Data: Whales/institutions have accumulated 60,333 ETH in batches over the past week, with an unrealized loss of $20 million.

According to ChainCatcher, crypto analyst Ember @EmberCN has monitored that a whale/institution has continued its swing trading recently, accumulating a total purchase of 60,333 ETH between September 20 and 26, spending $257 million at an average price of $4,256. Based on the current price, the floating loss is about $20 million.

The specific operations include: on September 20, buying 16,569 ETH at $4,484 each (totaling $74.3 million); on September 22, buying 20,000 ETH at $4,298 each (totaling $85.95 million); on September 25, buying 13,764 ETH at $4,133 each (totaling $56.89 million); and on September 26, buying 10,000 ETH at $3,965 each (totaling $39.65 million). Previously, this address bought 132,000 ETH at an average price of $2,540 in June and sold them in batches near an average price of $2,923, with a total profit of about $50 million.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Andrew Tate went long on BTC again today, but was liquidated within just one hour.

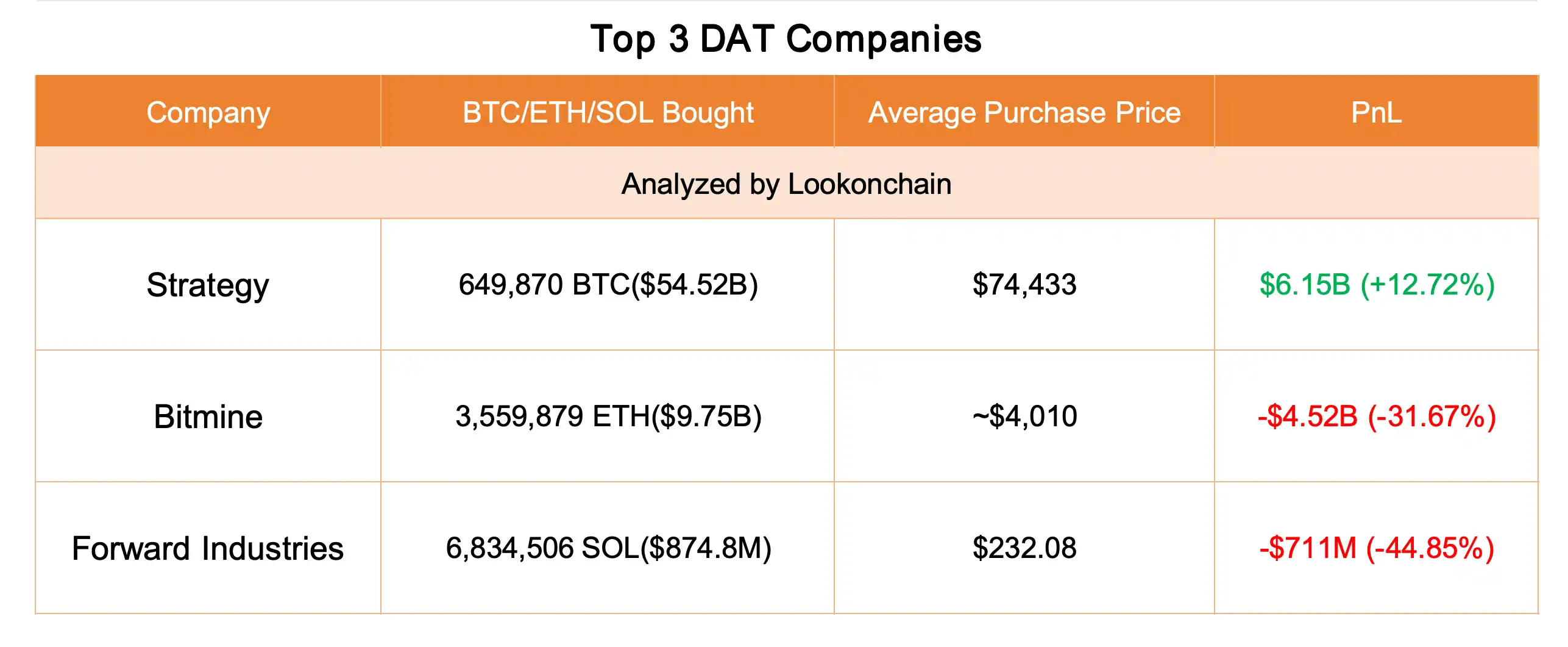

Bitmine's unrealized loss ratio on Ethereum holdings has reached 31.87%, with a loss of $4.531 billions.

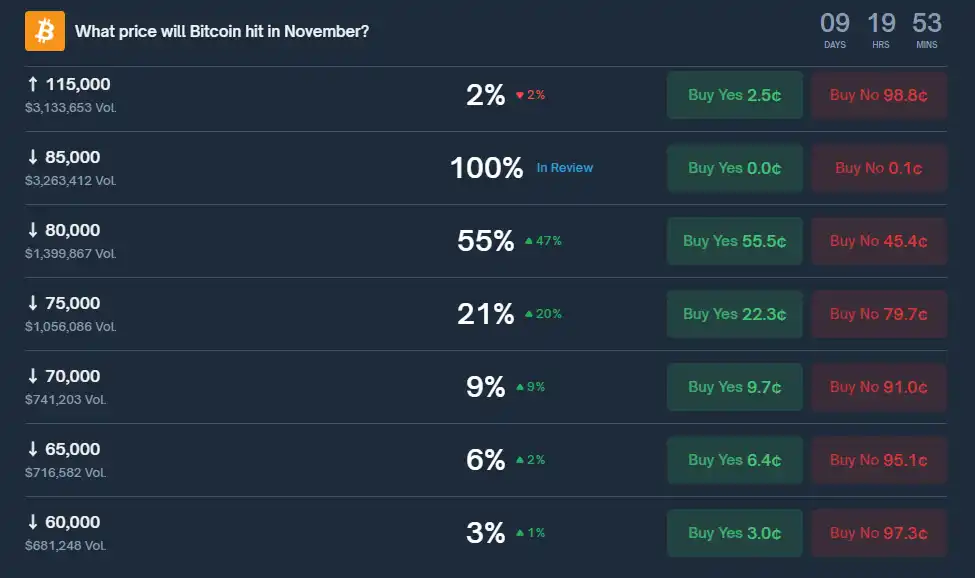

The probability of Bitcoin falling below $80,000 in November rises to 55%