Why will the crypto market shift to an institution-led "slow bull" in 2026?

Author: arndxt

Translation: Tim, PANews

Original Title: 2026, The Crypto Market Moves Toward an Institutionally Led "Slow Bull"

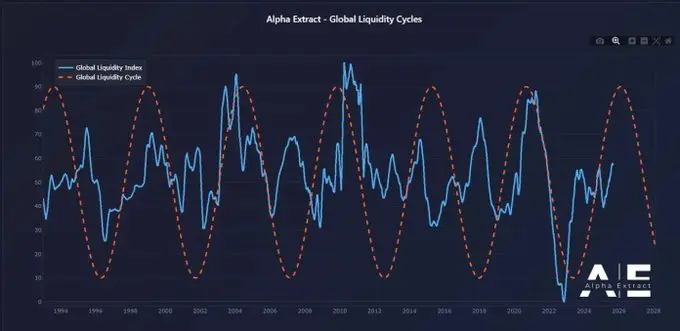

Macro Liquidity and Federal Reserve Policy

The biggest overall conclusion is: the crypto market will not decouple from the macroeconomy, but will instead become more closely integrated with it.

The timing and scale of capital rotation, the Federal Reserve’s interest rate path, and the manner of institutional adoption will determine how this cycle evolves.

Unlike 2021, the upcoming altcoin season (if there is one) will be slower, more selective, and more institutionally focused.

If the Federal Reserve implements an easing policy through rate cuts and bond issuance, and this resonates with institutional adoption, then 2026 could become the most significant risk cycle since 1999-2000. The crypto market will benefit from this, though its performance will be more restrained rather than explosive.

1. Federal Reserve Policy Divergence and Market Liquidity

In 1999, the Federal Reserve raised rates by 175 basis points, yet the stock market soared to its 2000 peak. Today, forward markets are pricing in the opposite scenario: a 150 basis point rate cut by the end of 2026. If realized, this would create an environment of injected liquidity rather than liquidity withdrawal.

The market landscape in 2026 may mirror 1999 and 2000 in terms of risk appetite, but the interest rate trajectory will be completely opposite. If this judgment holds, 2026 could see a "strengthened version" of the 1999-2000 market trend.

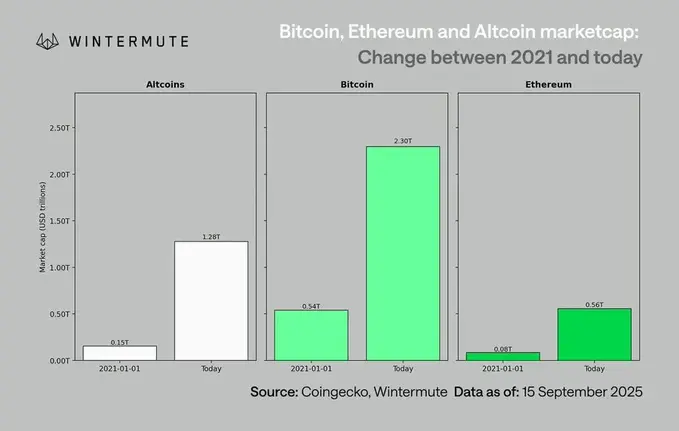

2. The New Landscape of the Crypto Market Compared to 2021

Comparing today to the last bull market cycle:

-

Stricter capital discipline: Rising interest rates and persistent inflation have made companies more selective in taking risks.

-

The liquidity surge during the pandemic will not be repeated: Without an M2 surge, growth must be driven by adoption and allocation.

-

Market size has expanded tenfold: A larger market cap base means deeper liquidity, but the likelihood of 50-100x outsized returns is reduced.

-

Institutional capital flows: As mainstream and institutional adoption is now a given, capital flows are more gradual, favoring slow rotation and consolidation rather than explosive cross-asset rotations.

3. Bitcoin’s Lag and the Liquidity Chain

Bitcoin lags behind liquidity conditions because new liquidity is trapped upstream in treasuries and money markets. As the farthest end of the risk curve, crypto only benefits when liquidity flows downstream.

Catalysts driving the crypto market:

-

Bank credit expansion (ISM > 50)

-

Outflows from money market funds after rate cuts

-

Treasury issuing long-term bonds, lowering long-term rates

-

Weakening dollar is easing global financing pressures

When these conditions are met, the crypto market has historically rallied in the late cycle, that is, after stocks and gold.

4. Risks Under the Baseline Scenario

Despite this bullish liquidity structure, some risks are emerging:

-

Rising long-term yields (due to geopolitical pressures).

-

A strengthening dollar leading to global liquidity tightening.

-

Weak bank lending or tighter credit conditions.

-

Liquidity stagnating in money market funds rather than rotating into risk assets.

The next cycle will be defined less by speculative capital shocks and more by the structural integration of the crypto market with global capital markets.

As institutional capital flows, disciplined risk investment behavior, and policy-driven liquidity shifts intertwine, 2026 could become a key turning point for the crypto market, shifting from isolated booms and busts to global systemic correlation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

$8.8 billion outflow countdown: MSTR is becoming the abandoned child of global index funds

The final result will be revealed on January 15, 2026, and the market has already started to vote with its feet.

Deconstructing DAT: Beyond mNAV, How to Identify "Real vs. Fake HODLing"?

There is only one iron rule for investing in DAT: ignore premium bubbles and only invest in those with a genuine flywheel of continuously increasing "crypto per share."

Empowered by AI Avatars, How Does TwinX Create Immersive Interaction and a Value Closed Loop?

1. **Challenges in the Creator Economy**: Web2 content platforms suffer from issues such as opaque algorithms, non-transparent distribution, unclear commission rates, and high costs for fan migration, making it difficult for creators to control their own data and earnings. 2. **Integration of AI and Web3**: The development of AI technology, especially AI Avatar technology, combined with Web3's exploration of the creator economy, offers new solutions aimed at breaking the control of centralized platforms and reconstructing content production and value distribution. 3. **Positioning of the TwinX Platform**: TwinX is an AI-driven Web3 short video social platform that aims to reconstruct content, interaction, and value distribution through AI avatars, immersive interactions, and a decentralized value system, enabling creators to own their data and income. 4. **Core Features of TwinX**: These include AI avatar technology, which allows creators to generate a learnable, configurable, and sustainably operable "second persona", as well as a closed-loop commercialization pathway that integrates content creation, interaction, and monetization. 5. **Web3 Characteristics**: TwinX embodies the assetization and co-governance features of Web3. It utilizes blockchain to confirm and record interactive behaviors, turning user activities into traceable assets, and enables participants to engage in platform governance through tokens, thus integrating the creator economy with community governance.

Aster CEO explains in detail the vision of Aster privacy L1 chain, reshaping the decentralized trading experience

Aster is set to launch a privacy-focused Layer 1 (L1) public chain, along with detailed plans for token empowerment, global market expansion, and liquidity strategies.