When the market is down, consider trying out Plasma mining. How can one mine effectively?

Plasma's Ten Million Dollar Grant

On September 25, the highly anticipated Plasma native token XPL was listed. After opening, the price surged to $1.6, and early depositors also received significant airdrop rewards. In addition to airdrop events on various major exchanges, even Binance Alpha's airdrop offered around $220 worth of $XPL, truly a moment in the sun.

Almost in a frenzy of giveaways, Plasma launched a large-scale liquidity incentive program lasting for 7 days after its listing, continuing until October 2, covering mainstream protocols such as Aave, Euler, Fluid, Veda, etc. Users can deposit stablecoins into these protocols or hold relevant tokens to receive XPL rewards.

If you missed out on depositing or missed arbitrage opportunities on-chain, then you cannot miss out on the chance to claim some rewards. Five mainstream mining pools compiled by BlockBeats offer some APRs exceeding 35%.

Preparation for Mining

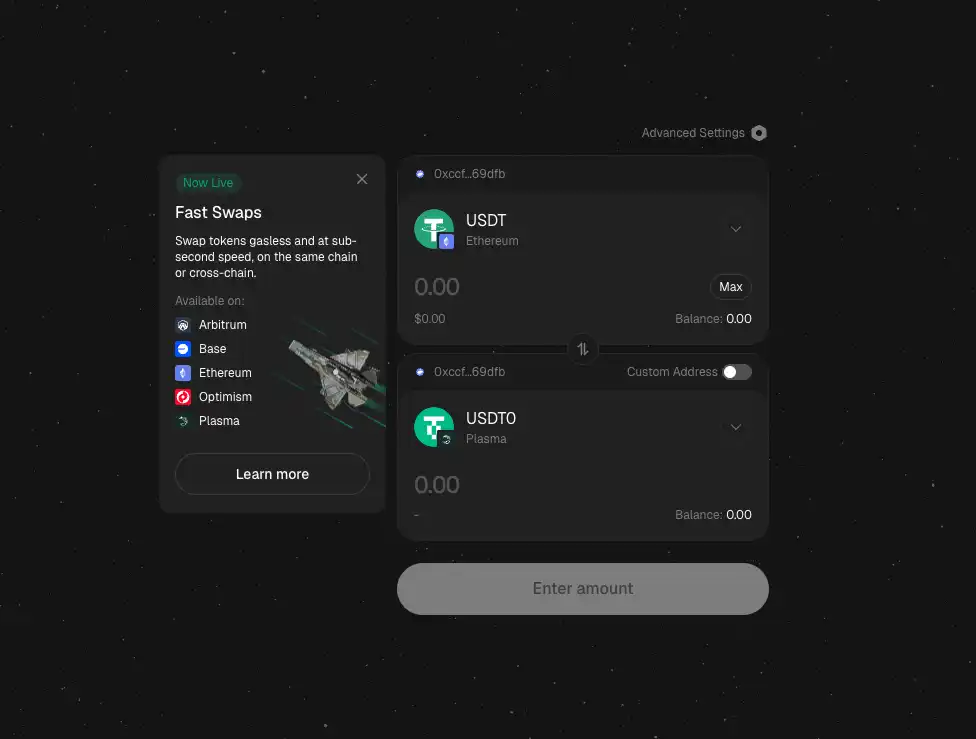

Prior to mining, asset preparation is required. Some protocols necessitate using Stargate to cross-chain mainnet USDT to Plasma, obtaining an equivalent USDT0. Additionally, a small amount of XPL is needed for transaction gas fees (typical for EVM-based systems).

For this event, Plasma has mostly collaborated with Merkl. Users can log in to Merkl's Dashboard at any time to track reward status. Merkl's platform automatically calculates rewards based on user deposit size and duration, requiring users only to regularly claim rewards manually.

Which Pools Are Good to Mine?

PlasmaUSD Vault

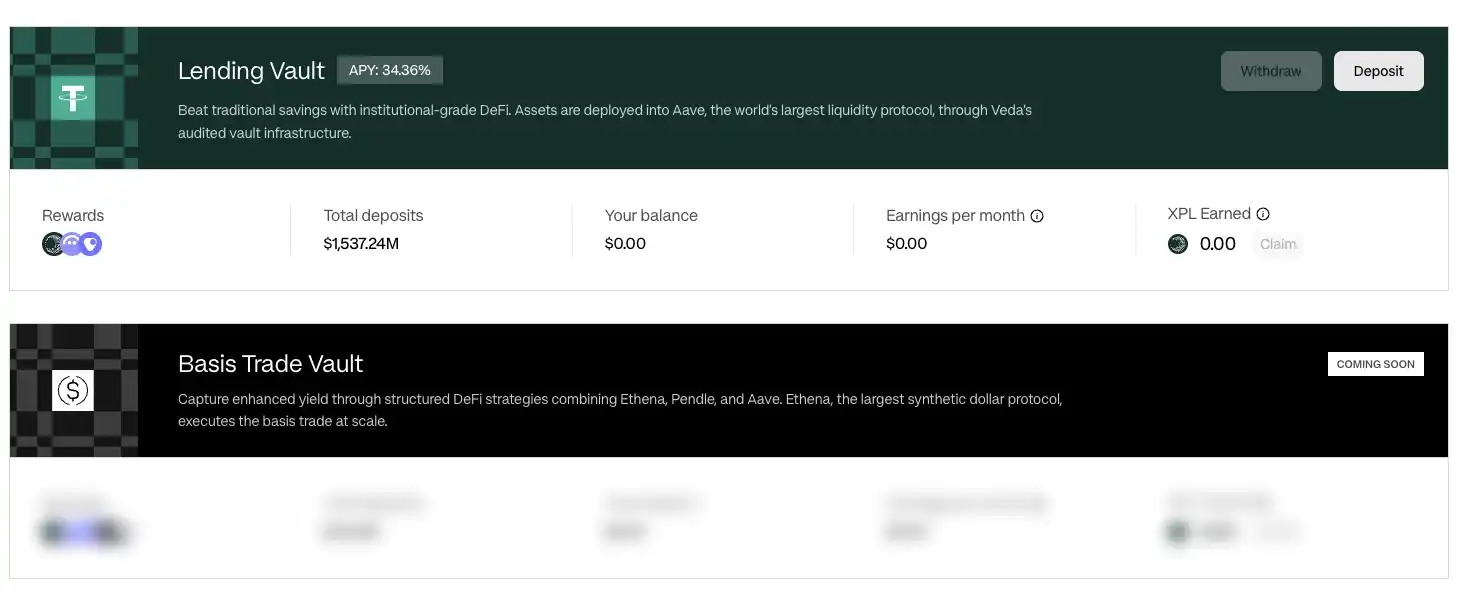

This activity is initiated by the Plasma team and distributes WXPL through the PlasmaUSD Vault under the Veda protocol in the form of coin holding mining. Currently, only the Lending Vault is open, and the Basis Trade Vault will also be open in the future.

The operation is quite simple. Just click on Deposit to deposit USDT0/USDT, hold shares of the Vault, and receive WXPL rewards, whether on the mainnet or Plasma chain. Rewards can be claimed every 8 hours, but there is a 48-hour withdrawal cooldown period for borrowed USDT0.

The current annualized return rate is approximately 34.36%, with a daily reward amount of up to $1.4 million. It is worth noting that the main reward pool of $1 million will only last for 3 days until the end of September 29, and it is unclear whether the official team will continue to provide incentives thereafter.

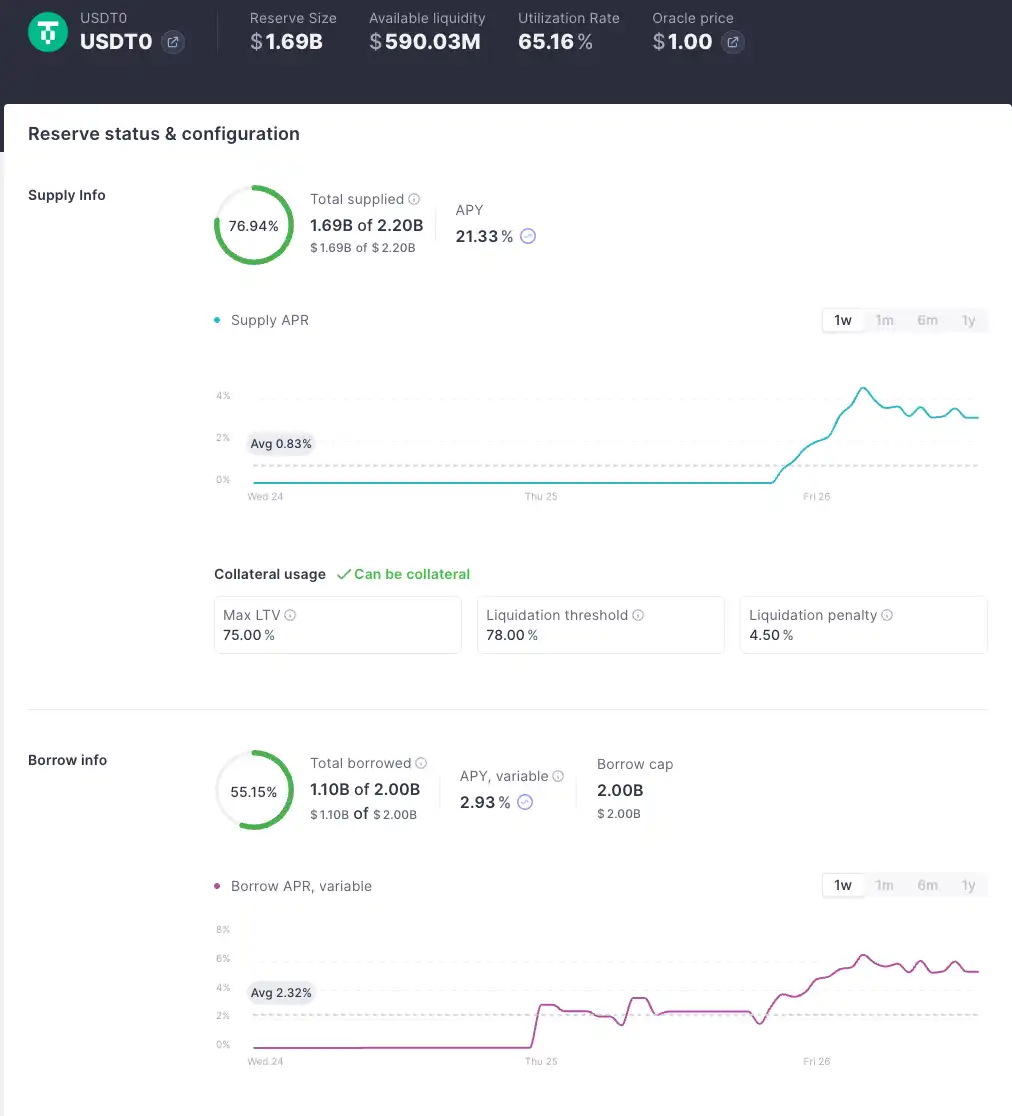

Aave USDT0

Similar to Plasma's lending Vault, depositing USDT0 lending on Aave also earns WXPL rewards. Currently, $1.7 billion has been deposited in the protocol, with an annualized return rate of about 21.33% (the protocol's own APY is about 3.19%, and WXPL's APY is 18.15%), with a daily reward of around $700,000 worth of XPL.

Compared to Plasma, the advantage here is the ability to withdraw at any time, but you need to provide USDT0 without holding any USDT0 or USDe debt, meaning you cannot engage in yield farming to boost utilization.

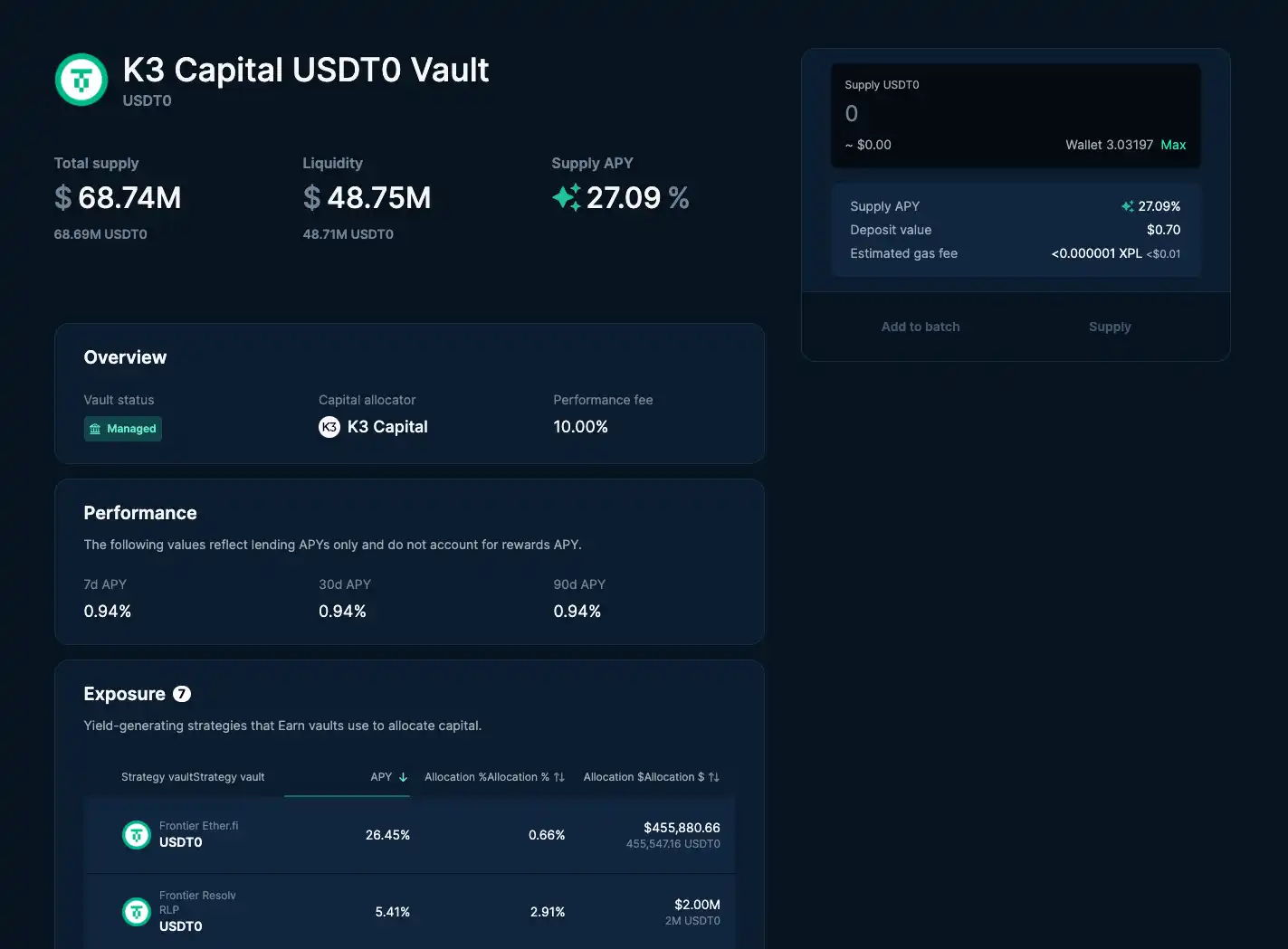

Euler K3 Capital USDT0 Vault

In the Plasma version of the Euler protocol, the USDT0 Vault managed by K3 Capital currently offers an annual percentage yield of approximately 27%, with a daily incentive distribution of around $55,000 worth of WXPL.

Users only need to deposit USDT0 on the Plasma mainnet and supply it to this Vault to start mining.

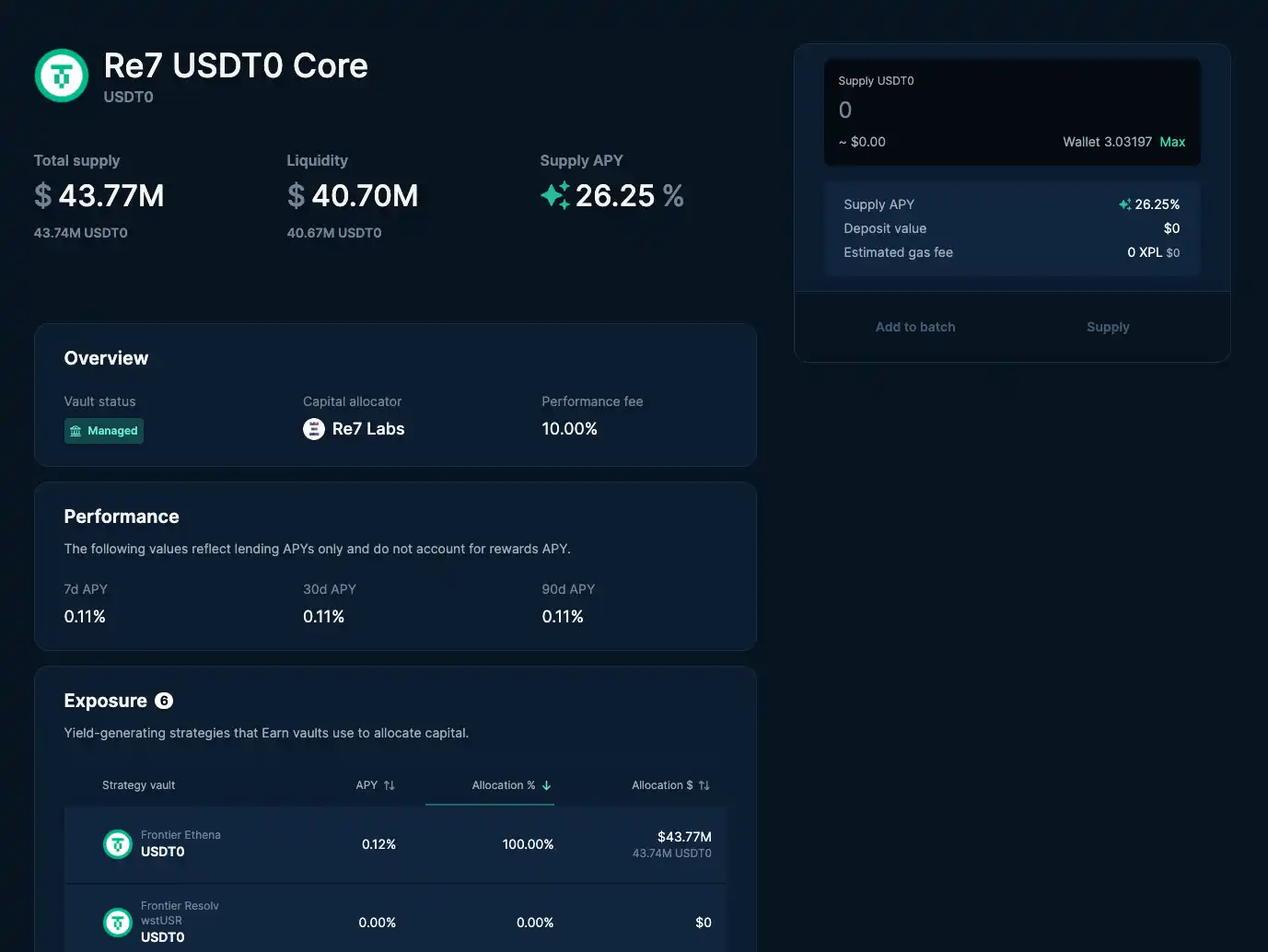

Euler Re7 Core USDT0 Vault

Also under the Euler protocol, the Re7 Core USDT0 Vault adopts a lossless term-lending model, where users can deposit USDT0 into the Vault to participate. The pool currently offers an annual percentage yield of about 30.43%, with daily rewards of approximately $35,000 worth of XPL. Although Euler's pool has a relatively lower TVL, the yield and reward levels are equally attractive, making it suitable for retail investors looking to diversify their holdings.

Fluid fUSDT0 Vault

The fUSDT0 Vault of the Fluid Protocol offers users rewards for depositing USDT0, USDe, and ETH into the lending Vault, as well as rewards for borrowing USDT0 using USDai and USDTO as collateral, meaning you can first collateralize USDai and USDT0 to borrow USDT0 and earn approximately a 24% annualized yield.

Then, use the borrowed USDT0 to provide liquidity to the lending pool, with the current annualized yield at around 25%.

It is worth noting that the majority of the APR for borrowing USDT0 is provided by Plasma's activity, with the current effective borrowing rate at around 3%. If borrowing demand increases, the rate may quickly rise, squeezing your net returns.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Meta’s announcement about Manus is being met with varied responses in Washington and Beijing

Australian Dollar climbs higher following a rebound from previous declines