CleanSpark secures second BTC-backed credit line this week without share dilution

Bitcoin mining company CleanSpark secured its second $100 million credit line this week without issuing new shares, highlighting the growing role of digital assets as collateral in mainstream finance.

The latest facility, disclosed Thursday, was arranged with Two Prime, an institutional Bitcoin (BTC) yield platform, and is backed entirely by CleanSpark’s Bitcoin treasury. With this agreement, CleanSpark’s total collateralized lending capacity is now $400 million.

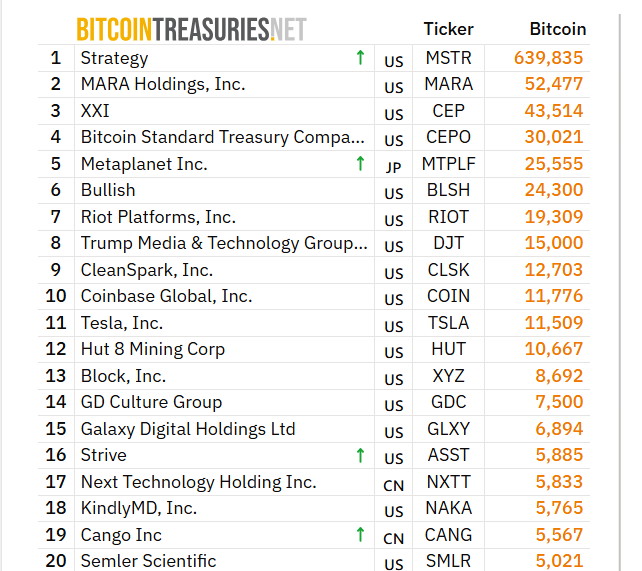

The non-dilutive nature of the financing is particularly notable. Public companies often raise growth capital through equity offerings, which can dilute existing shareholders’ stakes. By using its nearly 13,000 BTC holdings as collateral instead, CleanSpark gains access to liquidity while preserving shareholder value.

This deal follows another $100 million credit facility announced earlier in the week with Coinbase Prime, also secured against Bitcoin reserves. A company representative clarified to Cointelegraph that the Two Prime and Coinbase Prime facilities are separate arrangements, both contributing to the firm’s expanding financial flexibility.

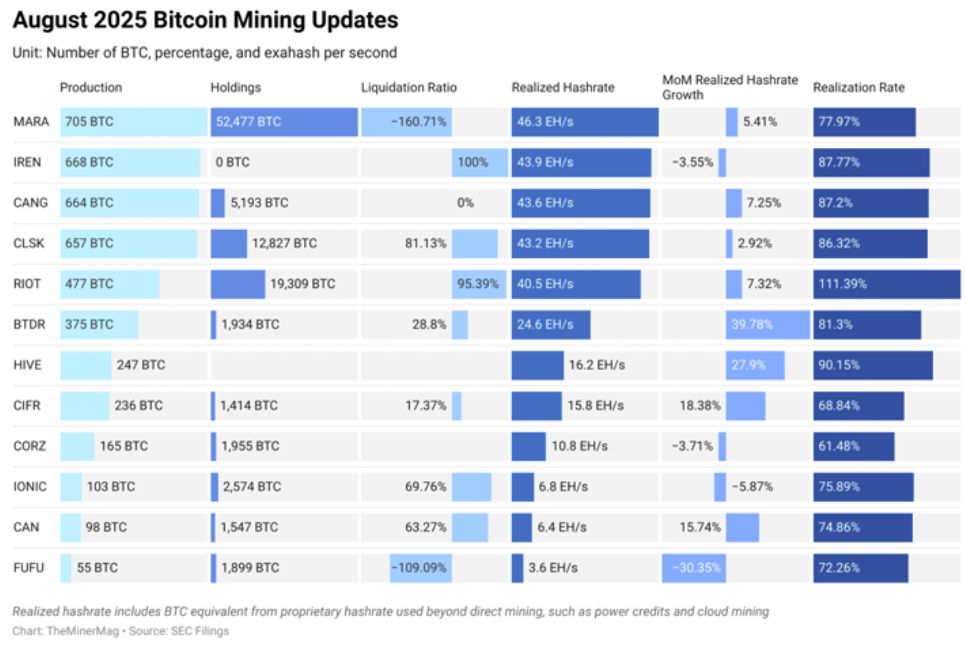

The funding provides CleanSpark with added flexibility to deploy capital quickly while avoiding excessive leverage. The company plans to use the credit to expand data centers, increase Bitcoin hashrate capacity and scale its high-performance computing infrastructure.

CleanSpark isn’t alone in tapping Bitcoin reserves for financing. Riot Platforms, which holds more than 19,300 BTC, secured a $100 million credit facility from Coinbase Prime earlier this year — the company’s first Bitcoin-backed loan.

Related: Twenty One Capital eyes Bitcoin-backed USD loans: Report

The growth of Bitcoin-backed financing

Bitcoin’s rising value and the wealth it has created for both companies and individuals have fueled demand for Bitcoin-backed loans — with some investors even using them to purchase real estate without selling their BTC, a strategy that also helps avoid triggering capital gains taxes.

For Bitcoin miners, this trend has changed treasury management. Instead of immediately selling their mined BTC to cover operating costs, more miners are holding Bitcoin on their balance sheets. As a result, collateralized lending has become an attractive option.

Such financing offers miners a non-dilutive way to raise capital while preserving exposure to Bitcoin’s potential upside. For miners with sizable BTC treasuries, borrowing against their holdings can sometimes be cheaper than traditional debt financing.

Magazine: 7 reasons why Bitcoin mining is a terrible business idea

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.