The Pump Fun platform emerged as the largest launchpad on the Solana $223 network, generating a significant trading volume earlier this year. This activity spurred the rapid increase in Solana ( SOL ) prices and exponentially increased network revenues. Additionally, it ushered in a new class of memecoins, injecting millions of new tokens into circulation. Nevertheless, the launch of PUMP Coin did not mirror the grandeur of its predecessors.

PUMP Coin Market Dynamics

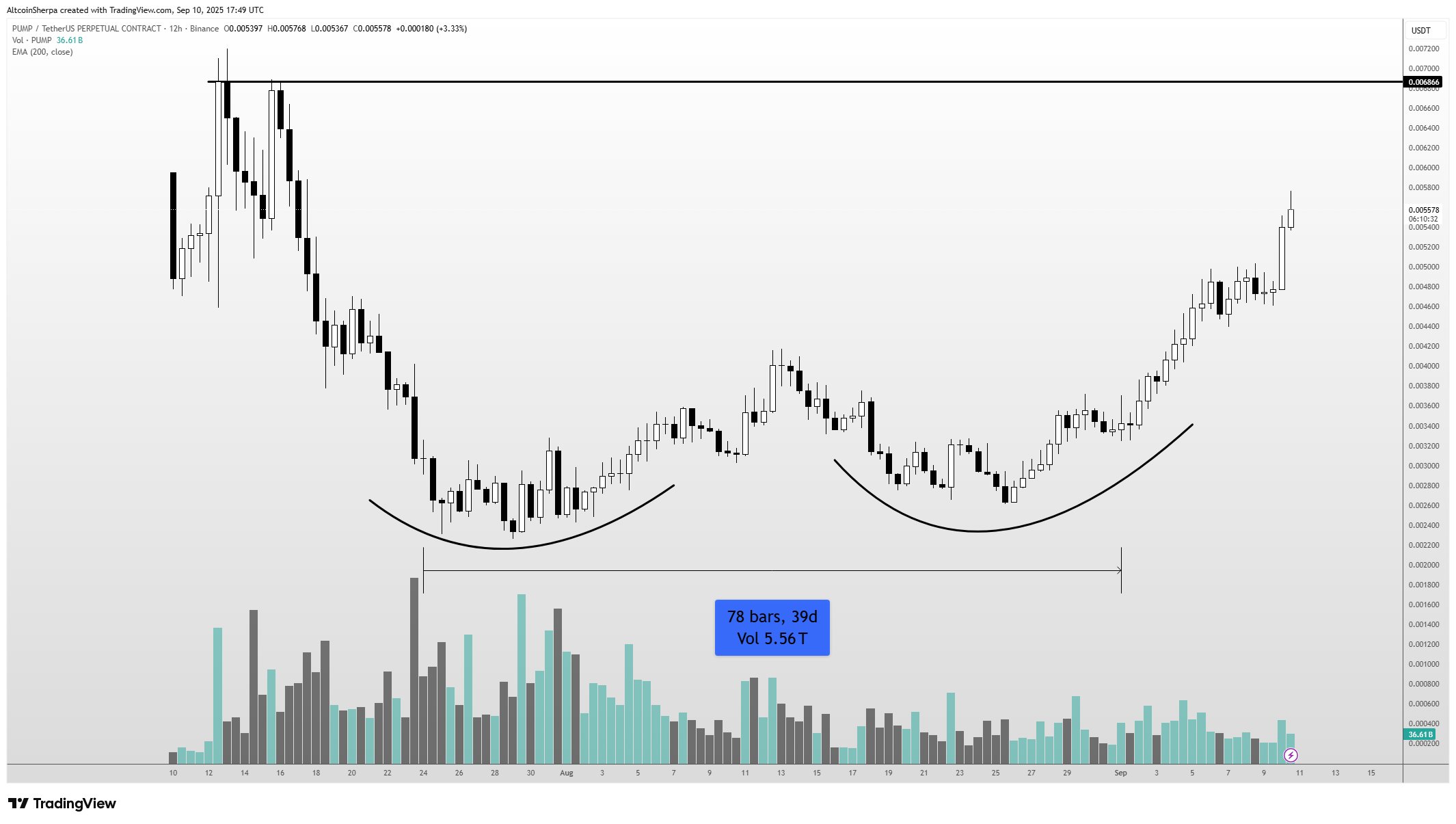

Choosing Pump Coin as an illustrative example, Altcoin Sherpa highlighted critical lessons from recent events in the cryptocurrency sphere. Before its official listing, Pump Coin, like many other altcoins , initiated premarket trading. This preliminary trading underscored the vital importance of price discovery before official spot listings. With the introduction of spot listings, the coin’s price dramatically reversed trend.

After experiencing a steep decline, the price dipped again with the spot listing, offering a temporary rebound before again descending, leaving investors sidelined. Currently, the price has surged above its initial figure, indicating intriguing new dynamics. This sequence of events transpired within just 39 days, a noteworthy timeframe for such movements.

The PUMP premarket system, as one observer noted, was the first mechanism to truly shape dynamics within decentralized exchanges (DEXs). HyperLiquid outperformed some of the leading centralized exchanges (CEXs) in trading volume, and such premarket mechanisms significantly accelerated price discovery. Although uncertainties linger, the excitement surrounding premarket trading is significantly diminished partly due to these mechanisms, leading to more efficient market movements over time.

The initial robust rise in PUMP’s price was worth noting, followed by a sharp decline that adversely impacted the entire crypto-trading community. The initial lavish cash inflow, substantial recognition, and interest contributed to this scenario. In retrospect, the execution seemed well-calibrated; though its intent remains unclear, it evoked reminders of the infamous PENGU graph. This led to turbulent price movements, and eventually, a new consistency appeared at lower levels.

From a technical analysis perspective, after fluctuating up and down for about a month, the price eventually made significant movements, with liquidity always present but prevalently at lower levels. Though insight is clear in hindsight, the occurrence of such recoveries is quite fascinating, with ongoing expectations of further uptrends.

SUI Coin Outlook

Analyst Ali Martinez maintains a bullish outlook for SUI Coin, suggesting it’s an optimal time to purchase. While a graph he shared pointed to a potential $7 target, SUI needs to overcome the barrier at $4.329 first. For a while, it hasn’t been able to approach this resistance, even as ETH fails to build a structure supporting broad market sentiment. Observers now await the release of CPI data, aiming to capture this ascent upon breaking through resistance.