DePAI vs Tesla Bots: Who Will Dominate the Future of Robotics?

Humanoid robots may become a breakthrough application area for DePAI in the future.

Humanoid robots may be the breakthrough application area for DePAI in the future.

Written by: The Smart Ape

Translated by: AididiaoJP, Foresight News

Background

This may sound unbelievable, but robots are no longer just science fiction.

They are gradually entering factories, warehouses, and will soon enter our homes.

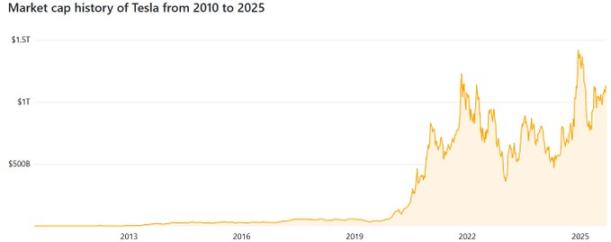

Elon Musk has promised that by 2030, Tesla will produce 1 million Optimus robots, and this humanoid robot could account for 80% of Tesla's value. Tesla's current market capitalization is 1.2 trillions USD.

Meanwhile, another vision is emerging: DePAI and RoboticsFi. In this model, robots are not corporate assets owned by tech giants, but autonomous economic agents equipped with wallets, governed by decentralized networks, and collectively funded.

Centralized Model

Musk claims that Optimus could become a mass-market product, priced at $20,000 to $30,000. Tesla plans to deploy the first advanced units by the end of 2025 and produce 1 million units annually before 2030.

But many remain skeptical and there has been widespread criticism: the robots walk awkwardly, are clearly remotely controlled, and have limited movements.

The problem with this model is that it is completely closed. Even if people pay $20,000–$30,000, the robots still belong to the company, and the data collected in your home may be reused by Tesla for monetization.

The company board makes all key decisions (updates, changes, new features), and users have no say.

The infrastructure is centralized, making it vulnerable to outages and hacking.

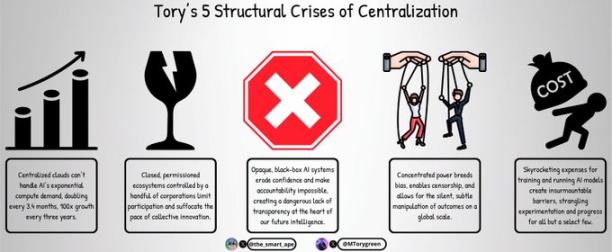

But these are not the only reasons why centralized AI is problematic; the issues are much broader. I recently read an insightful article by @MTorygreen, which highlighted five structural crises of centralization.

- Scale crisis: Centralized clouds cannot keep up with exponentially growing demand.

- Vulnerability crisis: There is a single point of failure.

- Access crisis: Cutting-edge resources are reserved for tech giants.

- Control crisis: Censorship and ideological bias.

- Cost crisis: Soaring expenses.

All five of these points also directly apply to centralized robotics.

DePAI & RoboticsFi

The term Physical AI was popularized by Nvidia CEO Jensen Huang at CES 2025. Messari subsequently introduced the concept of DePAI, extending it to decentralization.

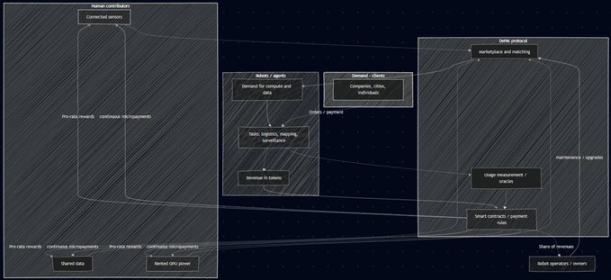

The vision is: no longer viewing robots as corporate assets, but starting to see them as physical agents with autonomous economies.

In this paradigm, each robot will have:

- A wallet for receiving and sending payments,

- An on-chain identity to prove its integrity,

- A DAO (Decentralized Autonomous Organization) governance system for deciding upgrades and use cases.

This new economic ecosystem is more attractive, with robots and humans participating in the same economic system. Humans connect sensors, share data, or rent out GPU computing power and receive token rewards. Robots generate income by performing tasks (logistics, mapping, surveillance) and redistribute part of the value to those who help build their infrastructure.

The pillar of all this is DePIN:

- Distributed computing: @ionet, @AethirCloud, @rendernetwork

- Storage and data: @Filecoin, @oceanprotocol

- Coordination and orchestration: @peaq, @Fetch_ai

The result is an open, scalable, and resilient infrastructure to which everyone can contribute and benefit.

Market Size

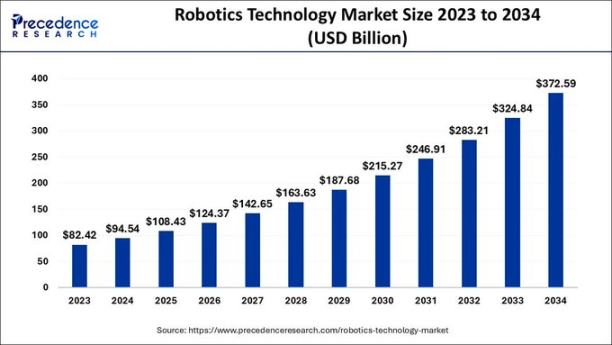

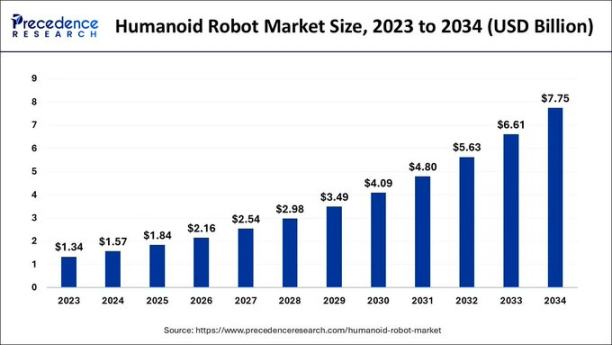

In 2025, the global robotics market will be worth $100 billions, and is expected to double in five years to $215 billions.

Humanoid robots currently account for 2% of robotics, worth about $1.84 billions, and are expected to double to $4 billions by 2030.

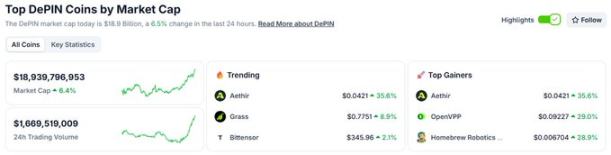

In terms of DePAI, we are just getting started, but the potential is huge. DePIN, a core component of DePAI, is already an $18 billions market with over 2,000 active projects. The leaders are generating millions of dollars in annual revenue.

According to @MTorygreen, by 2030, GPU production will only cover about 50% of AI demand, indicating that DePIN is likely to experience explosive growth as a solution to this bottleneck.

Ethical Considerations

Would you really want a Tesla humanoid robot in your home without knowing why it was programmed that way? What data does it collect? Where is that data sent? And what hidden restrictions are built in?

This requires blind trust. Although many people don't mind as long as the robot works, centralization also brings real efficiency issues.

As Tory Green said in a podcast: "I don't want people to see us as a decentralized company. I want them to see us as simply a better, cheaper, faster cloud service."

With RoboticsFi, governance is transparent and forkable:

- Rules are encoded on-chain and can be publicly audited.

- Local communities can vote on use cases (e.g., surveillance drones in cities).

- Models are open source, auditable, improvable, and forkable.

Economic Feasibility

The cost of the centralized model is staggering. Building data centers, manufacturing robots, and training AI require massive GPU resources. The reliance on Nvidia GPUs, which are often in short supply, creates further bottlenecks.

In contrast, the decentralized model can significantly reduce costs. Idle GPUs worldwide can be activated through platforms like @ionet, enabling shared infrastructure and greater resilience to outages.

Even more exciting, a DePAI robot can fund its own maintenance by performing tasks and investing its earnings in DeFi. In short, we're talking about self-employed robots.

Conclusion

The decentralized model is clearly more attractive and efficient, but the centralized model does have its advantages. Centralization allows for:

- Faster decision-making,

- Operational efficiency (less technical overhead),

- Easier access to financial and material resources.

But I like this proverb:

If you want to go fast, go alone. If you want to go far, go together.

The centralized model will move faster. But DePAI will build stronger, fairer, and more ethical systems that are built to last.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DOJ No-Sell on Samourai Bitcoin, Advisor Says – Kriptoworld.com

Macron Plans to Invoke EU Trade Mechanism Amid Rising Demands for Retaliation

Intel bets on fundamentals as rivals push AI in laptop market

TechCrunch Mobility: ‘Physical AI’ becomes the latest buzzword