Andrew Kang: Has Bought a Large Amount of ETH Short-Term Put Options

ChainCatcher news, Mechanism Capital partner Andrew Kang tweeted that he has bought a large amount of short-term ETH put options. Each contract cost $15, and if ETH drops to the $3,000 range, he will gain $400-1,000.

According to previous reports, Andrew Kang cited his article criticizing Tom Lee, stating, "Ethereum is Luna 2." In the article, Andrew Kang bluntly said that Tom Lee's theory about ETH is "idiotic," and refuted it with five main points, causing a stir in the industry: the adoption of stablecoins and RWA will not bring the expected returns; the analogy of Ethereum as "digital oil" is inaccurate; institutions buying and staking ETH? Pure fantasy; ETH being equivalent to the total value of all financial infrastructure companies? Utterly absurd; technical analysis shows ETH is still in a multi-year sideways range, and the most recent rally was ruthlessly rejected after touching the upper boundary.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

20,000 ETH transferred out from a certain exchange, worth $61.21 million

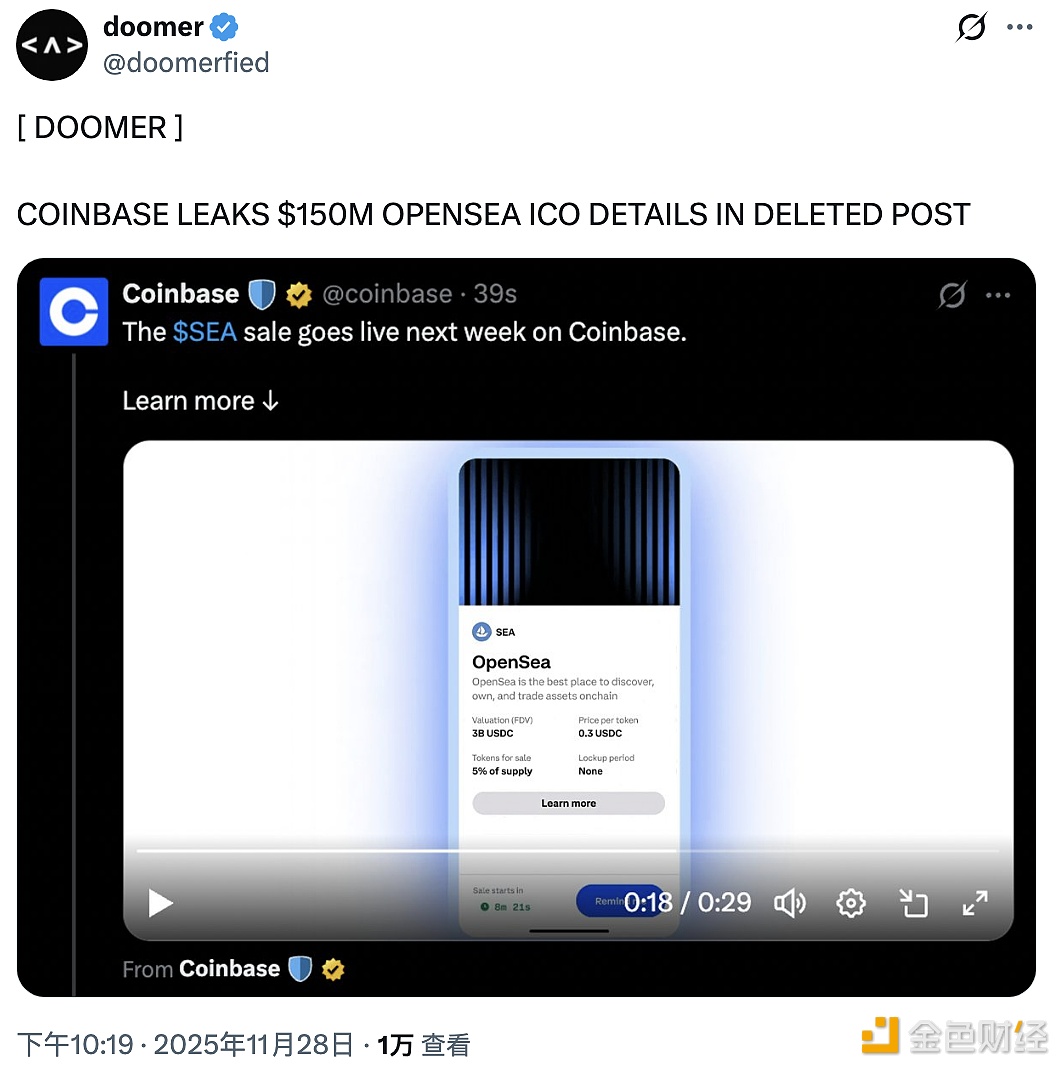

The probability of "OpenSea launching a token this year" rises to 52% on Polymarket

An exchange accidentally leaked details of OpenSea's $150 millions ICO

A certain exchange once posted "Opensea public sale next week," but later deleted it.