CME Group to Launch Options on XRP and Solana Futures

The CME Group will introduce options on XRP and Solana futures this October, a move that could strengthen liquidity and spark fresh institutional interest in both tokens.

The CME is planning to launch options contracts on XRP and Solana futures. New capabilities for SOL, Micro SOL, XRP, and Micro XRP futures should go live in less than a month.

This development should be highly bullish for the underlying assets if everything goes smoothly, but there hasn’t been an immediate price impact yet. Market conditions could change in the next few weeks, making predictions difficult.

CME to Add Options to XRP Futures

The CME Group achieved huge success when it began offering XRP futures a few months ago, boosting the underlying token with institutional investment. These products hit $1 billion in open interest last month, and now, the CME is going to expand its options.

Specifically, the CME released a statement claiming that it will offer options on XRP and Solana futures. Clients will be able to invest in options for these contracts and their “Micro” counterparts. This flexibility is a core component of the CME’s consumer engagement strategy:

“The launch of these options contracts builds on the significant growth and increasing liquidity we have seen across our suite of Solana and XRP futures. Available in two different sizes, these contracts will offer a wide range of market participants additional choice and greater flexibility,” said Giovanni Vicioso, the firm’s Global Head of Cryptocurrency Products.

Growth Potential for Two Tokens

The CME noted that Solana futures have achieved $22.3 billion in total trades, and XRP futures have $16.2 billion. Of course, the former product was released two months earlier, so the XRP market is a formidable player.

FalconX and DRW will continue partnering with the CME to support these new contracts. Assuming that regulators agree with the CME’s proposal, options on XRP and Solana futures will begin trading on October 13.

Although there are a few bullish developments in the short term, like a two-month high in XRP trading and a potential new spot ETF, these factors may not be as relevant in one month.

Still, this could be an important market opportunity. The CME’s XRP and Solana futures contracts were bullish developments for the underlying assets, and options may boost the gains even further.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

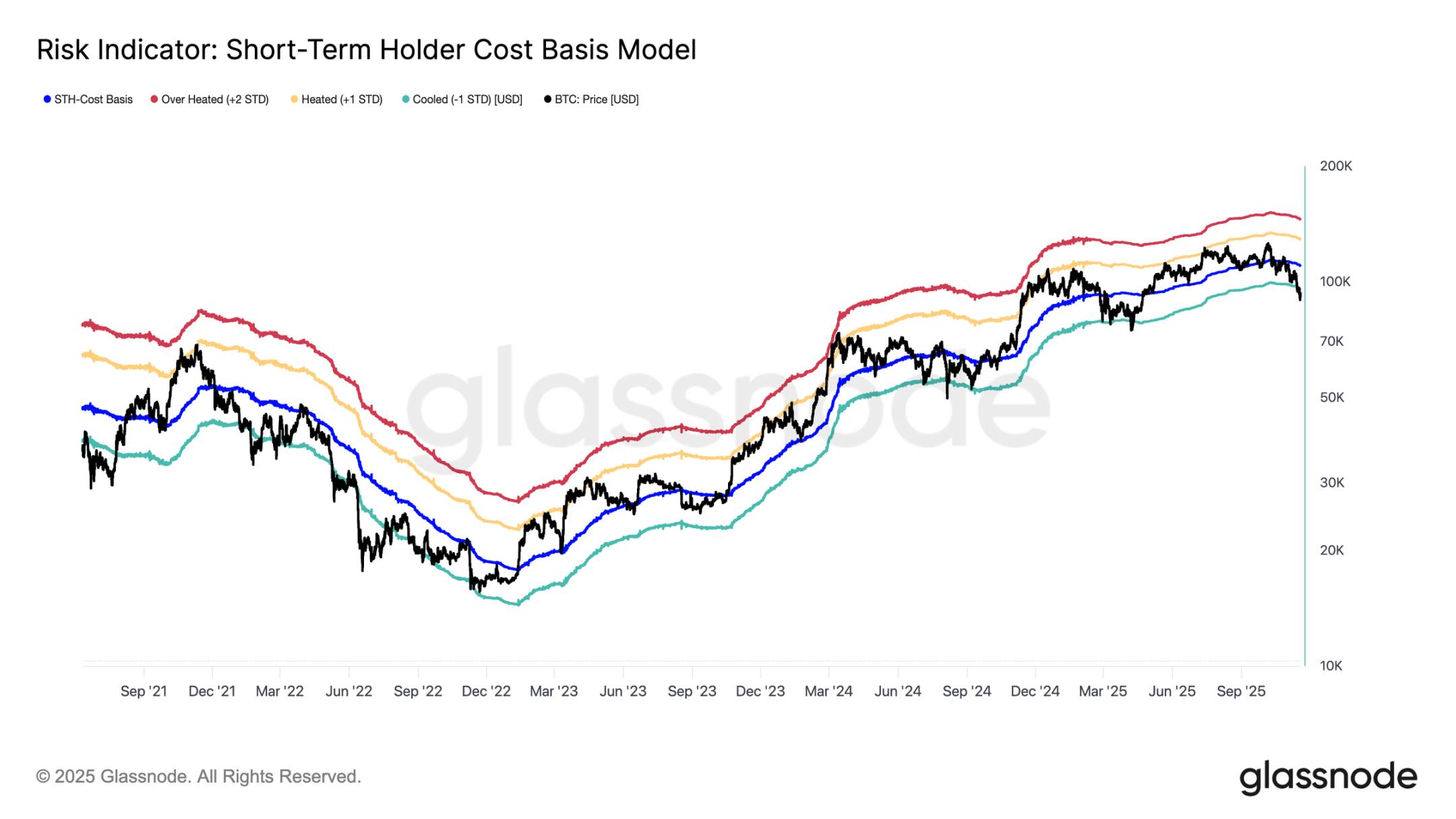

Bitcoin plunges 30%. Has it really entered a bear market? A comprehensive assessment using 5 analytical frameworks

Further correction, with a dip to 70,000, has a probability of 15%; continued consolidation with fluctuations, using time to replace space, has a probability of 50%.

Data Insight: Bitcoin's Year-to-Date Gains Turn Negative, Is a Full Bear Market Really Here?

Spot demand remains weak, outflows from US spot ETFs are intensifying, and there has been no new buying from traditional financial allocators.

Why can Bitcoin support a trillion-dollar market cap?

The only way to access the services provided by bitcoin is to purchase the asset itself.

Crypto Has Until 2028 to Avoid a Quantum Collapse, Warns Vitalik Buterin