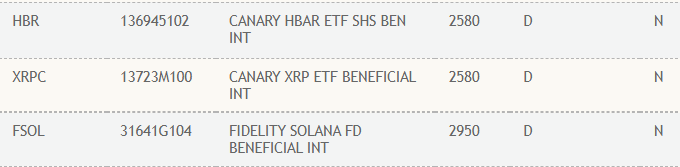

The Canary Capital Group’s XRP ETF application has been listed on the Depository Trust Clearing Corporation (DTCC) website, which is a central clearing and settlement service provider for securities transactions in the U.S. The listing, shared with Fidelity’s Solana $241 ETF application and Canary’s HBAR and Litecoin ETF applications, has heightened market expectations regarding the ETF process for XRP, SOL , HBAR, and LTC.

Understanding DTCC Listing Significance

The DTCC is a principal infrastructure provider for the registration, clearing, and settlement of securities in U.S. markets. An ETF application’s inclusion on the DTCC list indicates technical preparations for potential market launch. However, it does not imply approval by the U.S. Securities and Exchange Commission (SEC) for the related product.

XRP, SOL, HBAR

XRP, SOL, HBAR

Nate Geraci, President of NovaDius Wealth Management, noted that the DTCC listing is merely a standard preparatory step. Similar listings were observed during Bitcoin $115,455 and Ethereum $4,562 ETF processes, with the final decision awaiting SEC approval. Consequently, the same procedure is considered for XRP, SOL, HBAR, and LTC.

Investors should note that inclusion on the DTCC list does not guarantee an ETF will be traded on the market. For an ETF to be officially launched, SEC’s explicit approval is necessary.

High Expectations for the XRP ETF

The SEC stands as the final decision authority in ETF applications for the crypto market . A notable application on the XRP front comes from Franklin Templeton, with its decision date postponed to November 14. This brief delay suggests the application is in the final stages of evaluation.

Bill Morgan, a prominent legal figure within the XRP community, mentioned that the postponement indicates the SEC might soon issue a definitive decision. Morgan suggests the evaluation process for the XRP ETF, along with other altcoin applications, is reaching its conclusion.

Nevertheless, the SEC is known for conducting thorough reviews in Bitcoin ETF approval processes. A comprehensive examination is anticipated for XRP as well. Thus, without completing the process, approval for the ETF to trade on the market is unlikely.