Com’ETH the Whales, Com’ETH the Breakout: Here’s How Big Buys Are Pushing Price Higher

Ethereum price is holding above $4,320 after a week of flat trading. Whale buying and tightening supply hint at building momentum, but confirmation of a breakout is still needed.

Ethereum price is holding above $4,320, but trading has stayed flat for nearly a week. Since September 5, the token has barely moved, stuck between tight ranges. For traders, that kind of sideways action usually builds tension before a larger move.

On the charts, Ethereum might be breaking out of a bullish setup, but confirmation is still needed. Meanwhile, whale buying and supply signals show the buildup could already be underway.

Whales Grab $17 Billion as Exchange Supply Tightens

Over the past five days, whales have scooped up nearly 4 million ETH (from 95.73 million to 99.66 million). At today’s price of around $4,300, that equals close to $17 billion worth of ETH. This is not a small move. Big wallets often lead the trend, and when they buy in size, it can set the stage for stronger rallies.

Most importantly, the Ethereum whales scooped up supply when the ETH price was trading in a range (between September 5 and September 10). This could hint at early positioning. Maybe they also noticed the bullish pattern that we would discuss later in the piece.

Ethereum Whales In Action:

Ethereum Whales In Action:

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

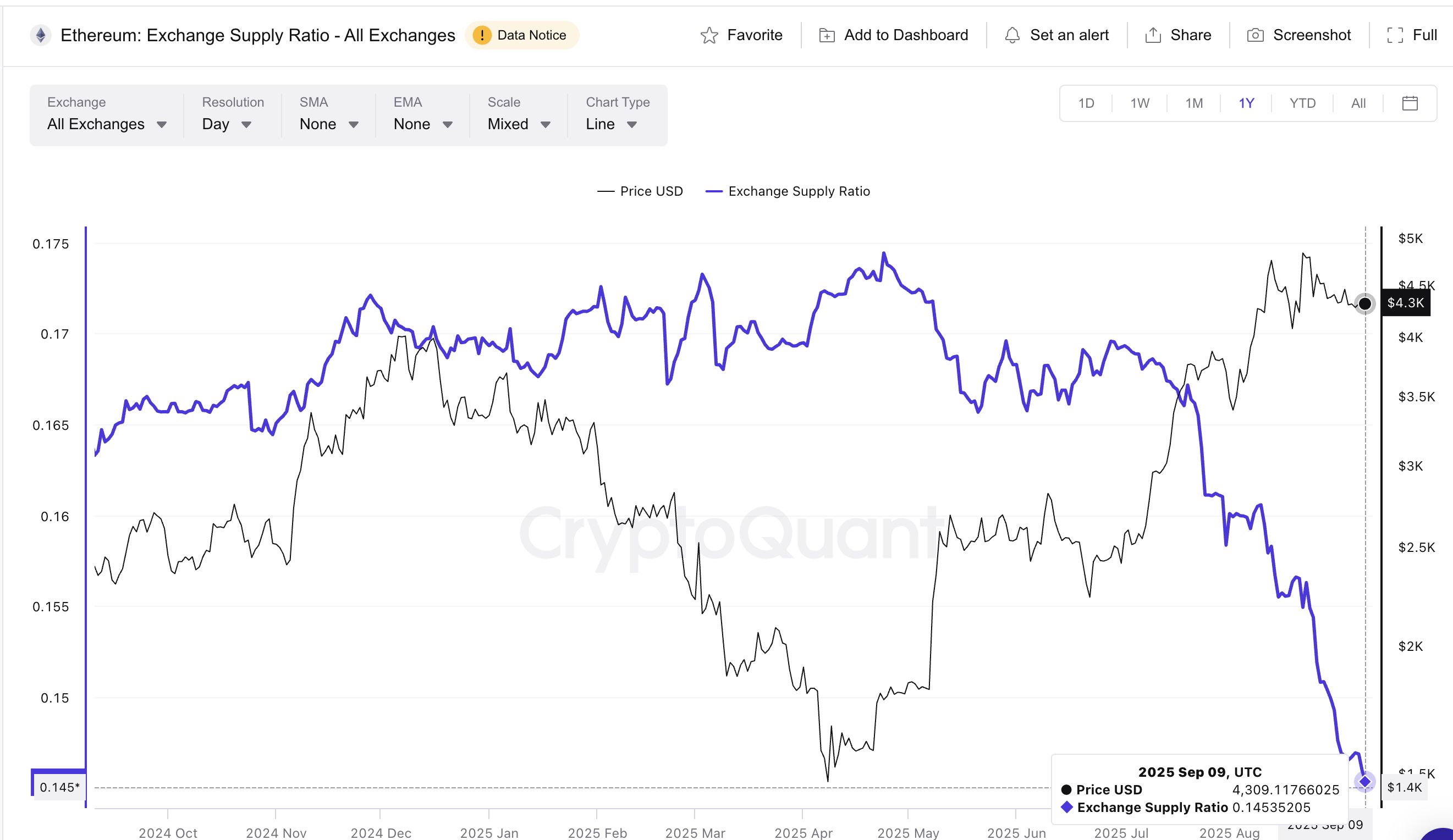

At the same time, the exchange supply ratio has dropped to 0.145, the lowest level in a year. Just a few weeks ago, in late August, it was at 0.156.

The exchange supply ratio measures how much ETH sits on exchanges compared to the total supply. This matters because if exchange reserves fall while the overall supply is steady or growing, it means less ETH is available to sell, a bullish supply squeeze signal.

Ethereum Supply Ratio Hits Y-o-Y Low:

Ethereum Supply Ratio Hits Y-o-Y Low:

When you put these two signals together, the story gets clearer.

Whales are adding billions in ETH, while fewer coins are parked on exchanges. The supply available for traders is tightening just as demand from large players rises; the perfect setup for a bullish move or a breakout.

Ethereum Price Eyes Breakout, But Confirmation Is Needed

On the daily chart, the Ethereum price is pressing against the upper boundary of a bullish “Falling Wedge” pattern that has been forming since the end of August. This setup, often linked to breakouts, comes after a period of lower highs and lower lows that squeezed the price into a narrowing range. ETH is now testing the top of that range near $4,320.

Ethereum Price Analysis:

Ethereum Price Analysis:

For traders, the breakout is not yet confirmed. A daily close above the upper line of the pattern is needed to seal the move. If that happens, the Ethereum price could target $4,490, $4,670, and even $4,950 (all-time high) next, based on the size of the pattern.

On the flip side, if ETH slips under $4,210, the breakout thesis weakens, and a fall toward $4,060 becomes more likely.

For now, whales buying billions and shrinking exchange supply provide fuel. The chart just needs to deliver confirmation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | Ethereum Fusaka upgrade officially activated; ETH surpasses $3,200

The Ethereum Fusaka upgrade has been activated, enhancing L2 transaction capabilities and reducing fees; BlackRock predicts accelerated institutional adoption of cryptocurrencies; cryptocurrency ETF inflows have reached a 7-week high; Trump nominates crypto-friendly regulatory officials; Malaysia cracks down on illegal Bitcoin mining. Summary generated by Mars AI. The accuracy and completeness of this summary are still undergoing iterative updates.

Do you think stop-losses can save you? Taleb exposes the biggest misconception: all risks are packed into a single blow-up point.

Nassim Nicholas Taleb's latest paper, "Trading With a Stop," challenges traditional views on stop-loss orders, arguing that stop-losses do not reduce risk but instead compress and concentrate risk into fragile breaking points, altering market behavior patterns. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

With capital outflows from crypto ETFs, can issuers like BlackRock still make good profits?

BlackRock's crypto ETF fee revenue has dropped by 38%, and its ETF business is struggling to escape the cyclical curse of the market.

Incubator MEETLabs today launched the large-scale 3D fishing blockchain game "DeFishing". As the first blockchain game on the GamingFi platform, it implements a dual-token P2E system with the IDOL token and the platform token GFT.

MEETLabs is an innovative lab focused on blockchain technology and the cryptocurrency sector, and also serves as the incubator for MEET48.