The Federal Reserve agrees to ease capital requirements for Morgan Stanley

Jinse Finance reported that the Federal Reserve stated on Tuesday that the stress capital buffer requirement for a certain exchange (MS.N) has been reduced from the initial 5.1% to 4.3%. This adjustment stems from the Wall Street institution's request in August for the Federal Reserve to reconsider the results of its annual stress test assessment. This multi-stage test is designed to evaluate the resilience of large U.S. banks under hypothetical economic recession scenarios. In a statement, the Federal Reserve said: "Based on the analysis of the information submitted by the exchange, the Board determined that the estimated losses for the bank's fair value option loan portfolio were overly conservative." All 22 banks, including the exchange, successfully passed this year's Federal Reserve stress test, demonstrating that these institutions can withstand losses exceeding $550 billions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin OG opens 5x ETH short position worth $15.04 million

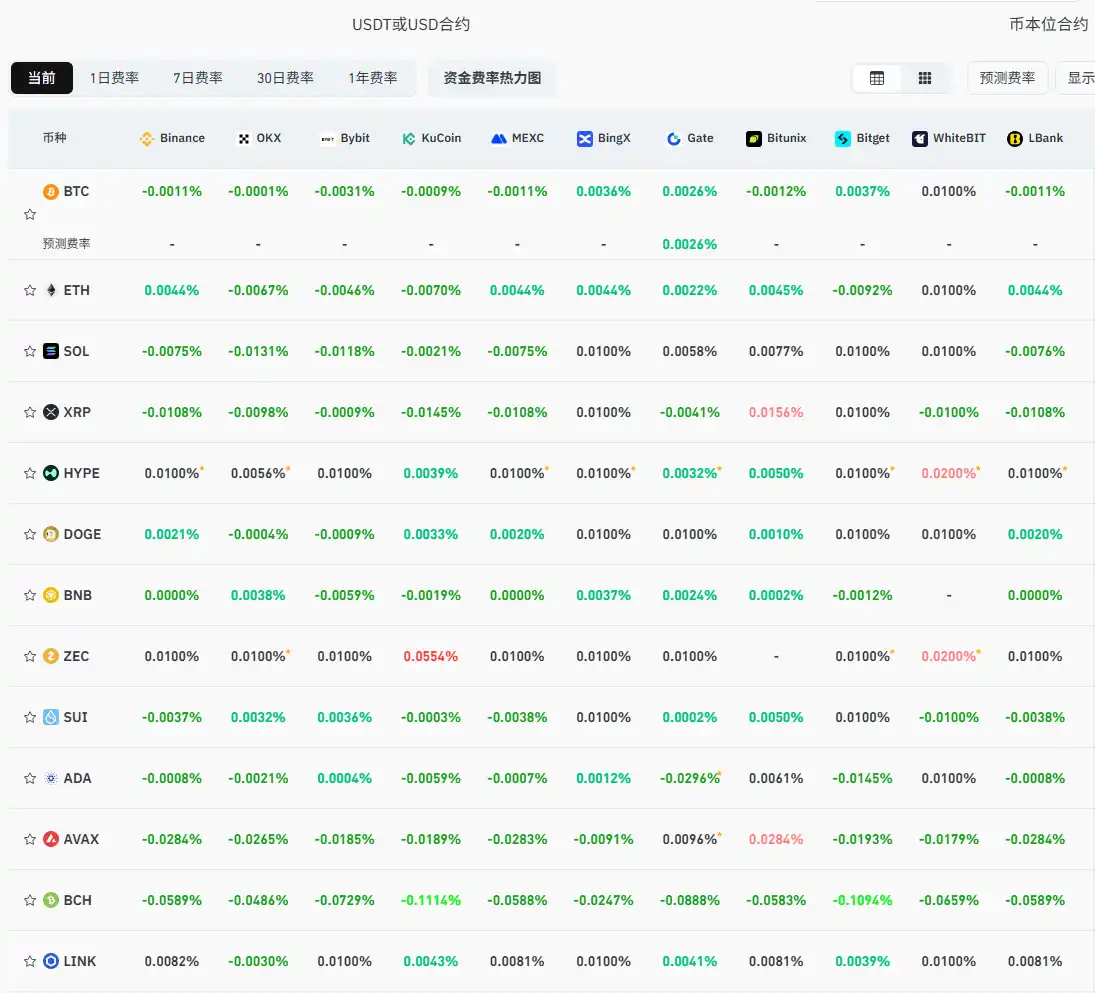

Current mainstream CEX and DEX funding rates indicate the market remains broadly bearish

The Crypto Fear Index rises to 28, escaping the "Extreme Fear" zone

Analyst: The current macro environment is similar to the pandemic period, and bitcoin still has room to rise