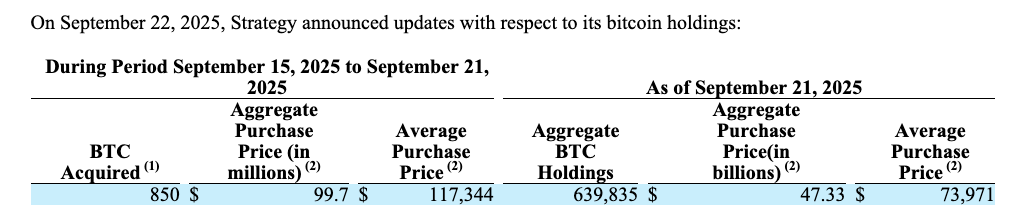

Strategy’s latest $99.7 million Bitcoin acquisition raised its holdings to 639,835 BTC, bringing total cost to about $47.3 billion; the company bought 850 BTC at an average price of $117,344 amid a Fed rate cut and subdued market volatility.

-

850 BTC bought for $99.7M at an average of $117,344 per coin

-

Strategy now holds 639,835 BTC, acquired for roughly $47.3 billion (avg. $73,971).

-

September buying pace slowed: 3,330 BTC vs. August 7,714 BTC and July 31,466 BTC.

Strategy Bitcoin acquisition: 850 BTC bought for $99.7M; see holdings and market context. Read analysis and key takeaways from COINOTAG.

Strategy’s latest $99.7 million Bitcoin acquisition brought its total Bitcoin holdings to 639,835 BTC, acquired for about $47.3 billion.

Michael Saylor’s Strategy, the world’s largest corporate Bitcoin holder, added more BTC to its balance sheet last week as the US Federal Reserve cut interest rates for the first time this year.

Strategy acquired 850 Bitcoin (BTC) for $99.7 million during the week ending Sunday, according to a US Securities and Exchange Commission filing on Monday.

The purchase was made at an average price of $117,344 per coin as BTC briefly surged to multiweek highs above $117,000 last Thursday following the Fed’s 25 basis point interest rate cut, according to CoinGecko data.

The acquisition brought Strategy’s total Bitcoin holdings to 639,835 BTC, purchased for about $47.3 billion at an average price of $73,971 per coin.

What is Strategy’s latest Bitcoin purchase?

Strategy’s latest Bitcoin purchase was 850 BTC for $99.7 million, executed during the week ending Sunday and disclosed in a US Securities and Exchange Commission filing. The buy increased total holdings to 639,835 BTC, reinforcing the company’s long-term accumulation strategy amid lower interest rates and muted volatility.

How much has Strategy bought year-to-date and what is the trend?

Year-to-date figures show a clear deceleration. In September Strategy bought 3,330 BTC so far, down from 7,714 BTC in August and sharply lower than July’s 31,466 BTC.

These numbers reflect a shift from large-scale monthly buys to more modest, periodic purchases. The decline in purchase volume aligns with reduced market volatility and growing institutional participation.

Why did Strategy buy more Bitcoin now?

Strategy’s purchase coincided with a 25 basis point Federal Reserve rate cut, which briefly lifted BTC to multiweek highs. Management has stated a commitment to accumulate over time. The buy appears driven by long-term positioning rather than short-term market timing.

How does this affect institutional Bitcoin dynamics?

Institutional purchases at these scales reinforce supply constraints and signal continued corporate appetite for BTC as an asset class. Reduced price volatility can encourage larger institutions to enter, but may dampen trader interest, making the market “boring” as volatility declines.

An excerpt from Strategy’s Form 8-K. Source: SEC

Frequently Asked Questions

How many Bitcoin does Strategy hold now?

Strategy holds 639,835 BTC after the latest 850 BTC purchase, with a total reported acquisition cost of roughly $47.3 billion and an average price of $73,971 per coin.

Did the Fed rate cut influence the purchase?

The timing of the purchase followed a 25 basis point Fed rate cut and a short-lived BTC price spike to above $117,000. Strategy cited accumulation goals; the purchase aligns with a long-term buy-and-hold approach rather than reactionary trading.

Key Takeaways

- Acquisition size: Strategy bought 850 BTC for $99.7M at ~$117,344 per coin.

- Holdings scale: Total holdings reached 639,835 BTC, cost basis ~$47.3B (avg. $73,971).

- Trend: Monthly purchase volume is slowing, indicating more measured accumulation.

Conclusion

Strategy’s latest move—850 BTC for $99.7 million—keeps the company at the forefront of corporate Bitcoin accumulation. The reduced buying cadence suggests a shift toward steady, opportunistic purchases as institutional adoption grows and volatility softens. Continue monitoring SEC filings and market metrics for updates; COINOTAG will provide ongoing coverage.