. Why, then, did the company choose Kazakhstan as the first destination for its super-app rollout?

Smit told TechCrunch that the decision followed a significant rise in digital adoption among consumers in Kazakhstan, the largest economy in Central Asia. InDrive also has its largest workforce based there, which serves as a central hub for research and development as well as operations.

While InDrive hasn’t shared detailed growth figures for its Kazakhstan operations, a recent Dealroom report, compiled with the support of the Astana Hub technology park, indicated that InDrive experienced 44% growth in the country over the previous year.

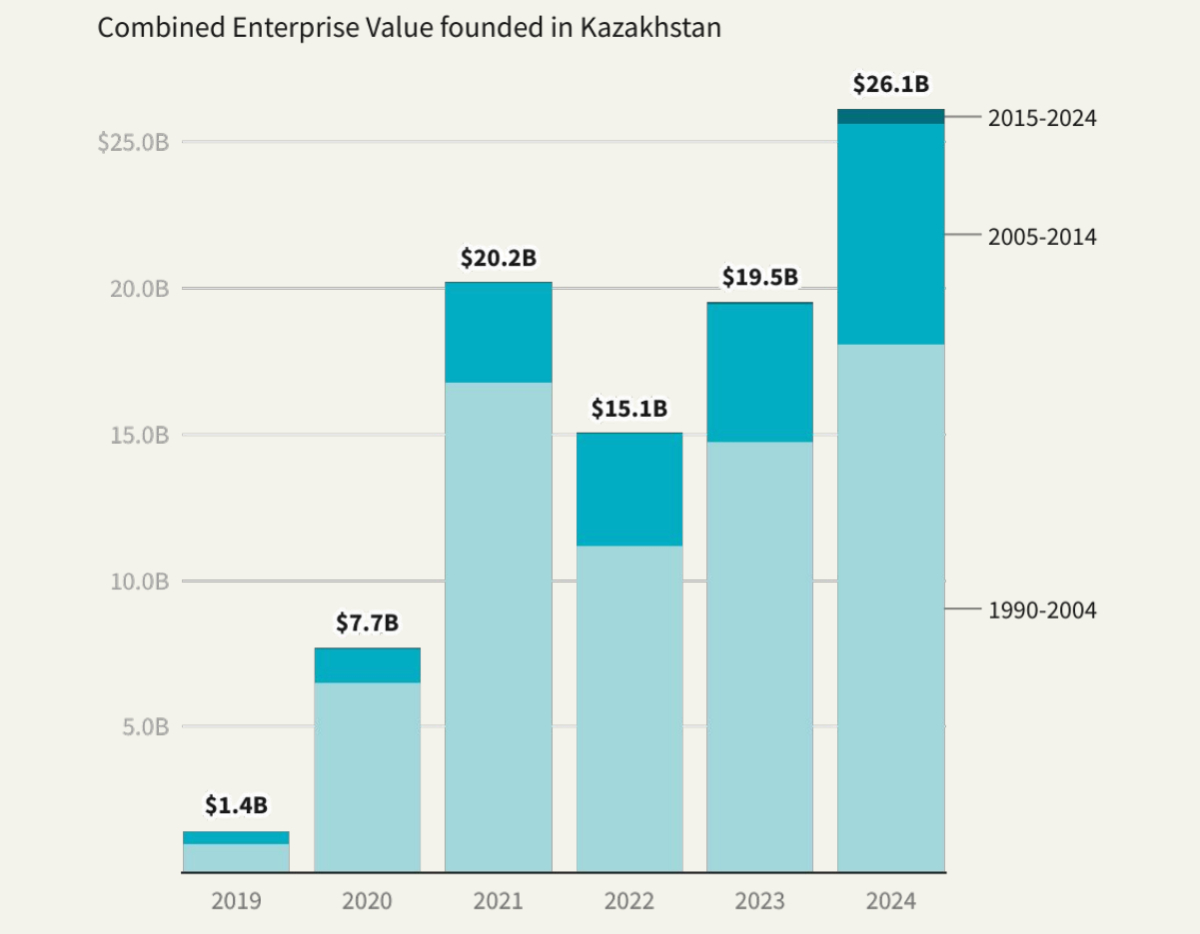

That same report estimated the value of Kazakhstan’s tech sector at $26 billion—a staggering 18-fold increase from 2019—reflecting a boom in new startups, investment, and digital services.

Image Credits:Dealroom

Image Credits:Dealroom

Although Kazakhstan already has grocery delivery applications catering to some of the demand, InDrive’s strategy is to win customers mainly through cost-effective pricing—positioning itself as the Aldi equivalent among online grocery providers.

“There are still accessibility and inequality issues—even some groceries are not easily available,” Smit said. “Many price-sensitive users either settle for less desirable goods or purchase from suboptimal sources, recognizing the limitations but feeling they have no better options.”

InDrive’s super-app: a differentiator or déjà vu

Numerous companies have attempted to create successful super apps. While platforms like WeChat and Gojek have thrived, others—such as Meta—have struggled to gain a firm foothold.

Having previously worked with WeChat in 2016, Smit observed firsthand the effectiveness of its integrated platform. He told TechCrunch that InDrive will leverage his experience and advanced AI tools to power its super-app ambitions. The integration of AI will allow for user personalization and improve accessibility for people with disabilities or lower literacy levels, he said.

InDrive’s Grocery Delivery service in Kazakhstan

Image Credits:InDrive

InDrive’s Grocery Delivery service in Kazakhstan

Image Credits:InDrive

In November 2023, InDrive announced the creation of a venture and M&A division with up to $100 million earmarked for investment over several years. Smit shared with TechCrunch that about 30% of this capital has already been allocated to the super-app project.

As part of this initiative, InDrive invested in the grocery startup Krave Mart in Pakistan in December. However, there is no confirmed launch date for InDrive’s grocery delivery service in Pakistan.

Uber, InDrive’s main competitor, has also diversified its services, adding offerings like Uber Eats in select areas. Smit explained that InDrive is focusing on a different segment of the market—primarily those who are more price-sensitive—though there is some overlap in certain regions.

“Our main focus is supporting and serving budget-conscious customers,” he said.

India as a “puzzle” market

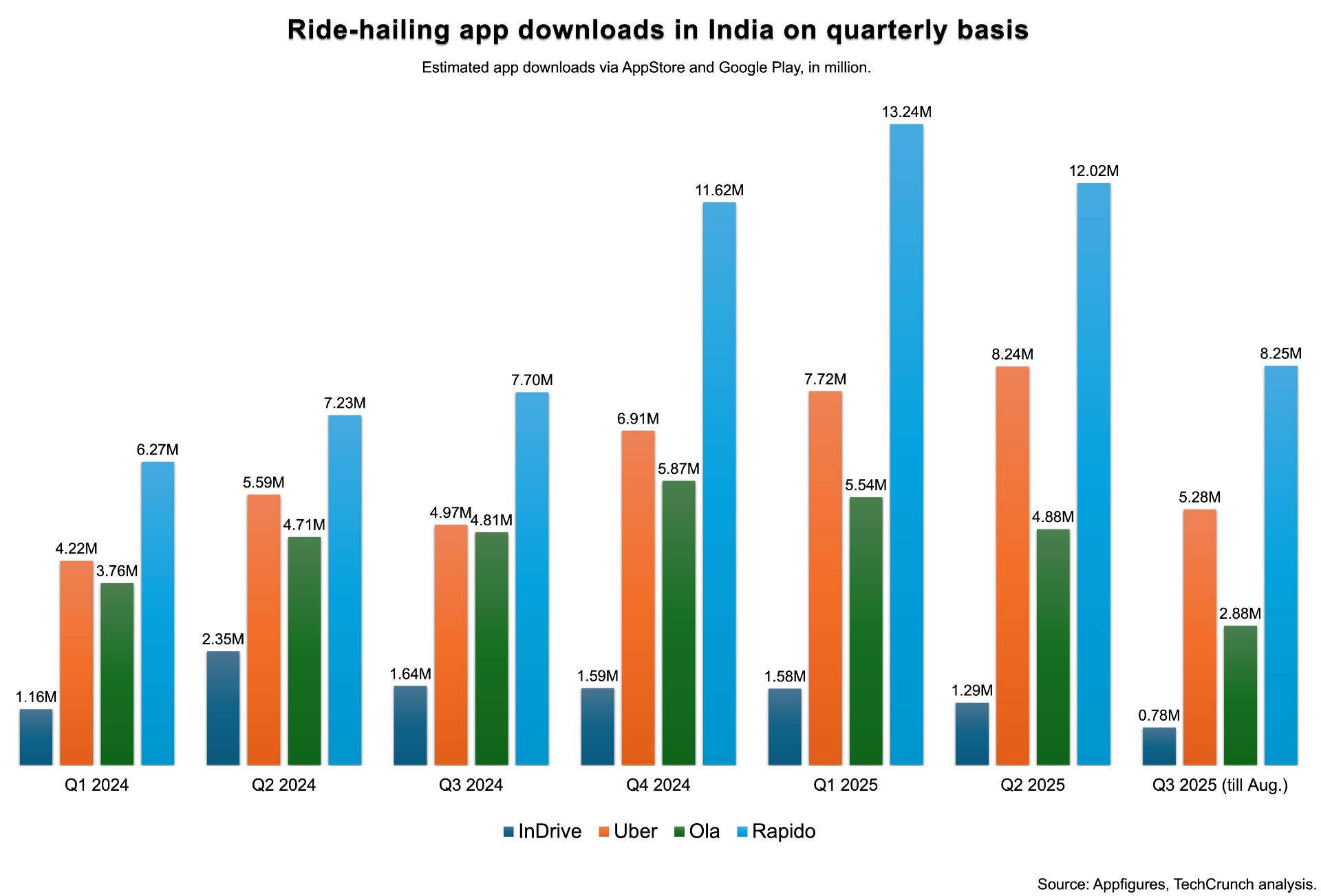

Alongside markets like Kazakhstan, InDrive has also operated in India, where it competes with Uber and domestic players such as Ola and Rapido. However, the company has struggled to gain significant traction in India. Uber even tested a version of InDrive’s bidding system in the country, seeking to replicate the model.

According to exclusive data from Appfigures shared with TechCrunch, InDrive saw 1.07 million fewer downloads this year compared to the same period in 2024, marking a 22.6% decline. Conversely, Uber experienced an increase of 8.02 million downloads (up 60.6%), Ola added 1.55 million (up 13.2%), and Rapido led growth with 14.9 million more downloads—an 80.9% jump.

“India remains a complex market for us,” Smit told TechCrunch. “The market is still expanding, and we’ve chosen to concentrate our efforts on key cities where we believe we can make the most impact.”

Image Credits:Jagmeet Singh / TechCrunch

Image Credits:Jagmeet Singh / TechCrunch

The company is experimenting with various approaches, especially in freight, while maintaining its signature model allowing negotiation between riders and drivers. This includes new payment models for drivers to receive daily payouts or select specific commission rates, according to Smit.

InDrive initially faced difficulties and slow adoption—even in countries like Pakistan, where it eventually overtook competitors following Uber’s exit.

“We’ve had markets that were slow to develop, but sometimes, if a competitor slips, we’re able to step in,” Smit explained.

More than a dozen riders and drivers in India told TechCrunch that safety concerns have led them to stop using InDrive. Some drivers reported that the bidding system was being abused by riders—or even by other drivers acting as riders—to negotiate aggressively and cause trouble for peers.

Smit emphasized that customer safety and service quality are top priorities for the company.

“We recognize the need to better address perceptions about safety, and we’re committed to increasing awareness and training for both drivers and passengers,” he stated.

Next verticals in plans

InDrive intends to further develop its super-app by introducing new services tailored to local needs. Smit shared with TechCrunch that financial services are under consideration, such as micro-loans for drivers—already available in Brazil and Mexico—and potentially for passengers and small businesses involved in deliveries.

The company also aims to launch micro-mobility solutions, connecting users to local businesses and public transport systems.

“We want to tailor our offerings to each city, potentially providing a range of services,” Smit said. “Our focus is on expanding in areas where we have expertise and strong operational foundations. If we lack experience in a certain sector, we will seek to work with established partners.”