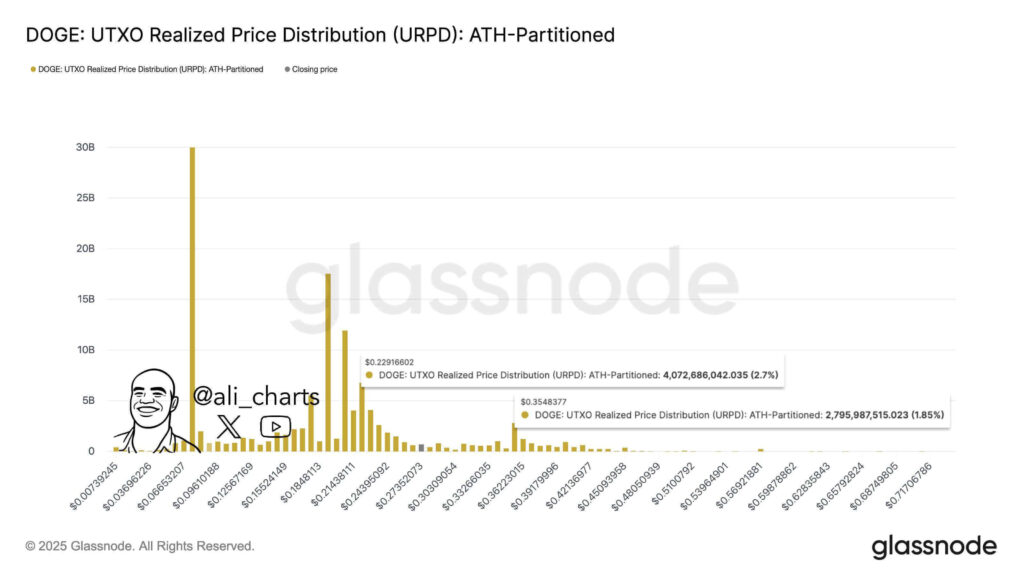

Dogecoin is testing a critical resistance at $0.355, with dense supply clusters between $0.22 and $0.35 on URPD and a 12-hour bull flag signaling a potential breakout toward $0.347 if confirmed.

-

Key resistance: $0.355 — dense supply at $0.22–$0.35 may cap upside

-

Largest holder base sits near $0.0096 with ~30 billion DOGE moved there historically

-

Technical pattern: 12-hour bull flag targets ~ $0.347 per Trader Tardigrade

Dogecoin resistance at $0.355 tested — URPD and chart patterns show dense $0.22–$0.35 supply. Read expert analysis, targets, and practical next steps.

What is Dogecoin’s key resistance level?

Dogecoin’s primary resistance sits at $0.355, identified by on-chain URPD data and trader analysis. This level aligns with a dense supply band between $0.22 and $0.35 that could produce meaningful selling pressure as price approaches it.

How does on-chain URPD show holder concentration?

URPD (UTXO Realized Price Distribution) maps where DOGE last moved on-chain and highlights cost base clusters. The largest pocket appears at $0.0096, where nearly 30 billion DOGE last transacted, forming a substantial holder foundation.

Additional concentrated realized prices exist in the $0.15–$0.25 range, showing persistent accumulation during earlier cycles. Above $0.35 the realized distribution thins, implying fewer buyers at higher valuations.

Dogecoin nears a key test as analysts note $0.355 resistance, with dense supply clusters between $0.22 and $0.35.

- Dogecoin’s largest holder base is at $0.0096, where nearly 30 billion DOGE last moved, forming a strong foundation.

- Resistance clusters are at $0.229 and $0.354, holding 4.07 billion and 2.79 billion DOGE respectively.

- A bull flag pattern on the 12 hour chart suggests a breakout target near $0.347, according to Trader Tardigrade.

Dogecoin is approaching a key technical test, with analysts identifying $0.355 as the most significant resistance barrier ahead. According to analyst Ali, this level is where strong supply pressure could resume. Clusters of long-term holder cost bases concentrated between $0.22 and $0.35 underline the importance of this zone for near-term price action.

Why is the $0.22–$0.35 band important?

The $0.22–$0.35 band is a dense supply zone visible on URPD, housing notable concentrated holdings at $0.229 (approx. 4.07 billion DOGE) and $0.354 (approx. 2.79 billion DOGE). These clusters could cause selling as traders defend realized profits.

If DOGE clears this band, the thinner realized distribution above suggests fewer overhead holders and comparatively less immediate selling pressure, potentially enabling a stronger continuation.

Dogecoin Holders Outlook chart, Source: Ali on X

This largest-holder cluster indicates many holders remain in profit at current levels. The $0.15–$0.25 range, formed during prior bullish cycles, also represents sustained accumulation that influences current market dynamics.

How do technical patterns affect the outlook?

A bull flag on the 12-hour timeframe has been identified by Trader Tardigrade. Bull flags typically resolve upward, and the measured move target given is near $0.347, which aligns closely with URPD resistance near $0.354 and analyst Ali’s $0.355 level.

Convergence of chart-based targets and on-chain resistance increases the significance of the $0.22–$0.35 band as a decisive zone for near-term breakout potential.

Frequently Asked Questions

What happens if Dogecoin breaks $0.355?

If Dogecoin clears $0.355 decisively with volume and on-chain support, overhead supply thins above this band, reducing immediate resistance and increasing the likelihood of a sustained rally toward higher targets.

When is a bull flag confirmed on Dogecoin?

A bull flag is typically confirmed when price breaks the flag’s upper boundary on higher-than-average volume and maintains support on a retest. Confirmation increases the probability of the measured target being reached.

Key Takeaways

- Primary resistance: $0.355 is the key level to watch because of clustered supply.

- Holder structure: Nearly 30 billion DOGE last moved near $0.0096, forming a strong base.

- Technical outlook: A confirmed 12-hour bull flag could target ~$0.347, aligning with URPD resistance.

Conclusion

Dogecoin’s immediate path is defined by the dense $0.22–$0.35 supply band and the critical $0.355 resistance. Combining URPD analysis with the 12-hour bull flag gives traders a clear framework: confirmation above $0.355 on supportive volume and on-chain flows would materially improve bullish odds. Monitor these levels and on-chain indicators closely for actionable signals.