Key Notes

- A dovish Fed chair could become the single biggest bullish catalyst for Bitcoin.

- Trump’s reported shortlist includes candidates seen as more open to earlier rate cuts.

- Bitcoin is trading near $109K after ten weeks in a $109K–$124K range.

Bitcoin is trading in a cautious range, but a change in leadership at the US Federal Reserve could provide the momentum that pushes the cryptocurrency to new all-time highs. Investors are watching closely who will replace Jerome Powell, waiting for the next crypto explosion .

A Victory at a Big Cost

Galaxy Digital CEO Mike Novogratz said that a strongly dovish Fed chair could be the biggest bullish driver for Bitcoin and the wider crypto market.

He suggested that aggressive easing might send Bitcoin into a rapid, extended rally, potentially reaching levels that would alter the conversation. At the same time, he warned that such a path would carry big costs for the US economy and the Fed’s independence.

President Donald Trump has said he would favor a more dovish candidate, and reports place Kevin Hassett, Christopher Waller, and Kevin Warsh on a narrowing shortlist.

Waller, among those named, has previously pushed for earlier rate cuts, and markets typically treat such views as dollar-negative and supportive of risk assets like Bitcoin.

Bitcoin in a Crucial Zone

Technically, Bitcoin’s price action remains fragile, trading around $109,000 after a 5% decline in the past week. Analysts at Swissblock stated that Bitcoin has been range-bound for roughly ten weeks, fluctuating between approximately $109,000 and $124,000.

Risk models indicate that the market has moved into a destabilization phase but are now showing early signs of stabilization.

Bitcoin lost $110K, and yet the Risk-Off Signal never triggered.

Despite trading close to $107.3K, the prior local low from August’s correction, the structure is holding.

Bitcoin shows signs it may be preparing for a final round. 👇

Chart from @bitcoinvector pic.twitter.com/v1ZYKeQo9i

— Swissblock (@swissblock__) September 26, 2025

Swissblock highlighted that selling by long-term holders has slowed and that ETFs and treasuries continue to buy , which supports the market from below.

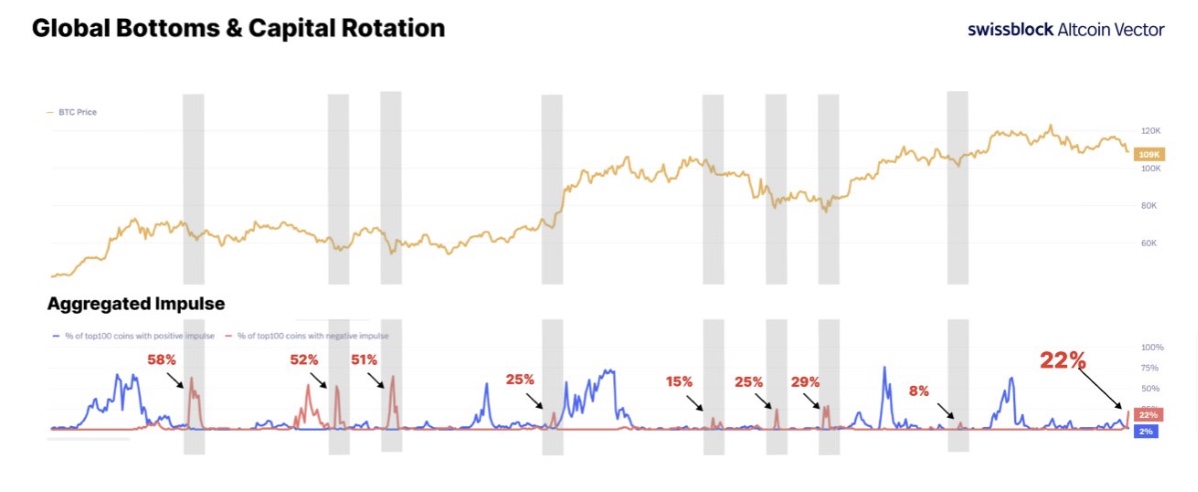

Their “Aggregated Impulse” indicator, built from price structures across hundreds of digital assets, suggests the market is in a reset phase. Historically, similar signals have marked major lows followed by strong rebounds in both Bitcoin and altcoins.

Swissblock’s aggregated impulse indicator | Source: Swissblock

On the other hand, October and November often bring favorable conditions for crypto, and a potential Fed easing cycle would act as a macro tailwind.

If the next Fed chair adopts a notably dovish stance , a weaker dollar and lower yields could accelerate flows into cryptocurrencies as investors seek higher returns.

next