Bitcoin price shows no clear reversal signals today: BTC/USD remains range-bound, trading near $115,767, with hourly charts neutral and weekly bars indicating consolidation. Traders should expect sideways action between $115,500–$116,500 while buyers accumulate before any decisive breakout or breakdown.

-

BTC trading sideways in a narrow range ($115,500–$116,500).

-

Hourly momentum is neutral; neither support nor resistance is being tested aggressively.

-

Weekly structure suggests accumulation; expect low volatility until next catalyst.

Bitcoin price outlook: BTC trading sideways near $115,767; watch $115,500–$116,500 for range breakout — read latest analysis and next steps.

What is the Bitcoin price outlook today?

Bitcoin price is neutral short-term and consolidating within a narrow range, trading around $115,767 at press time. Volume and momentum indicators show no reversal signals, so sideways action between $115,500 and $116,500 is the most likely scenario until a clear break of support or resistance occurs.

How do BTC technicals look on hourly and weekly charts?

On the hourly chart, BTC displays neutral momentum and remains distant from immediate support and resistance levels. This reduces the probability of sharp intraday moves. On the weekly timeframe, the current bar sits within the prior bar, indicating balance between buyers and sellers and a need for further accumulation before a sustained trend emerges.

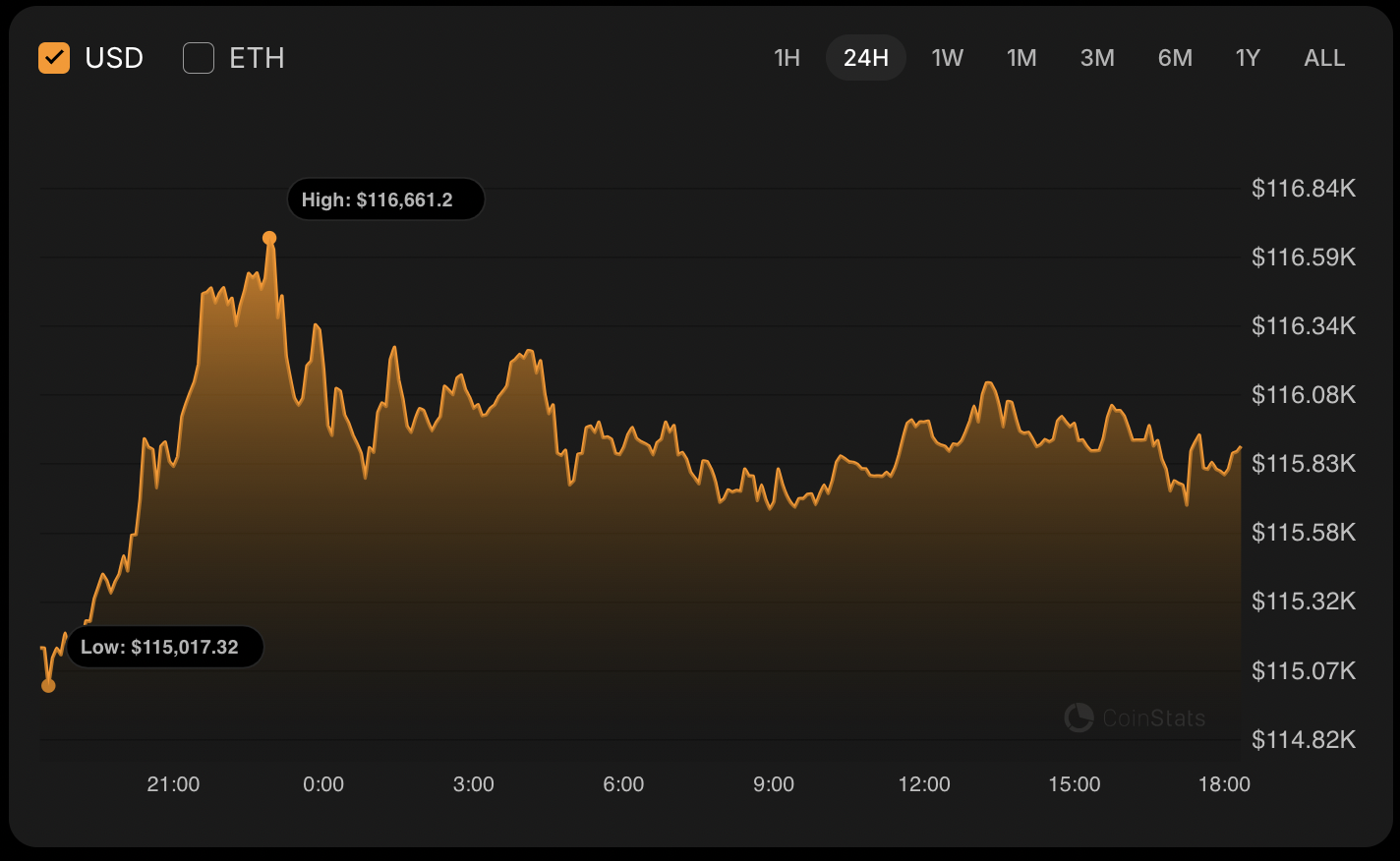

There are no reversal signals so far today, according to CoinStats.

BTC chart by CoinStats

BTC/USD

BTC/USD has risen modestly by 0.62% since yesterday, reflecting limited directional conviction. Short-term indicators are flat, and market participants are waiting for macro cues or on-chain flows to drive a decisive move.

Image by TradingView

On the hourly chart, the rate of BTC is neither bullish nor bearish as it is far from the support and resistance levels. In this case, any sharp moves are unlikely to happen by tomorrow. Traders should favour risk management and avoid directional overcommitments until volatility increases.

Image by TradingView

On the bigger time frame, the price of the main crypto is within yesterday’s bar, which means neither side has enough energy for a further move. This intra-week overlap typically precedes either a measured breakout or extended consolidation depending on order flow.

In this regard, sideways trading in the narrow range of $115,500-$116,500 is the more likely scenario until the end of the week.

Image by TradingView

From the midterm point of view, the picture is similar. Even if the weekly bar closes around the current prices, buyers might need more time to accumulate energy for a further move. On-chain metrics and order book data will be key to confirm accumulation.

Bitcoin is trading at $115,767 at press time.

Frequently Asked Questions

Is Bitcoin likely to break out this week?

Currently unlikely. With BTC trading inside yesterday’s bar and hourly momentum neutral, the market favors continued consolidation. A breakout requires higher volume or a macro catalyst to shift the balance.

How should I manage risk while BTC consolidates?

Use tight position sizing, place stop-loss orders beyond $115,500 support or $116,500 resistance, and avoid over-leveraging. Focus on clear confirmation signals before increasing exposure.

Key Takeaways

- Neutral short-term: BTC shows no reversal signals and is range-bound near $115,767.

- Watch the range: $115,500 (support) and $116,500 (resistance) are the primary levels to monitor.

- Trade plan: Favor patience and wait for volume-backed breakouts; manage risk with defined stops.

Conclusion

This market update concludes that Bitcoin price remains in consolidation with no immediate reversal signals. Traders and investors should watch the $115,500–$116,500 range for confirmation. Follow COINOTAG updates for on-chain metrics and technical cues as volume or macro news provide the next directional catalyst.

Author: COINOTAG | Published: 2025-09-13 | Updated: 2025-09-13