Key takeaways

- BTC has reclaimed the $114k mark and is now targeting the $117k resistance level.

- The core Producer Price Index (PPI) dropped 0.1% month-over-month, increasing the chances of a Fed rate cut next week.

Bitcoin reclaims $114k

The cryptocurrency market has continued its excellent start to the week, with BTC and other leading cryptos currently in the green. Bitcoin reclaimed the $114k mark on Wednesday after adding 3% to its value over the past few days.

The positive performance comes following the PPI data release on Wednesday. The core Producer Price Index (PPI), which excludes food and energy, declined 0.1% month-over-month, which is lower than the 0.3% increase analysts expected. Annual core inflation eased to 2.8% from July’s revised 3.4%.

The decline in inflation could pave the way for the Fed to cut interest rates next week. The CPI data will be published on Tuesday, and this could strengthen the Fed’s resolve.

In an email to Coinjournal, XBTO’s Chief Investment Officer, Javier Rodriguez-Alarcón, stated that a Fed rate cut could spark Bitcoin’s next breakout. The analyst added that,

Macro conditions are also supportive: investors are widely expecting the Federal Reserve to begin cutting rates this month, which has lifted confidence across risk assets and reinforced Bitcoin’s role as a hedge.

At the same time, the SEC has unveiled a more crypto-friendly rulemaking agenda, and Cboe is preparing to launch new long-dated Bitcoin and Ethereum futures, showing how policy and market infrastructure are moving in tandem.

BTC targets $117k resistance level

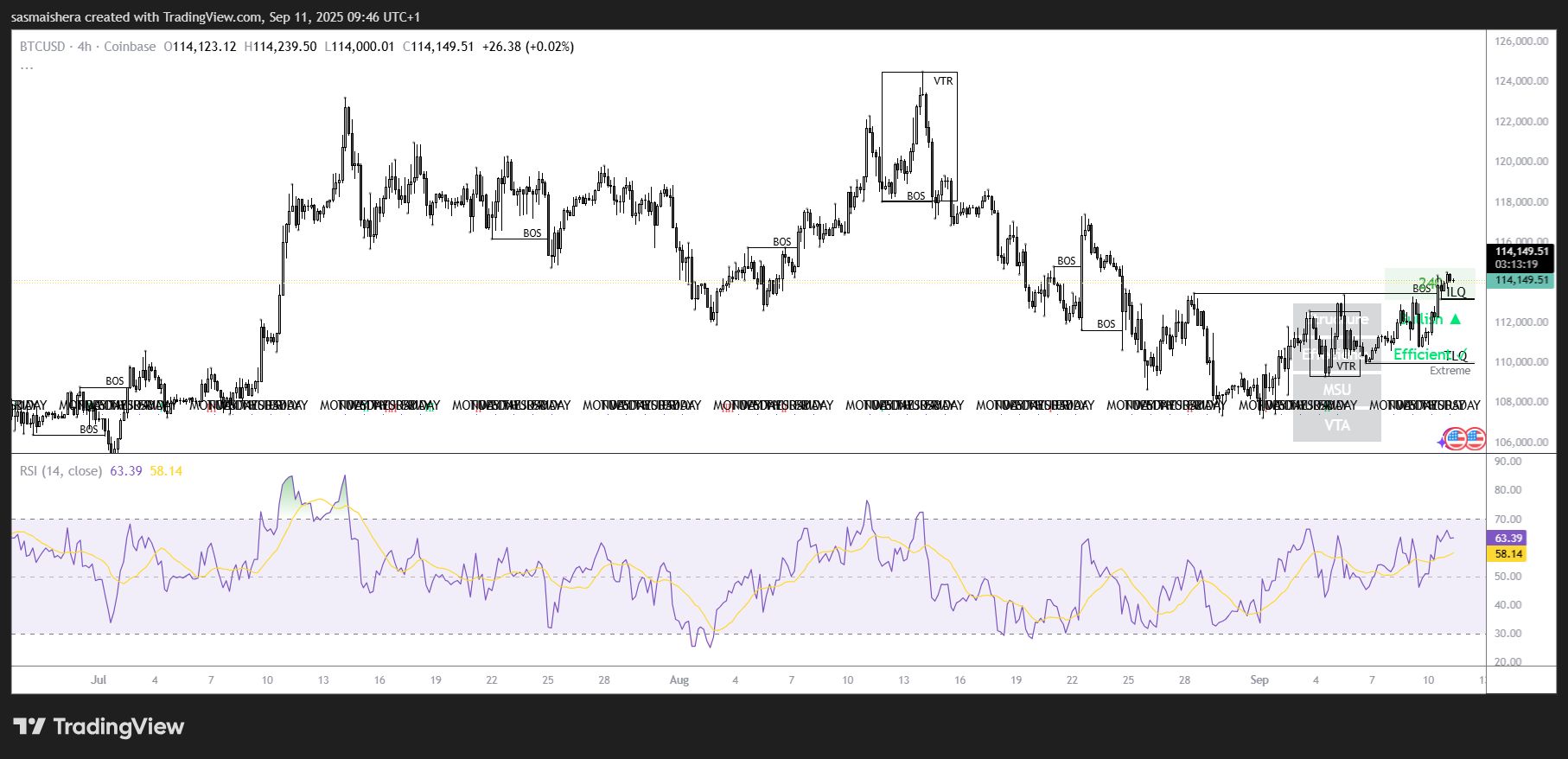

The BTC/USD 4-hour chart is bullish and efficient as Bitcoin has been performing well over the past few days. The momentum indicators are also bullish, suggesting that BTC could be preparing for another breakout.

The RSI of 62 shows that buyers are in charge, with the MACD lines also within the bullish region. If the rally continues, BTC could surge past the first major resistance level at $117,424 in the coming hours or days. An extended bullish run would allow BTC to reclaim the $119k level.

However, the market might undergo a correction heading into the weekend. If that happens, BTC could retest the TLQ and support level at $110k in the near term.