Virtual asset venture capital loosens restrictions—Is a spring for crypto startups coming in South Korea?

The amendment to the "Enforcement Decree of the Special Act on Fostering Venture Businesses," passed by South Korea's Ministry of SMEs and Startups and the Cabinet on September 9, removes "blockchain/virtual asset (cryptocurrency) trading and brokerage" from the list of "restricted/prohibited investment" industries. The amendment will officially take effect on September 16.

Author: Zen, PANews

After 7 years, South Korean virtual asset companies have finally regained their status as "venture enterprises," allowing them to be recognized as technology-based startups and growth companies, and to enjoy support such as venture capital, technology guarantees, and policy financing.

The door for crypto companies was opened by the amendment to the "Enforcement Decree of the Special Act on Fostering Venture Businesses," passed by the Ministry of SMEs and Startups and the Cabinet on September 9. The amendment removes "blockchain/virtual asset (cryptocurrency) trading and brokerage" from the list of "restricted/prohibited investment" industries and will officially take effect on September 16.

7 Years of Restrictions and the Near "Disappearance" of Korean Crypto Startups

In October 2018, the South Korean government, aiming to curb speculation, protect retail investors, and maintain financial stability, included virtual asset-related businesses in the "restricted/prohibited industries" list of the Enforcement Decree of the Special Act on Fostering Venture Businesses. Similar to nightclubs and casinos, which were also listed as restricted industries, regulators at the time viewed cryptocurrencies as a "high-risk, unauthorized sector."

At that time, the government's strict regulation was not without reason. Amid a global crypto boom, multiple cases of "fraud" and "fake projects" emerged in South Korea, causing thousands of retail investors to suffer losses.

For example, a company named Shinil Group launched the "Shinil Gold Coin," claiming that buyers would receive a share of a vast amount of gold supposedly recovered from a Russian shipwreck. Over more than a year, the token attracted about 100,000 Korean investors and $53.7 million in investment. However, the company's CEO later admitted that "there was no conclusive evidence that anything valuable was on the ship," and the scam caused more than 2,600 investors to lose at least $8 million.

Similar incidents occurred repeatedly, involving amounts ranging from hundreds of thousands to millions of dollars, further fueling negative perceptions of "crypto speculation" among the public and government. This became one of the main reasons for tightening regulations and marginalizing the virtual asset industry in South Korea.

It should be noted that although crypto-related startups were not completely banned at the time, being listed as a restricted industry carried a label of high risk and distrust. Due to a lack of tax incentives, loan guarantees, and policy funding, they were at a clear disadvantage compared to industries like artificial intelligence and biomedicine.

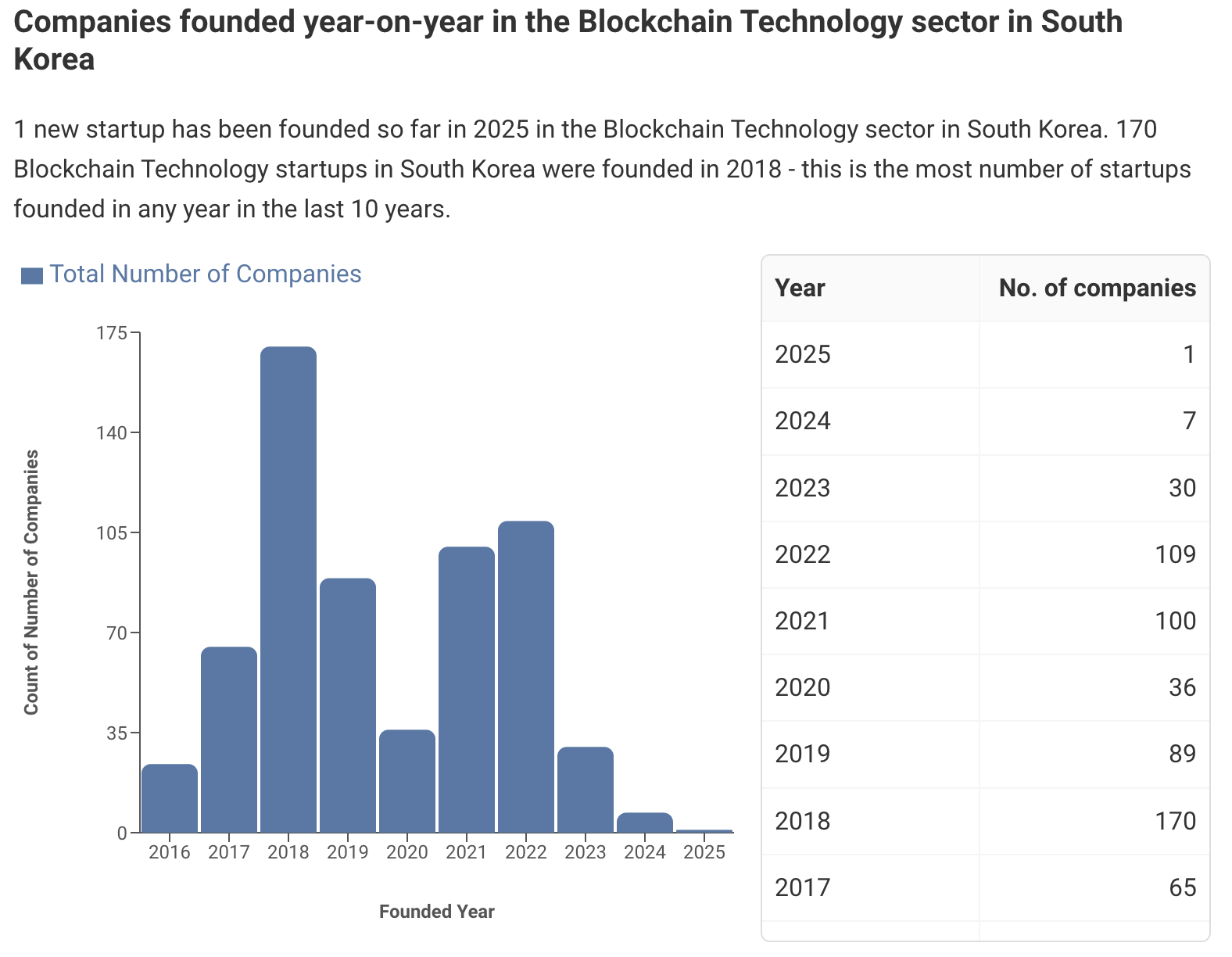

According to Tracxn data, as of July 23 this year, only one new blockchain technology startup was established in South Korea. In 2018, 170 blockchain technology startups were founded in the country—the highest number in the past decade. Additionally, only during the crypto bull market and its aftermath in 2021 and 2022 were more than 100 blockchain technology startups established.

Number of companies established in the Korean blockchain technology sector, year-on-year

Number of companies established in the Korean blockchain technology sector, year-on-year Furthermore, as of July 2025, Korean blockchain technology companies have raised a total of $13.3 million in four rounds of equity financing, while in the same period last year, they raised $32.3 million in 17 rounds—a year-on-year decrease of 58.82%.

Drivers Behind the New Policy: Improved Regulatory System and Digital Asset Trends

In the official announcement by the Ministry of SMEs and Startups, it was clearly stated that the newly revised Enforcement Decree of the Venture Business Act aims, on the one hand, to establish a digital asset ecosystem in line with global trends and lay the foundation for nurturing innovative industries, and on the other hand, to cooperate with financial authorities to establish a transparent market order with user protection as the top priority. These two points respectively address the intensifying global trend of virtual assets and the necessity of regulating the crypto market and protecting investors.

The key figure behind this amendment, Minister of SMEs and Startups Han Seong-sook, believes that this regulatory reform aims to align South Korea with global digital asset trends and ensure future growth engines. She stated: "We will focus policy efforts on building a transparent and responsible ecosystem that allows venture capital to flow smoothly and supports the development of emerging industries."

Minister of SMEs and Startups Han Seong-sook

Minister of SMEs and Startups Han Seong-sook It is clear that this policy relaxation is not only due to the significant rise of the digital asset industry globally but is also closely related to South Korea's increasingly mature regulatory environment. In 2021, South Korea amended the "Act on Reporting and Using Specified Financial Transaction Information," introducing a virtual asset business reporting system, and brought virtual asset service providers under AML/KYC obligations similar to financial institutions. The "Virtual Asset User Protection Act," effective in 2024, grants financial regulators substantial supervisory, inspection, and sanctioning powers, and stipulates a series of specific obligations to protect user assets and prevent improper transactions.

The revision of these two key laws has filled regulatory gaps in "anti-money laundering supervision" and "user protection/market order," weakening the previous "lack of regulation, so just ban it" policy logic and shifting to a stance where existing regulatory capacity is sufficient to support industry development.

Ban Lifted, Korean Crypto VC May Usher in a New Spring

Lifting the restrictions will undoubtedly inject new vitality into South Korea's crypto industry.

Crypto startups will now find it easier to obtain domestic venture capital and government support, reducing financing costs and difficulties, creating new early-stage financing opportunities in areas such as DeFi and blockchain infrastructure, and accelerating the growth of the domestic blockchain industry while expanding its overseas influence.

For Korean crypto venture capital firms, they can now operate more freely and may deploy capital more aggressively, expanding investments in early-stage DeFi, blockchain infrastructure, and foundational projects. Notable VCs include:

Hashed, one of the most influential and publicly blockchain/crypto-focused early-stage VCs in Korea, is headquartered in Seoul with a presence in Silicon Valley, Singapore, and other locations. Hashed has long participated in major global and domestic projects (its website and portfolio list chains/projects such as Aptos and Injective), and organizes hackathons and ecosystem-building activities in Korea. It is an important capital driver and a model of "community-investment" integration in the Korean Web3 ecosystem.

Dunamu & Partners, the investment subsidiary of Upbit operator Dunamu, has a large and public investment portfolio, covering blockchain/FinTech and broader tech startups. As Dunamu itself operates a leading exchange, it may provide market liquidity support to projects as a strategic investor.

Kakao Ventures, the VC arm of the Kakao group, has long engaged in strategic investments in blockchain and payment scenarios. Leveraging Kakao's traffic and the Kaia ecosystem, it provides traffic, foundational chains, and commercialization channels for its portfolio companies. For on-chain projects seeking to establish themselves in Korea, the Kakao group is an important source of strategic capital and an ecosystem gateway.

In addition, Korea's financial system and large tech conglomerates are also accelerating their crypto layouts. Bank- and institution-backed investment platforms such as KB Investment can provide institutional capital and channel resources needed for long-term growth, thanks to their financial strength, compliance, and risk control capabilities. Samsung's strategic investment arm, Samsung Next, is known for its industry-level technology and market synergy, offering technical endorsement, global resources, and ecosystem-level cooperation opportunities for blockchain infrastructure and application projects.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Dips Below ETF Cost-Basis Levels

Bitcoin under pressure: JPMorgan identifies the real culprits

Ethereum Dip Triggers Massive Losses For Crypto Treasuries

UK SFO Opens First Major Cryptocurrency Fraud Investigation into $28M Scheme