Benchmark sees big arbitrage upside in Strive-Semler deal, could set template for bitcoin treasury consolidation

Quick Take The combined company will hold nearly 11,000 BTC once finalized, making it the 12th-biggest public-traded corporate bitcoin treasury. The deal could position Strive as the sector’s “consolidator of choice,” according to Benchmark analysts.

Strive's all-stock acquisition of Semler Scientific could become a template for consolidation in the bitcoin treasury sector.

On Monday, Strive (ticker ASST) reached a definitive agreement to acquire Semler Scientific (SMLR). The deal's fixed exchange ratio of 21.05 Strive shares for each SMLR share implies a value north of $86.30 per SMLR share at current ASST prices.

Yet SMLR closed Monday at $32.06 per share, creating what Benchmark analyst Mark Palmer called an "unusually wide arbitrage spread."

"We believe the discount underscores both the market's skepticism and the opportunity, as it appears to demonstrate that the market has yet to fully process the implications of Strive's strategy or the value of consolidating bitcoin-rich balance sheets within a single firm," Palmer wrote in a client note.

The combined company will hold nearly 11,000 BTC (~$1.2 billion) once finalized, making it the 12th-biggest publicly traded corporate bitcoin treasury . The deal could position Strive as the sector's "consolidator of choice."

Strive is using equity as currency to capture bitcoin at discounts, "arbitraging the levels at which bitcoin treasuries have traded," Palmer said. This lets it secure more bitcoin per share and may push peers to act before becoming acquisition targets themselves.

<span data-mce-type="bookmark" class="mce_SELRES_start" data-v-01c090ad></span>

One lesson from the rise of bitcoin treasury companies is that scale opens access to better financing tools like perpetual preferred stock, which avoids the maturity cliffs and margin risk of debt-heavy strategies. Strive has signaled a "preferred-equity-only" leverage model, the analyst said.

Smaller firms with meaningful reserves but lower valuations — SMLR trades at an mNAV of just 1.01 — are natural candidates for stock-for-stock tie-ups, Palmer continued. If consolidation is taking hold, the winning strategies will likely combine scaled bitcoin holdings with perpetual preferred capital, and sometimes cash-flowing operating assets that can be tapped when equity markets turn.

Benchmark reiterated a "buy" rating on SMLR while lowering its price target from $101 to $86. Palmer noted that the steep discount to the deal’s implied value offers unusually high potential returns in a merger-arbitrage trade and comes "at a time when typical spreads are measured in single digits."

Bitcoin is trading around $112,600 on Tuesday, according to The Block's price page .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

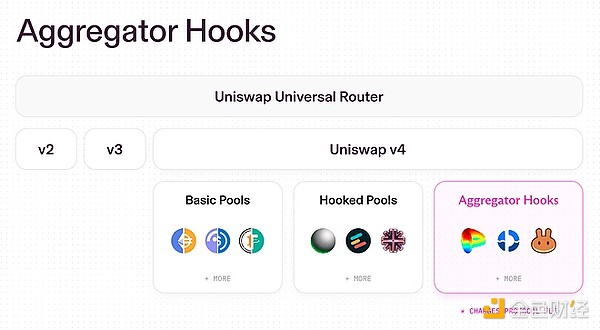

UNI surges nearly 50%: Details of the Uniswap joint governance proposal

Burning is Uniswap's final trump card

Hayden’s new proposal may not necessarily be able to save Uniswap.

The surge of ZEC has fueled NEAR

Focus on creating a good product, regardless of its application scenarios.