Australia plans to legislate licensing requirements for crypto platforms

According to ChainCatcher, the Australian Treasury has announced a draft proposal to amend the Corporations Act 2001, requiring crypto trading platforms and tokenized custody platforms to hold an Australian Financial Services License.

The draft will categorize Digital Asset Platforms (DAP) and Tokenized Custody Platforms (TCP) as a new type of financial product, subjecting them to the full set of licensing and consumer protection rules applicable to existing financial institutions. The Treasury pointed out that the framework focuses on businesses that hold users' assets, rather than the digital assets themselves, and the main regulatory model will be consistent with financial intermediaries such as portfolio operators. According to the proposal, the Australian Securities and Investments Commission (ASIC) will be the licensing authority, and the consultation period will be open until October 24, 2025.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Japanese bond yields rise as market focuses on this week's economic data

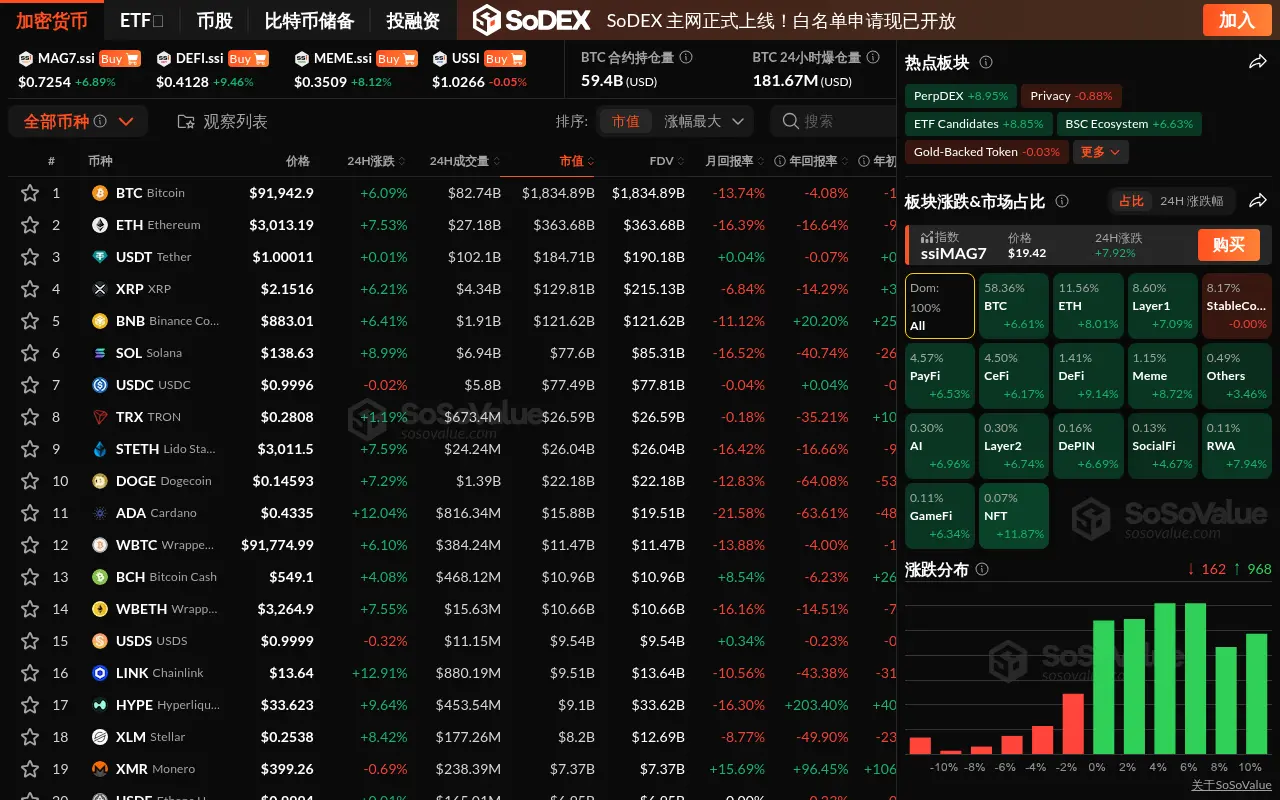

Data: The crypto market rebounds across the board, NFT sector leads with nearly 12% gain, BTC surpasses $91,000

Kalshi co-founder Lopes Lara becomes the world’s youngest self-made female billionaire