Bitwise Files for First Hyperliquid ETF Amid Rising Competition From Aster

Contents

Toggle- Quick Breakdown

- Bitwise seeks approval for Hyperliquid ETF

- SEC hurdles ahead

- Aster surges as Hyperliquid slips

Quick Breakdown

- Bitwise has filed to launch the first Hyperliquid (HYPE) ETF, directly holding the token.

- The ETF offers in-kind redemptions, similar to Bitcoin and Ether ETFs.

- Rival DEX Aster is surging, with trading volume more than tripling Hyperliquid’s.

Asset manager Bitwise has moved to launch the industry’s first exchange-traded fund (ETF) tied to the Hyperliquid token (HYPE), as perpetual futures DEX rivalry intensifies.

Bitwise seeks approval for Hyperliquid ETF

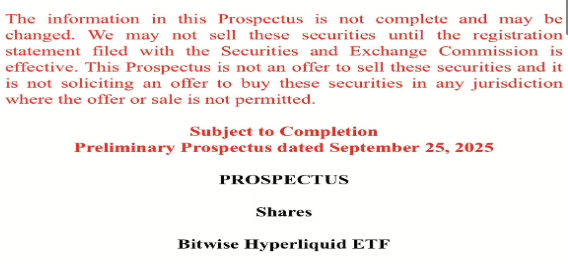

Bitwise submitted a Form S-1 filing to the SEC on Thursday for the proposed Bitwise Hyperliquid ETF, which would directly hold HYPE tokens. The token is used on the Hyperliquid decentralized exchange (DEX) for fee payments and trading discounts.

Source:

SEC

Source:

SEC

The filing does not yet disclose the ETF’s exchange listing, ticker symbol, or management fees. However, it specifies that the fund will operate with in-kind creations and redemptions, meaning investors can swap ETF shares for HYPE tokens instead of cash. This feature mirrors recent SEC-approved structures for Bitcoin and Ether ETFs, which regulators said make crypto funds “less costly and more efficient.”

SEC hurdles ahead

While the S-1 filing represents an early step, the ETF will also require a Form 19b-4 submission to begin the formal approval process. Under SEC rules, this process could take up to 240 days.

The SEC recently introduced generic listing standards for crypto ETFs, designed to streamline approvals if the underlying asset has traded on a Commodity Futures Trading Commission (CFTC)-regulated exchange for at least six months. Bitwise acknowledged in its filing, however, that Hyperliquid futures are not currently registered with the CFTC, which may complicate its path to approval.

Aster surges as Hyperliquid slips

Bitwise’s filing arrives at a time when Aster, a perpetual futures DEX on BNB Chain, is rapidly overtaking Hyperliquid in market share.

On Thursday, Aster’s trading volume reached an all-time high of $70 billion, with $35.8 billion traded in the past 24 hours—more than triple Hyperliquid’s $10 billion during the same period, according to DeFiLlama.

CoinGlass data shows Aster’s open interest has soared to $1.15 billion, a dramatic jump from just $143 million on September 20. Meanwhile, Hyperliquid’s open interest fell 1.85% to $2.2 billion, as its token price dropped 3.5% to $42.5.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin, altcoins sell-off as Fed chair switch-up, AI bubble fears spook markets

From yen rate hikes to mining farms shutting down, why is bitcoin still falling?

The recent decline in bitcoin prices is primarily driven by expectations of a rate hike by the Bank of Japan, uncertainty regarding the US Federal Reserve's rate cut trajectory, and systemic de-risking by market participants. Japan's potential rate hike may trigger the unwinding of global arbitrage trades, leading to a sell-off in risk assets. At the same time, increased uncertainty over US rate cuts has intensified market volatility. In addition, selling by long-term holders, miners, and market makers has further amplified the price drop. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

The Economist: The Real Threat of Cryptocurrency to Traditional Banks

The crypto industry is replacing Wall Street's privileged status within the American right-wing camp.

Grayscale's Top 10 Crypto Predictions: Key Trends for 2026 You Can't Miss

The market is transitioning from an emotion-driven cycle of speculation to a phase of structural differentiation driven by regulatory channels, long-term capital, and fundamental-based pricing.