I. Project Introduction

Falcon Finance (FF) is a financial protocol focused on synthetic dollars, offering sustainable interest returns through diversified, institutional-grade yield strategies. It is committed to building a compliant and transparent financial infrastructure to effectively bridge traditional finance with the crypto world.

Its core architecture adopts a

dual-token system:

USDf is an over-collateralized synthetic dollar that can be minted using multiple mainstream and selected crypto assets as collateral.

sUSDf is a yield-bearing asset designed under the ERC-4626 standard, which automatically accumulates returns. Users can redeem their original collateral or USDf at any time on demand.

Unlike traditional synthetic dollar protocols that focus on a single arbitrage model, Falcon Finance integrates funding rate arbitrage (both positive and negative), cross-exchange price arbitrage, native staking of major assets, and dynamic collateral allocation, delivering an annualized APY of around

9%. Its risk management emphasizes institutional-grade oversight and full on-chain transparency, including regular audits and real-time data dashboards. It also supports diversified collateral, including blue-chip and selected altcoins, enhancing the protocol’s composability and productivity.

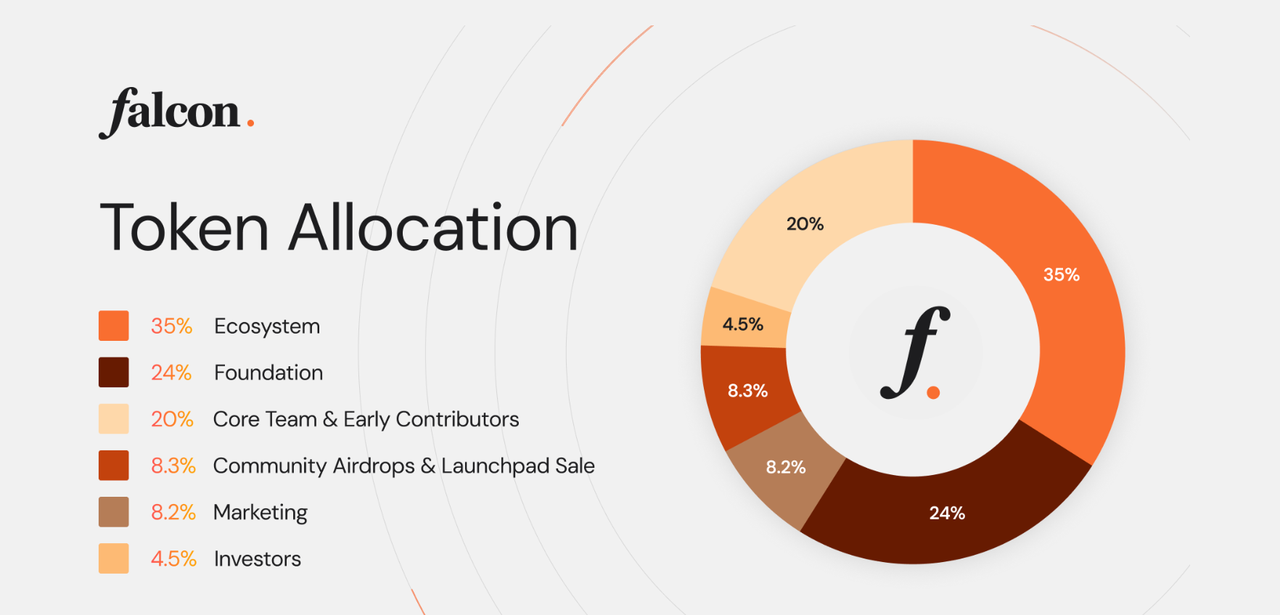

From a tokenomics perspective, FF has a

total supply of 10 billion tokens, with about

2.34 billion (23.4%) circulating at TGE. The allocation structure is as follows: 35% ecosystem, 24% foundation, 20% team, 8.3% community airdrop and sale, 8.2% marketing, and 4.5% investors. As a governance and utility token, FF supports protocol decision-making, incentive mechanisms, and certain product privileges, but it does not provide direct revenue-sharing.

Currently, Falcon Finance has a

TVL of approximately $1.9 billion, with about

$1.5 billion in

USDf

circulation and

58,000 monthly active users. The project has completed a

$10 million funding round, established an insurance fund, and is scheduled to launch on the secondary market on

September 29, 2025. Looking ahead, Falcon Finance plans to roll out an

RWA engine in 2026, enabling the tokenization of corporate bonds and private credit assets.

II. Project Highlights

Diversified Institutional-Grade Yield Strategies Falcon Finance adopts multi-strategy yield generation, breaking away from reliance on single arbitrage models. It accepts various high-quality collateral (stablecoins, BTC, ETH, and selected altcoins) and deploys basis trading, funding rate arbitrage, cross-exchange arbitrage, and native staking. These combined strategies deliver stable and sustainable yield while enhancing risk resistance.

Comprehensive Risk Management & Transparent Collateral Mechanism The protocol uses a dual-layer risk control system, combining automated real-time monitoring with manual oversight. Custody solutions follow compliant off-chain frameworks with MPC, multi-signature, and hardware key security to reduce centralization risks. A real-time dashboard displays TVL, USD issuance, and collateral composition. Independent third-party audits are conducted quarterly, ensuring high transparency and regulatory compliance.

Innovative Dual-Token Economic Model Driving Long-Term Value

USDf: Overcollateralized synthetic stablecoin enabling flexible circulation.

sUSDf: Yield-bearing token offering multi-strategy income.

FF: Governance and utility token for decision-making, staking benefits (reduced minting fees, enhanced yield), and ecosystem privileges.

This model enhances community stickiness and supports sustainable protocol growth.

Forward-Looking RWA Integration & Global Expansion Roadmap Falcon Finance aims to connect on-chain and traditional finance:

2025: Global banking rails, gold redemption in the UAE to back USDf with tangible assets.

2026: Launch of a dedicated RWA engine supporting tokenized corporate bonds, treasuries, and private credit, enabling institutional collaboration and global USDf adoption.

III. Tokenomics

Total Supply: 10 billion FF

Ecosystem: 35% — Growth incentives, airdrops, RWA adoption, multi-chain expansion

Foundation: 24% — Operations, liquidity, exchange partnerships, audits

Core Team & Contributors: 20% — Long-term incentives (1-year lock, 3-year vesting)

Community Airdrop & Launchpad Sales: 8.3% — User engagement and early support

Marketing: 8.2% — Awareness campaigns and adoption

Investors: 4.5% — Early supporters (1-year lock, 3-year vesting)

Utilities of FF Token:

Governance: Participate in protocol upgrades and parameter changes

Staking & Yield: Reduced minting fees, enhanced sUSDf returns

Ecosystem Access: Priority participation in new products, liquidity mining, partner incentives

Preferential Terms: Priority minting and trading conditions

Protocol Entry: Required for collateralization, ecosystem participation, and liquidity support

IV. Team & Fundraising

Falcon Finance was incubated and strategically supported by DWF Labs. Its founder is Andrei Grachev, co-founder of DWF Labs. To ensure compliance and transparent governance, the FF Foundation was established, independently managing token distribution and governance apart from the operating team.

Funding History:

Private Round: $10M led by DWF Labs, primarily for infrastructure (allocated 4.5% FF)

Public/Community Sale: Target $4M, oversubscribed to $112M on BuildPad (allocated 8.3% FF)

Team & Contributors: 20% allocation (subject to lockup and vesting)

V. Risk Factors

Yield Dependency: Protocol relies on arbitrage and asset management opportunities. If volatility falls or markets weaken, sUSDf yield may decline, affecting USDf’s attractiveness and stability.

Unlock Pressure: With 10B total supply and 23.4% circulating at TGE, rapid release of incentives or airdrops could lead to early investor exits and sell pressure if adoption lags.

VI. Official Links

Disclaimer: This report was generated by AI and human-verified for accuracy. It is not intended as investment advice.