Onchain collateral is crypto held directly on-chain and preferred for crypto-backed loans because it enables 24/7 liquidation, greater liquidity and higher loan-to-value (LTV) ratios. Lenders can execute margin calls in real time, reducing counterparty and market-timing risk for both banks and borrowers.

-

Onchain collateral allows real-time liquidation and higher LTVs.

-

Banks and digital-asset lenders favor tokens over ETFs due to continuous market access and clearer settlement mechanics.

-

Figure Technology’s Nasdaq debut and TradFi interest (JP Morgan plans under review) show institutional momentum; market data: lending activity fell sharply in 2022, then gradually recovered.

Onchain collateral: banks prefer direct crypto tokens for 24/7 liquidation and higher LTVs — read expert analysis and practical steps for borrowers.

The 24/7 nature of onchain markets makes spot crypto collateral preferable to lenders than crypto held in investment vehicles like ETFs.

Summary: Fabian Dori, chief investment officer at digital asset bank Sygnum, says banks offering crypto-backed loans prefer onchain assets as collateral because they are more liquid and can be liquidated 24/7, enabling more competitive loan-to-value (LTV) structures for borrowers.

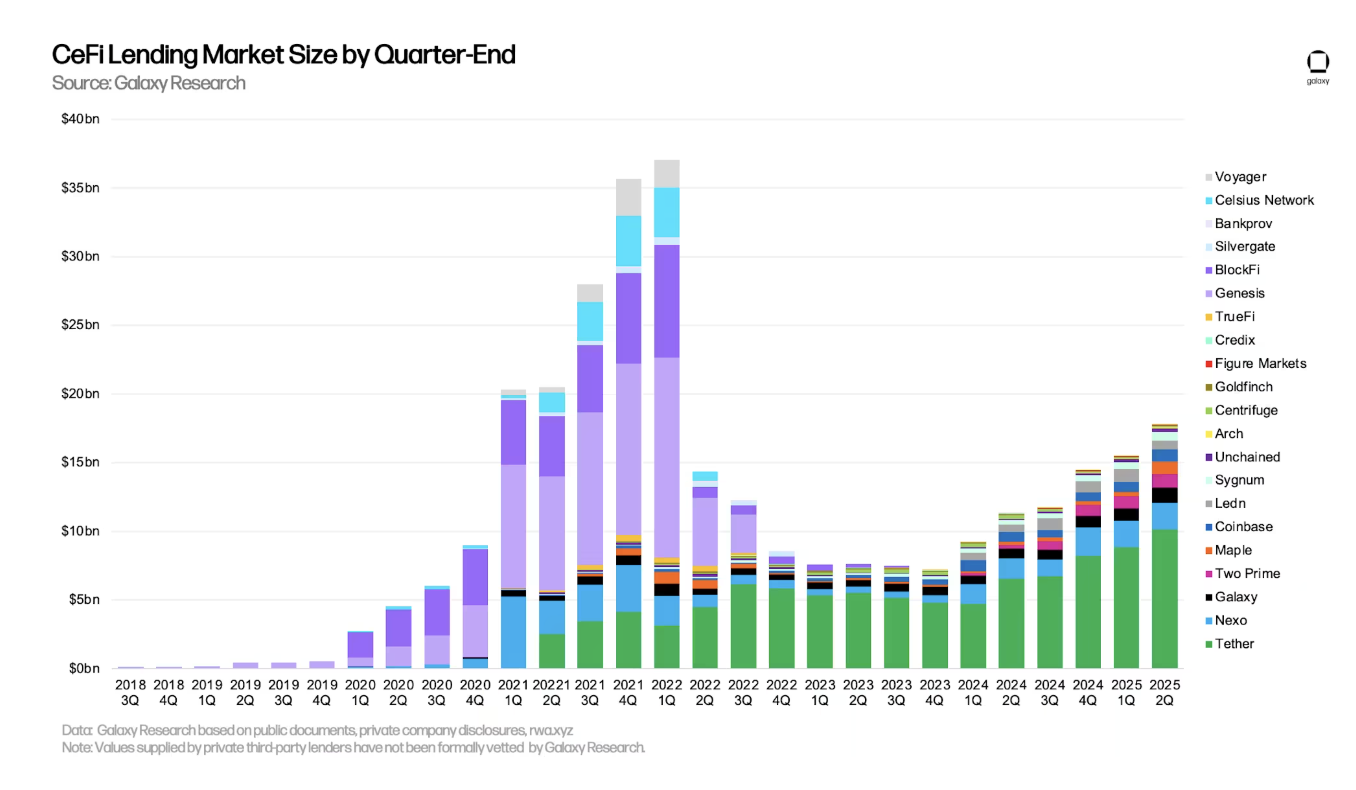

Lending in crypto by centralized institutions sharply declined during the 2022 bear market, which saw the blow-up of several crypto lending firms, but is on the rise again. Source: Galaxy

Lending in crypto by centralized institutions sharply declined during the 2022 bear market, which saw the blow-up of several crypto lending firms, but is on the rise again. Source: Galaxy

What is onchain collateral and why do lenders prefer it?

Onchain collateral is crypto held in wallets or smart contracts that can be monitored and liquidated on public blockchains. Lenders prefer it because it enables continuous price discovery, immediate margin execution and reduced settlement friction compared with exchange-traded funds or off-chain vehicles.

How does onchain collateral affect loan-to-value (LTV) ratios?

LTV measures loan size versus collateral value. Because onchain assets are tradable 24/7, lenders can reduce liquidation risk and therefore offer higher LTVs. This improves borrower access to credit while keeping lender risk controls, such as automated margin calls and real-time monitoring, intact.

How did crypto lending change after 2022 and what does market data show?

Centralized crypto lending contracted sharply in 2022 after multiple platform failures. Activity has since recovered as risk frameworks improved and regulatory clarity advanced. Public events — including companies listing on exchanges and TradFi firms signalling interest — indicate gradual institutional re-entry to secured crypto lending.

Why does 24/7 liquidity matter for crypto-backed lending?

24/7 liquidity allows lenders to react instantly to price moves, reducing the window for losses from rapid volatility. For borrowers, this means loan terms can be more competitive because the lender’s liquidation risk is lower when collateral can be converted at any hour.

What are LTV implications for borrowers and lenders?

Higher LTVs let borrowers access more credit against the same collateral. Lenders adjust LTVs based on asset volatility, market depth and custody controls. For example, highly liquid tokens typically command more favorable LTVs than low-liquidity or wrapped assets.

Frequently Asked Questions

How do lenders monitor onchain collateral?

Lenders use block explorers, price oracles and custodial dashboards to track balances and valuations. Automated alerts and smart-contract triggers execute margin calls when collateral falls below agreed thresholds.

Can ETFs be used as crypto loan collateral?

ETFs are accepted in some cases but present settlement and market-hour constraints. Lenders may accept them with lower LTVs or additional covenants due to potential delays in liquidation compared to onchain tokens.

Key Takeaways

- Onchain collateral enables 24/7 liquidation: This reduces market-timing risk and supports higher loan-to-value ratios.

- Lenders favor tokens over ETFs: Direct tokens offer clearer settlement and continuous price discovery.

- Market recovery underway: Post-2022 corrections, institutional listings and TradFi pilots indicate growing adoption of crypto-backed loans.

Conclusion

Onchain collateral is increasingly preferred for crypto-backed loans because it delivers continuous liquidity, transparent settlement and the potential for higher LTVs. As institutional frameworks mature and TradFi experiments with offering secured crypto credit, borrowers and lenders should monitor custody, oracle reliability and regulatory developments. For practical guidance, assess token liquidity and custody arrangements before posting collateral.