XRP spot ETFs projected to draw $8 billion inflow in first trading year

The first US spot exchange-traded fund tied to XRP will begin trading today, and analysts believe it could unlock billions in institutional inflows within its first year.

REX-Osprey, the issuer behind the fund, confirmed that the product, trading under the ticker XRPR, will list on the CBOE BZX Exchange. The company will also roll out a Dogecoin fund under the ticker DOJE today.

However, investor attention is firmly centered on XRP.

This is unsurprising considering anticipation around XRP-linked ETFs has been building for months, with more than a dozen similar applications still awaiting review at the Securities and Exchange Commission (SEC).

As a result, Nate Geraci, president of Nova Dius Wealth, described the XRP ETF as a “litmus test” for whether investor enthusiasm can stretch to the Ripple-linked digital asset.

XRP ETF inflows could reach billions

CryptoSlate spoke to several market experts who believe that XRP-focused funds, including XRPR, could attract as much as $8 billion in fresh capital during their first trading year.

Julio Moreno, head of research at CryptoQuant, estimated that between 1% and 4% of XRP’s circulating supply could be absorbed by ETFs in the first year, equivalent to 600 million to 2.4 billion tokens, or $1.8 to $7.2 billion at current prices.

Such levels, he argued, would meaningfully improve liquidity while establishing XRP as a more mature investment vehicle in institutional portfolios.

Meanwhile, Bitget’s Chief Marketing Officer Jamie Elkaleh was much more bullish as he told CryptoSlate that inflows could reach between $4 billion and $8 billion within the first year. He added that such momentum could push XRP’s price toward the $4-$8 range by year-end.

According to him, this is similar to the early trajectory success of Bitcoin and Ethereum ETFs, which attracted record flows at launch.

Notably, Bitcoin-focused funds attracted more than $100 billion in assets within their first year of trading. In comparison, their Ethereum counterparts have seen over $10 billion in inflows within the last three months.

However, Elkaleh also warned that lingering regulatory delays or heightened market volatility could temper those projections.

How ETF fees could impact flows

On the other hand, analysts at Bitunix outlined a more scenario-based forecast where fees play a significant role in influencing the flows.

In their base case, the ETF could attract $500 million to $1.5 billion in its first month and $1–3 billion in the first quarter of trading.

Under a bearish setup, where fees are high or distribution channels are limited, inflows might shrink to as little as $200-500 million initially. Conversely, if fees remain low and brokerages offer wide access from day one, inflows could climb to $3-5 billion within three months.

The analysts explained that their projections are based on the Bitcoin and Ethereum ETF launch data, which were adjusted for XRP’s smaller market position and liquidity structure.

They also pointed out that XRP lacks the “legacy trust redemption overhang” that constrained Bitcoin and Ethereum inflows, suggesting its early numbers may appear cleaner.

So, if the XRP ETF inflows capture even 2-6% of the circulating supply within the first quarter, this could lead to significant price appreciation for the digital token.

The post XRP spot ETFs projected to draw $8 billion inflow in first trading year appeared first on CryptoSlate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Exclusive Interview with Bitget CMO Ignacio: Good Code Eliminates Friction, Good Branding Eliminates Doubt

A software engineer’s philosophy of branding.

App delays and launch sniping: Base co-founder’s token issuance sparks community dissatisfaction

While most major altcoins are showing weakness, Jesse has chosen to issue a token at this time, and the market may not respond positively.

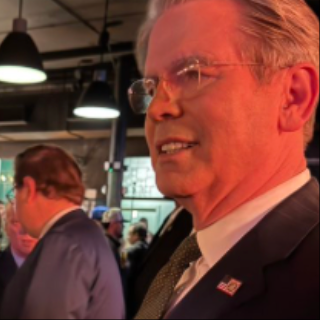

"Crypto bull" Tom Lee: The crypto market correction may be nearing its end, and bitcoin is becoming a leading indicator for the US stock market.

"Crypto bull" Tom Lee stated that on October 10, an abnormality in the cryptocurrency market triggered automatic liquidations, resulting in 2 million accounts being liquidated. After market makers suffered heavy losses, they reduced their balance sheets, leading to a vicious cycle of liquidity drying up.

Besant unexpectedly appears at a "Bitcoin-themed bar," crypto community "pleasantly surprised": This is the signal

U.S. Treasury Secretary Janet Yellen made a surprise appearance at a bitcoin-themed bar in Washington, an act regarded by the cryptocurrency community as a clear signal of support from the federal government.